Tether was a hit from moment one, rising within months to billions of dollars issued. It provided a much-needed service for active crypto users, a stable settlement vehicle for volatile times, open to everyone globally—even those whose local currencies and banks could not serve the same purpose.

Disclosure: This is a Sponsored Article

But there could be a crimp in this digital wiring, with rising scrutiny over a lack of auditing and transparency, and worry about the role regulators might play going forward. And it’s left some investors looking for better alternatives.

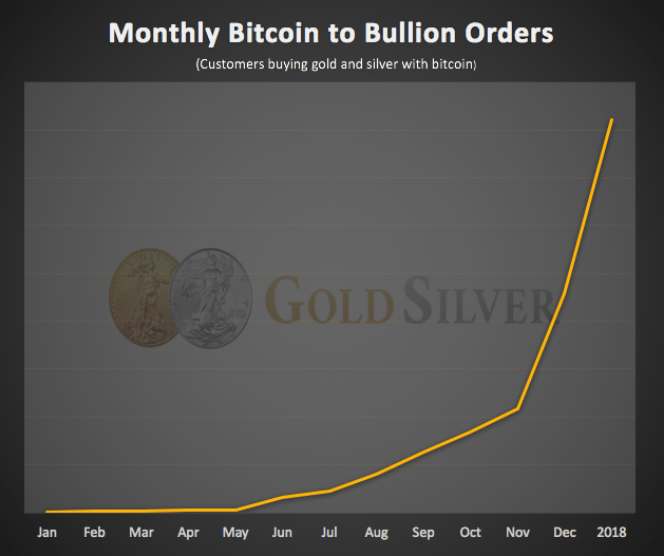

Increasingly, gold seems to be taking up at least some of the slack in that territory. US-based global gold and silver dealer GoldSilver.com has seen a massive increase in gold purchased using cryptos, up more than 1,000% in the last 6 months.

Europe-based Sharps Pixley and GoldCore have also reported spikes.

Given the similarities between gold and cryptos—their comfortable distance from the monetary and banking system, global 24/7 markets with massive liquidity (gold trades roughly 20x more volume per day than bitcoin on futures markets alone, let alone OTC)—plus gold’s longstanding role as a safe haven, the crypto/gold trade makes a lot of sense. But why is the pair trade rising so much right now?

Is the Tether Fraying?

Cryptocurrency Tether will convert your cash into digital tokens, which are “tethered” to the value of the US dollar, euro, or yen. Many crypto investors have used the service as a way to lock in gains in other cryptocurrencies, a sort-of parking spot for their digital cash while they decide what to do next. The service is very liquid, provides almost instantaneous transactions, and perhaps best of all, you don’t have to leave the exchange you’re using to place your next trade.

Before Tether, the selling process was slow, certainly not a reasonable expectation for a digital transaction. And if you had a lot of different coins, you were pretty much forced to convert them into bitcoin first in order to move into US dollars. You can sell through crypto exchange Coinbase, for example, but it’s slow and comes with daily limits. Tether, on the other hand, has trading pairs against a dozen or more popular cryptocurrencies on most major exchanges—so you can see why it could be a useful tool.

But now Tether is under investigation, being scrutinized by US regulators for, among other things, its ability to maintain a one-to-one peg with the US dollar. That’s important, because when you transfer funds to Tether, you obviously want to get the same amount of currency back.

Tether’s market cap as I write is about $2.2 billion—which means they’ve got to have that much in reserves. Do they? And perhaps just as worrisome, can they get that much out of the banking system if they need to? That’s not an unrealistic question, when you’ve got many crypto prices falling which could potentially lead to a lot investors exiting the industry or at least piling even more into what they see as more stable tokens backed by US Dollars in the short term.

During most big pullbacks in cryptos, you’ll see Tether trading from $1.02 to $1.04 on exchanges, as investors panic and pay a premium to lock in gains. In fact, watching the price of Tether has been a useful leading indicator of pullbacks over the last year. But in this latest market correction, Tether lost value, trading as low as 93 cents at one point. That hadn’t been seen before, which speaks to the questions about Tether that have become louder every day.

And those concerns have reached regulators. Last week the Commodity Futures Trading Commission issued a subpoena to Tether. They also subpoenaed Bitfinex, the world’s largest cryptocurrency exchange located in Hong Kong. The concerns spiked further when Tether severed its relationship with its auditor.

Tether promises all digital tokens are backed up. And just because they’re being investigated doesn’t mean they’re guilty. On the other hand, it does appear the accounting has been hazy and not as transparent as it should be. It might all be fine, but at a minimum the company has not done a good job of showing that.

The concerns, however, have alarmed a lot of investors. Many have left, with some swearing off the company even if they get their issues straightened out.

Finding Safe Haven

“It might all be above board,” says John D, an early crypto adopter we interviewed who wants to remain anonymous since he’s sitting on seven figures in profits. “But I can’t afford to take that risk. I’ve used Tether before while taking profits over several weeks, but I actually found it hard to sleep… I won’t use it again.”

What is he doing instead? “I don’t have these risks with gold and silver,” he says. “Gold is the ultimate alternative currency, so it lets me bypass all these worries. Now that I can buy gold and silver directly with Bitcoin, that’s where I’ll be parking profits from now on.” He drives the point home by adding, “To me, precious metals are the ultimate tether.”

That’s not just lip service. It highlights one of the major advantages of physical gold: no counterparty risk. Tether and Bitfinex and Coinbase and all other crypto exchanges stand between the investor and their coins. One must rely on them for transactions and storage and other services. If that party fails to provide their services for any reason, redemptions can be delayed, compromised, or even lost altogether.

On the other hand, “Gold has no middleman,” John points out. “It is not someone else’s liability, and doesn’t need to be backed by a government or bank. That’s an attractive feature when you look at what’s happening in some areas of the crypto world right now.”

Since he began converting to precious metals, he’s also found that he likes its tangibility. “I would much prefer to convert to real money, gold and silver, than use a digital derivative of the US dollar. That’s the main reason people are in cryptos anyway, as an alternative to the current system.”

I can personally attest to the huge increases of trading into storage from Bitcoin users at GoldSilver.com. It’s quite remarkable to see the amount of transfers taking place from users that viewed this new sector with such deep reverence just a few months earlier. And it’s not just us—Sharps Pixley and GoldCore have also reported similar behavior from crypto users in Europe. It seems clear a trend is underway.

If the concern with Tether turns out to be just growing pains, investors still have to worry about what happens in the interim, including counterparty risk and the lack of tangibility. It’s enough to push them to look for not just another solution, but one outside the crypto arena that still offers the features they were attracted to in the beginning.

Gold is an ideal solution for the worn-out crypto user. Investors can avoid the ongoing uncertainty and risks of the crypto world by swapping out for physical gold and silver. And you can buy gold and silver with bitcoin very easily, and get a 3% discount.