Decentralized Finance (Defi) remains a crypto buzzword and hot topic. Despite its unwavering and unstaggering popularity. Its growth doesn’t appear to decline nor wane. Every day we continuously see new projects come out to service different sections of the decentralized finance movement. All of which are gearing towards one goal: the increase in overall usage and mass adoption to the benefits of both the users and the entire ecosystem.

Two aspects define Decentralized Finance application in the real world; Yield farming, a type of crypto-themed farming activity where users commit their token to a vault. Staking, where users can choose to lock their tokens/coins for a specific period and get rewards.

Yield Farming

The increased ability to have all of the traditional finance instruments in decentralized finance is expanding rapidly. Staking and Yield Farming, two different earning mechanisms, only with slight distinct features, is the Defi technology centerpiece. Yield farming works like the fixed compound earning attributed to centralized banking only with a decentralized entity like dapps; there is no need for bureaucracies – a centralized structure – to have transactions executed.

Yield Farming removes all of the bureaucratic bottleneck associated with a centralized structure to optimize the time it takes to earn by connecting users’ wallets with liquidity pools or vaults and specific Annual Percentage Yield (APYs). Users are thereby assured of their earning potentials.

The percentage yield offered by most Defi applications is relatively huge compared with banking institutions that provide far lesser APY and are responsible for the increasing number of users and projects providing such services. The proliferation of projects offering Yield farming operations calls for concerns about why few genuine projects are still in operation. Simultaneously, there are quite the scammy ones coming out daily with malicious intentions to rugpull.

Among the credible yield farming projects currently operational, Yield Protocol recently concluded its DaoMaker Strong Hand Offering (SHO) and took the credible position for various reasons.

About Yield Protocol

According to their website, Yield Protocol is an open-source platform deployed on the Ethereum blockchain that allows anybody to create and execute yield farming and trading strategies.

What sets the platform apart from other solutions in the Ethereum Defi ecosystem is its design in minimizing smart contract risks by simplifying each contract’s abilities. The platform also allows anyone to design financial strategies that others can leverage without giving them access to their funds.

Multipurpose modular design allowing users to design and deploy yield farming strategies, algo trading, lending, and everything in between. These aspects of the protocol with an ever-growing arsenal of supporter protocol and pools will ensure that Yield Protocol remains the perfect solution.

DaoMaker Partnership

Yield Protocol is part of three platforms that have successfully run their token offering using the brilliant Strong Hand token Offering model of Britain-based blockchain incubator, Daomaker. As with other projects, Yield Protocol recorded a massive success and was well received by the community.

