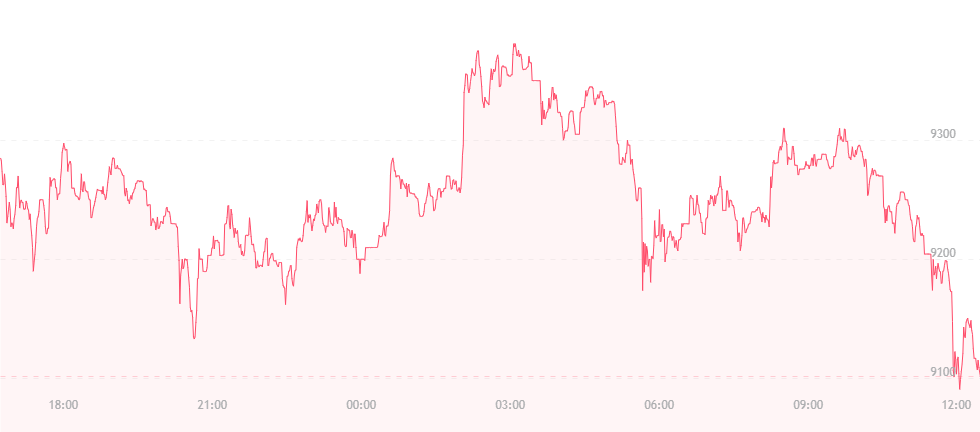

Bitcoin has jumped to just over $9,200. That’s a $400 increase from yesterday’s trading position of $8,800, and it appears the bulls are back in the game.

The last 48 hours had everyone worried somewhat, with the currency experiencing a $500 drop from its recent high of $9,300. A whirlwind of phony deals and Mt. Gox maneuvers may have potentially led to a dip in the currency’s price, though it appears the worry and fear has largely dissipated thanks to some newfound regulatory steps in Europe.

France – a country infamous for its maltreatment of bitcoin and related cryptocurrencies – has recently agreed to slash its present cryptocurrency tax rate from a whopping 45 percent to 19 percent. The tax is being cut by more than half, and thus showcases signs of potential mainstream acceptance in both France and Western Europe.

The move stems from the reclassification of bitcoin and its altcoin cousins within the country’s financial system. Previously, digital assets like bitcoin were labeled as “non-commercial profits,” which subjected them to relatively high tax figures, though now, cryptocurrencies fall under “moveable property.”

France also pushed heavily for global cryptocurrency regulation during this year’s G20 Summit in Argentina, suggesting that the country, at that time, was in no way a fan of virtual coins, and didn’t trust the technology behind them.

In addition, Advanced Micro Devices, Inc. (AMD) stock shares have risen by a whopping 14 percent since February, and are now trading for over $11 each. The company attributes the sudden boost in trading and overall revenue to bitcoin’s surge past the $9,000 mark, thus making bitcoin and cryptocurrency mining profitable again. Fundstrat’s Tom Lee insisted that if bitcoin remained below $8,600, miners would not see profit from their efforts, but the market is again entering bullish territory, and thus miners see money in their midst once again.

AMD now says that cryptocurrency mining accounts for roughly ten percent of its revenue, and graphic chip sales have seriously improved since the beginning of the year.

Unfortunately, not everyone is convinced bitcoin will do well in the long run. Despite its newfound bullish behavior, some still believe the currency has no future, and should not be garnering the attention it’s getting.

One of these figures is former PayPal CEO Bill Harris, who recently called bitcoin the “biggest scam in history,” and stated that when it came to cryptocurrency, everyone was “drinking the Kool-Aid.”

“Bitcoin is a scam,” he stated in an interview. “I’ll just say it.”

Harris also mentioned that in his opinion, bitcoin possesses “no store value,” and that it should not be “accepted as a means of payment” due to its alleged lack of intrinsic value.

“In my opinion, it’s a colossal pump-and-dump scheme – the likes of which the world has never seen,” he continued. “In a pump-and-dump game, promoters ‘pump’ up the price of a security, creating a speculative frenzy, then ‘dump’ some of their holdings at artificially high prices, and some cryptocurrencies are pure frauds… Even in emerging markets, they might as well use dollars, euros or existing currencies if the local currency is subject to hyperinflation.”

Oh well. You can’t please everyone.