After a bullish rally last week and a weekend of sideways trading, Bitcoin price is struggling to hold the $24k support level this Monday as trading volume shows a substantial increase. Bitcoin is trading at $24,090, with a 24-hour trading volume increase of 50%. Ethereum’s price dipped below $1,900 this Monday, with its market cap hovering at half of Bitcoin’s.

Key Points:

- Bitcoin price tests support at $24k, while Ethereum struggles to hold above $1.9k

- The 24-hour trading volume for BTCUSD and ETHUSD shows a significant increase, suggesting a price continuation pattern for the digital assets.

- Bitcoin briefly surpasses $25k on Sunday, breaking its 2-month high.

- Long-term sentiment for crypto markets remains bullish despite short-term retracements.

Bitcoin and Ethereum Trading Volume Rises

While cryptocurrency prices are struggling this Monday, the sharp increase in trading volume shows that the traders have been waiting on the sidelines over the weekend to make their next move.

The increase in trading volume in conjunction with a price decrease is a bearish sign of price continuation. This likely means that Bitcoin and Ethereum will continue to trade sideways today as the market establishes support at the $24k level for BTC and the $1.9k level for ETH.

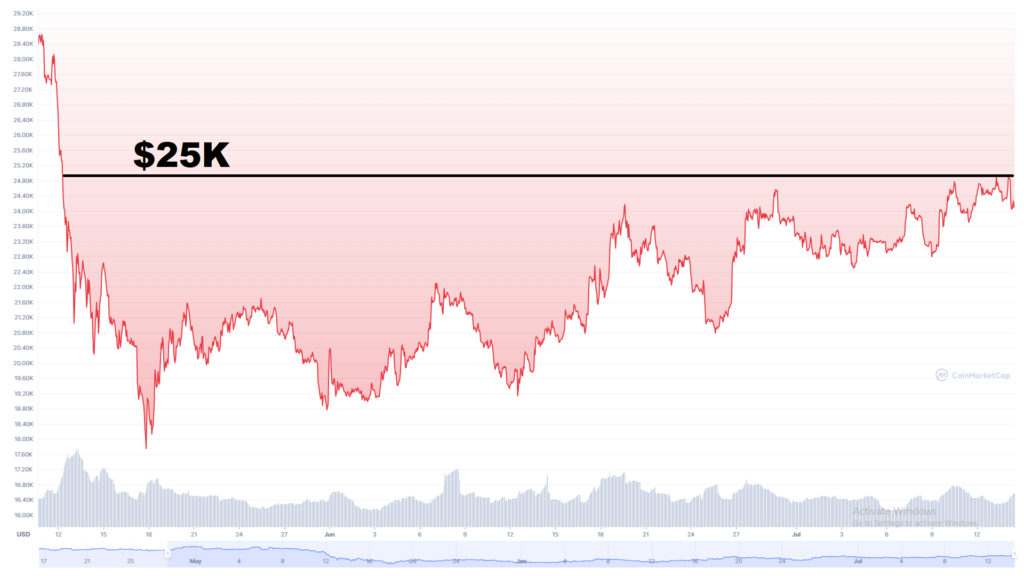

2M BTCUSD // Source: CoinMarketCap

On the other hand, on Sunday, Bitcoin briefly breached the $25k level, breaking its two-month-high. The last time BTC traded above this level was on June 12th, when the cryptocurrency saw a significant decline from a high of $28k to a low of $18k, causing market panic.

While it only took two months to regain most of its valuation, BTCUSD has been on a clear uptrend, signaling bullish potential in the next few weeks/months.

In relevant news, BlackRock’s announcement last week of their private Bitcoin trust will prop up demand for the digital asset, opening up the gates to an influx of funds flowing into crypto markets which could fuel the next significant bull run for BTC, sending it to new heights.

In addition, the partnership between Coinbase and BlackRock announced on August 5th shows that the cryptocurrency industry continues to evolve, and there are plenty of retail and institutional investors who haven’t been exposed to digital assets in a meaningful way just yet.

The next few months will be pivotal for BTC and ETH, with more institutional investors opening positions in major cryptocurrencies. In addition, Ethereum’s network merge will fuel plenty of market momentum in September and could even contribute to Ethereum’s market cap overtaking BTC.

The medium-long term sentiment for Bitcoin and Ethereum markets remains bullish despite sideways trading and minor retracements in the short term.

Bitcoin is trading at $24k, with a 24-hour trading volume of $31 billion, up 41% in the past 24 hours. Ethereum is trading at $1,894, with a 24-hour trading volume of $19.6 billion, up 52% in the past 24 hours. The overall cryptocurrency market cap is $1.15 trillion, down 2.98% in the past 24 hours.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news!

Image Source: yalcinsonat/123RF