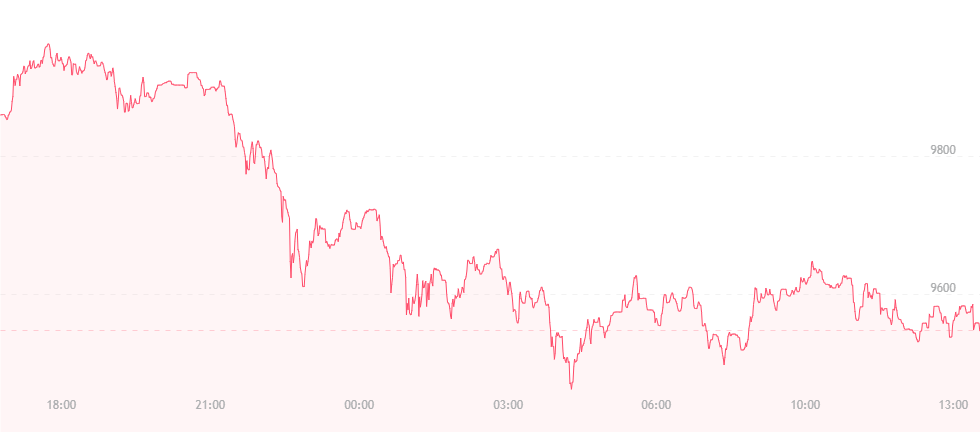

Bitcoin recently made its first attempt since March to test the $10,000 mark, but has ultimately come up short. After spiking to $9,800 and leaving many investors and traders certain that a new border would be crossed by the end of the week, the asset has seemingly fallen back to $9,500, where it stood on Thursday, marking a four percent drop in just 24 hours.

The good news is that this probably won’t be the last time bitcoin nears the 10K line. Trading is still relatively high, and demand for bitcoin is not faltering. We’re likely to see the bullish momentum strike again next week, though it’s virtually impossible to say when.

One of the reasons for the drop may once again be Warren Buffett. The billionaire mogul and Berkshire Hathaway executive was recently in the news spewing more nasty words about the world’s most popular cryptocurrency. While preparing for Berkshire’s annual shareholders meeting on Saturday, Buffett exclaimed that bitcoin was “probably rat poison squared,” meaning the cryptocurrency had the power to do more harm than good over the coming months. Last January, Buffett was noted as stating:

“In terms of cryptocurrencies, generally, I can say with almost certainty that they will come to a bad ending. If I could buy a five-year put on every one of the cryptocurrencies, I’d be glad to do it, but I would never short a dime’s worth.”

One of the big questions investors like to ask regarding bitcoin and its crypto-cousins is, “When is the volatility going to end or become weaker?” The answer appears to be “never,” or at least, “not for a long time.” Volatility is a feature of most cryptocurrencies, according to one source, which says it is not just the temporary result of a coin’s growing volume.

It is not a short-term problem, yet in many ways, the volatility exhibited by bitcoin and other digital assets is not necessarily a bad thing. In fact, the massive swings that often place these coins in the red have occasionally moved in the opposite direction, shifting their courses and placing these assets deep in green territory, like what occurred last December.

Swiss-based financial expert Kristjan Dekleva is confident that bitcoin can at least come to terms with relative stability over the next ten years, but that it will take mainstream acceptance before this even starts to occur, and Dekleva doesn’t see that happening for a while.

“In my opinion, it will be at least 10 years before we see stability,” he claims. “In the short-term, falls have been driven by emotion, and in many cases, disinformation. A small rumor can have a big impact. Demand is driven by market speculation, but the absence of institutional investors means the market is unstable.”

Granted an asset class can rise by 20 times in a single year – as bitcoin did in late 2017 – it can also halve, which is what occurred with the asset in early January. Bitcoin determines its value by supply and demand, just like an equity class. It is entirely decentralized, and cannot be controlled by a single individual, thus preventing it from operating like a Ponzi scheme.