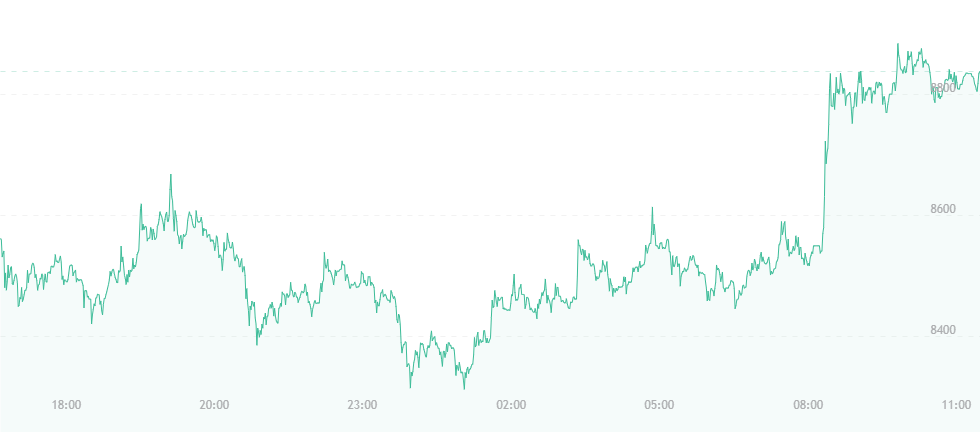

Bitcoin has endured an impressive price hike. After yesterday’s short jump to approximately $8,300, the currency has seemingly increased by over $500, and is trading at just under $8,900. It’s a nice bit of news for crypto advocates, and the coin could potentially be trading at $9,000 in just a matter of days.

One source goes so far as to suggest the bitcoin bear run may have reached an official end. Fundstrat’s Thomas Lee, which has remained a strong proponent of bitcoin and its ever-changing technology, states that the recent crash may have affected bitcoin, but was directed primarily towards altcoins, of which 75 percent remain in the red.

He did mention that this crash is now easing up, though he states it will likely be another five to six months before altcoins make a full return to numbers seen earlier this year.

Bitcoin, on the other hand, is recovering much faster. He suggests that people continue to hang onto their BTC stashes, as the coin really hasn’t stayed down as much as people might think. While enduring drops here and there, the damage done to bitcoin does not equal what occurred in the altcoin market, and that bitcoin has managed to incur price hikes (though small) relatively quickly following its many slumps.

Ever-bullish, he also maintains that bitcoin will hit its alleged $20,000 marker again this coming summer.

Other sentiment regarding bitcoin’s sudden jump revolves around the success of the recent G20 summit in Argentina. One source states that leading up to the event, investors were likely backing away from “sell-offs” – waiting to see what regulators would say or do before they sell any more of their coins. Will there be further regulatory clampdowns? Will authorities seek to impose stronger limitations?

Either way, it appears the sense of fear investors may have been feeling got in the way. With fewer coin and token sales occurring via exchange platforms, bitcoin finally had some time to repair its shattered value. In being allowed to sit for the time being, the price is finally entering a zone of recovery, though as usual, it remains unclear how long this period might last.

The summit has also resulted in other success. Figures like the Bank of England’s Mark Carney, a longtime opponent of bitcoin and cryptocurrencies in general, ultimately took back several recent comments and offered a new thought to his public – that digital currency wasn’t as bad or risky as originally thought. He suggested that cryptocurrencies, while popular, still only account for a very small percentage of the globe’s financial infrastructure, and thus do not bear the influence of cash or credit cards. That makes them non-threatening, at least for the time being.

He did mention that the financial industry will likely change as cryptocurrencies grow and attain mainstream status, but that this probably wouldn’t occur in the immediate future. For now, it seems users can breathe a sigh of relief – and that sigh has potentially resulted in the latest price hike.

Additionally, consistent price dips have given more investors the option of buying at lower prices. This has certainly helped to boost bitcoin as more seek to get in on the action.