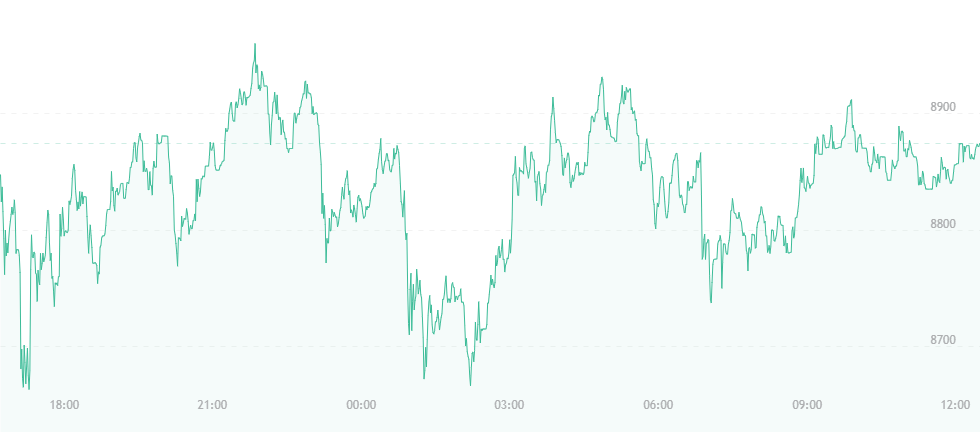

Bitcoin has dropped to $8,800. This is a $100 drop from yesterday’s $8,900, which in turn was a fall from the currency’s previous high of $9,300 last Tuesday.

People are scratching their heads and wondering what’s going on. Bitcoin’s market cap has sunk from $158 billion to $140 billion in less than 24 hours. Analysts were sure a bull run was imminent and likely to continue through the summer, but after two consistent falls from grace and a near five percent slump within 48 hours, it’s safe to say that some are a little confused. Were the analysts wrong, or is this just a small break in the financial chain that’s likely to be mended?

The drop may be the result of Nexon’s recent dealings (or former dealings) with Bitstamp. Nexon is a South Korean video game developer that began in 1994. The company was recently rumored to have purchased Luxembourg-based cryptocurrency exchange Bitstamp for a whopping $350 million.

Had the deal gone through, it would have been the third-largest crypto-related takeover this year after Circle acquired Poloniex in February and Monex Group took over Coincheck in March. Sadly, the partnership doesn’t appear solid. Executives of Nexon are denying they were ever in talks to purchase Bitstamp, citing misrepresentation of facts and speculation as the reasons behind the story getting out.

Bitstamp stands as the world’s tenth-largest cryptocurrency exchange, so given its size and popularity, the death of the purchase rumors may have taken a toll – at least in the short-term – on bitcoin’s price.

Strangely, the currency’s value showed no gains even after Nasdaq stated that in the future, when the market shows further signs of maturity, it would be open to serving as a cryptocurrency exchange, thus bringing bitcoin and its altcoin cousins closer to mainstream acceptance. Though CEO Adena Friedman says cryptocurrencies still have a long way to go, she understands the strength and promise they hold, and thus sees Nasdaq’s future aligned with them within the next ten years.

Perhaps the biggest concern (once again) stems from the now defunct bitcoin exchange Mt. Gox. At this stage, all that name does for anyone is conjure feelings of stress and strain, and it appears the company recently moved as many as 16,000 bitcoins from its vault to an unknown address. This has caused panic over what some claim could be a sign of an incoming crash.

Many have speculated over what feels like Mt. Gox’s consistent power over the bitcoin community. Some blame a recent sell-off instigated by the company’s remaining trustees as the reason behind bitcoin’s drop to $6,600, though representatives deny their actions bore any brunt on the price.

The shift was first noticed and reported on by The Next Web, and it’s the first time in nearly three months in which the company has moved any of its assets.

“It appears the Mt. Gox trustees have moved the funds to a wallet belonging to an exchange desk,” wrote analyst Ivo Jonkers. “The last time this happened, Mt. Gox proceeded to sell the funds at market rate, practically sending the entire market in the red. I wouldn’t be surprised if this happens again.”