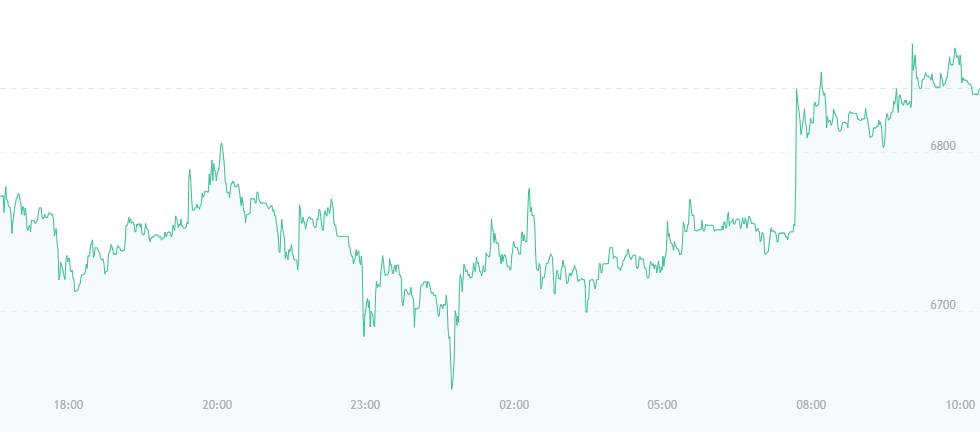

Bitcoin is currently standing at $6,800. After a weekend rise to $7,000, the coin’s ascension was halted suddenly and fell back to the $6,700 mark. It has risen by over $100 since yesterday.

The previous rise could be attributed to major financial players getting involved in the crypto space. After repeatedly calling bitcoin a “bubble” and “mere speculation,” wealthy hedge fund manager George Soros gave his company Soros Fund Management a clear path towards cryptocurrency investments and announced that the venture would start trading cryptocurrencies within the coming months.

Considering Soros’ power in the financial industry, it’s safe to say that his previous statements regarding bitcoin’s legitimacy (or lack thereof) delivered some serious gut punches to advocates.

His entry into the crypto-arena ultimately cleared the way for other financial magnates to become involved. Not long after Soros’ announcement, the famed Rockefeller family of New York released the news that their company Venrock – the venture capital firm of the Rockefeller Foundation – would be partnering with cryptocurrency and blockchain advisory firm Coinfund.

Both groups can allegedly bring immense power to the digital asset world, and push it further towards mainstream acceptance and full financial recognition.

Despite this news, it appears the price of bitcoin is “still up for grabs” in a sense, and leaving many analysts examining whether bitcoin is a bubble or an actual currency that could experience recovery in the coming months.

A group of Barclays analysts sits in the former category. They explain that bitcoin’s price is not likely to see the surges it did in 2017, and they compare bitcoin’s previous rise to the spread of infectious diseases, as more investors and one-time enthusiasts ultimately became “immune to its appeal” the way they might become immune to dangerous health hazards.

While this seems like an exaggerated and somewhat over-the-top comparison, the analysts used actual studies from the field of epidemiology (which deals with the spread, distribution and control of infectious diseases), and built their current model around those studies, claiming that the prices “tend to rise when infections spread from one buyer to another.” Ultimately, the power of bitcoin spread mostly via word of mouth, particularly to those who had a “fear of missing out.”

They also say that while the droves of new entrants to the cryptocurrency market did help to improve the overall price of bitcoin, the subsequent crash led to several exits amongst people who are now “immune” to the idea of getting rich overnight. As more time passes, fewer people will be susceptible to the power of bitcoin, and will seek to stay as far away as possible.

The economists summed up their arguments by saying:

“This occurs with infectious diseases when the immunity threshold is reached, i.e. the point at which a sufficient portion of the population becomes immune such that there are no more secondary infections.”

At the same time, cryptocurrency exchange platform Gemini is now rolling out bitcoin and ether block trading as a way of reducing the impact large orders have on the market. This suggests that crypto purchases and trading have not lost all their popularity, as many are still trying to get their hands on as many bitcoins and ether coins as possible.