After remaining flat over the weekend and exhibiting little price action, Bitcoin and Ethereum are showing signs of life today as trading volume for both crypto assets rises significantly. Bitcoin is trading at $19k, up 1% in the past 24 hours, with a 24-hour trading volume of $40.2 billion, up over 77% today. In comparison, Ethereum is trading at $1,300, up 1.5% in the past 24 hours, with a 24-hour trading volume of $15 billion, up 50% today. Let’s look at any relevant Bitcoin and Ethereum news that might affect their prices this week.

Key Points:

- The cryptocurrency market is showing signs of life this Monday as trading volume for top crypto assets rises significantly.

- Bitcoin’s fixed supply is inherent to inflation, which has been a significant reason for the downfall of the US and global economies.

- While investors remain wary of the markets, the Fed is optimistic that the increase in interest rates will help curb inflation and restart the economy.

- Ethereum’s Merge is yet to be priced in, but the network upgrade could set ETH up to overtake BTC next year.

- The SEC believes that all Ethereum transactions occur in the US because most validators are in the states, causing outrage in the crypto and NFT communities.

- We’re likely to see slight bullish momentum this week as Ethereum attempts to find new support at a higher level and Bitcoin attempts to reach $20k again.

Bitcoin News

Despite the drastic bear market this year, one trending statement that has been circulating on social media regarding Bitcoin is “1 BTC = 1 BTC.” The idea relates to the fact that Bitcoin as a cryptocurrency is inherently resistant to inflation since it has a fixed supply of 21 million tokens.

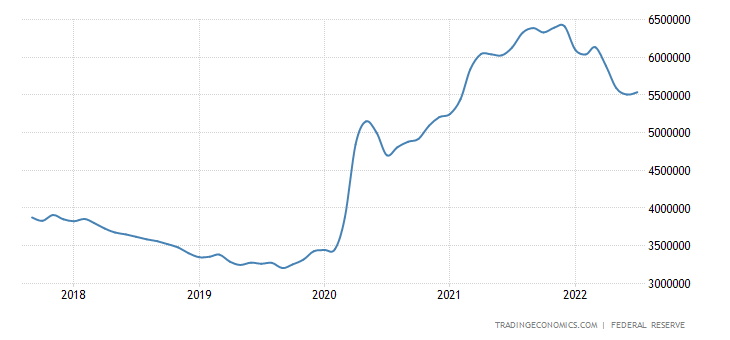

Comparing that to the US Dollar, whose supply rose from 3,000,000 USD Million to over 6,200,000 USD Million from 2020 to 2022, according to data from tradingeconomics.com:

Imagine if Bitcoin’s supply more than doubled in two years. That would cause significant bearish momentum in the market, and it’s unlikely BTC would ever recover from such a high inflation rate.

Speaking of the Federal Reserve, a report from the New York Times suggests that the Fed appears to be more optimistic than some investors when it comes to improving the US economy soon. The Fed hopes to reduce inflation as gently as possible while maintaining a resilient economy. Whether that will happen is yet to be seen. Still, one thing is for sure, every week, when the Federal Reserve decides to raise interest rates, it sets back stock markets significantly as investors battle with uncertainty.

Ethereum News

When it comes to Ethereum, while the Merge was successful, it caused bearish momentum for the cryptocurrency as it dropped from a high of $1,700 pre-merge to a low of $1,200 post-merge.

Vitalik Buterin had some words to say about Ethereum and the Merge in a recent interview with Wired. When asked how Vitalik thinks the Merge has gone, the Ethereum founder stated:

“I’m definitely happy, and definitely relieved. This is a transition that the whole Ethereum community has been working towards for the last eight years.”

While Ethereum’s price still hasn’t seen the fruits of the labor, as they say. The Merge was a significant accomplishment that will benefit the crypto asset in the long term.

At the same time, Ethereum’s network merge also caused some uncertainty regarding regulation and, more specifically, the SEC. Since Ethereum is proof-of-stake, and more than half of the validators are in the United States, the SEC claims that ETH is now qualified as a security.

If Ethereum enters into a legal battle with the SEC, we could see a similar scenario unfold to XRP, which isn’t going to be good for Ethereum’s long-term potential or price.

There it is

The supermassive black hole sized bad take at the heart of the Balina filing

h/t @LordBogdanoff https://t.co/ZopOGQchU4 pic.twitter.com/ucn5sZkK5b

— laurence (undergrad arc) (@functi0nZer0) September 19, 2022

There’s evident outrage in the community regarding the SEC’s latest statements, as Ethereum is a global crypto asset. Regardless of where the validators are, the transactions are initiated by individuals and businesses worldwide.

Despite the SEC’s view of Ethereum, the cryptocurrency’s price remains relatively healthy, trading above $1,300. This week we’re likely to see ETH push to the $1,400-$1,500 range as Ethereum seeks to establish newfound support.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news!

Image Source: kall1st0/123RF // Image Effects by Colorcinch