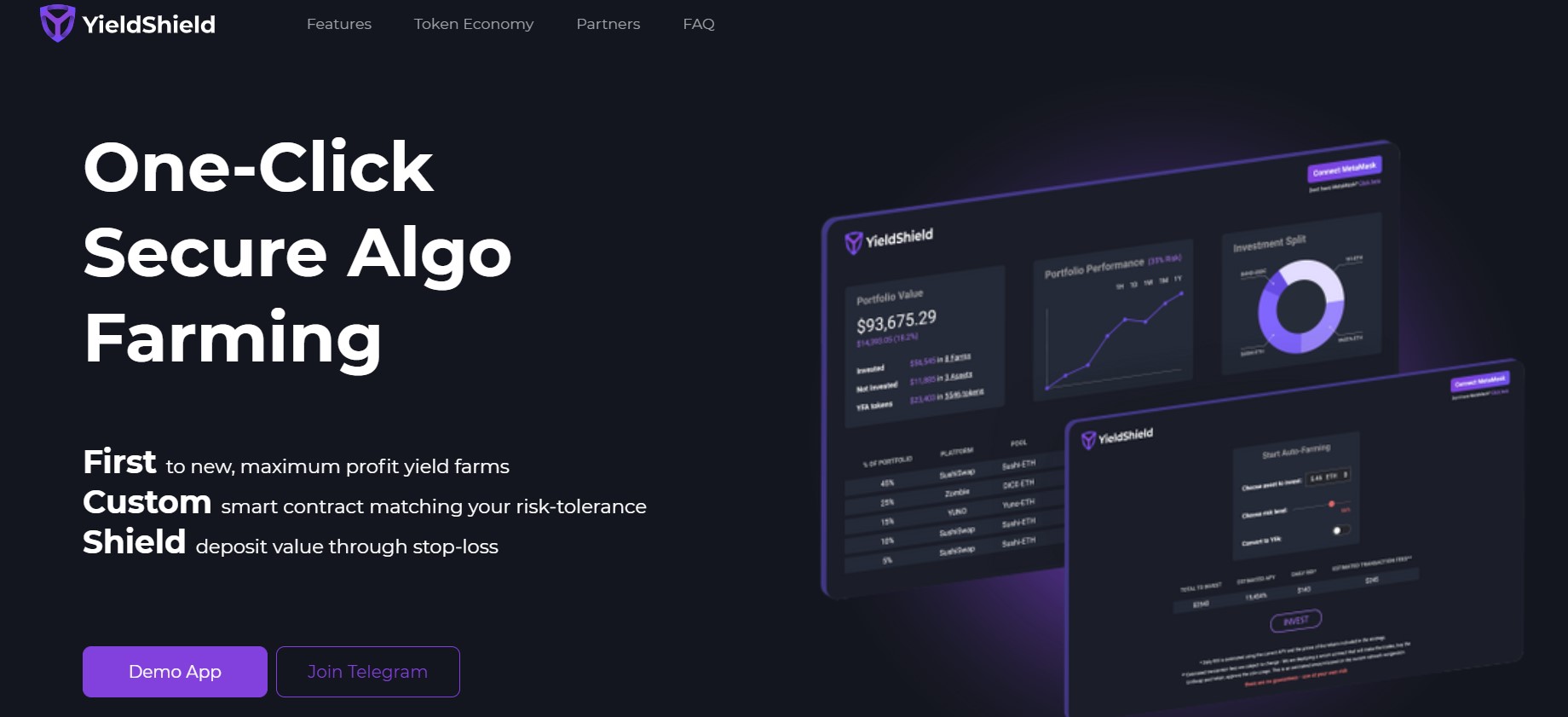

YieldShield is the first product of the Yield Protocol platform. It is an algorithmic Defi farmer that starts its development in June 2020, providing users with custom smart contract matching their risk tolerance and shield deposit value through stop loss. The team used high-level programming language for the factory smart-contract, personal smart-contract, Investing Contract, and pool contract. These Library collections allow users to interact with the platform seamlessly, providing the highest protocol aggregation to provide the best APYs to its users.

Gate and Uniswap Exchange Listing

Their partnership with Daomaker and other significant influencers in the crypto market has created hype for YieldShield within the crypto community. Now, it’s exciting to watch how the new exchange listing in Gate exchange will be received by the massive number of traders active in the China-based exchange.

According to an official tweet, $YIELD token is now listed on Gate.io and Uniswap today, March 5, at 12 PM UTC. This is very exciting for everyone, from the Yield Protocol team to the DaoMaker team to Gate.io staff to everyone who has been waiting for this moment for months.

Decentralized Finance (Defi) finds real-life applications for everyday users’ financial needs. There’s plenty of room for growth alongside the first digital cryptocurrency-bitcoin, even at such a young age. Platforms such as Yield Protocol will be among the frontline of Defi aggregators facilitating such development.

Useful Resources

Yield Protocol Listing Announcement: https://twitter.com/yield_protocol/status/1367134940278718467

Yield Protocol SHO Result by Gate.io:

https://www.gate.io/en/article/19548/?ch=en_sm_0221

Yield Protocol Daomaker Page:

https://daomaker.com/incubation/yield_protocol

Other Yield Protocol Details:

Website: https://www.yieldprotocol.org/

Twitter: https://twitter.com/yield_protocol