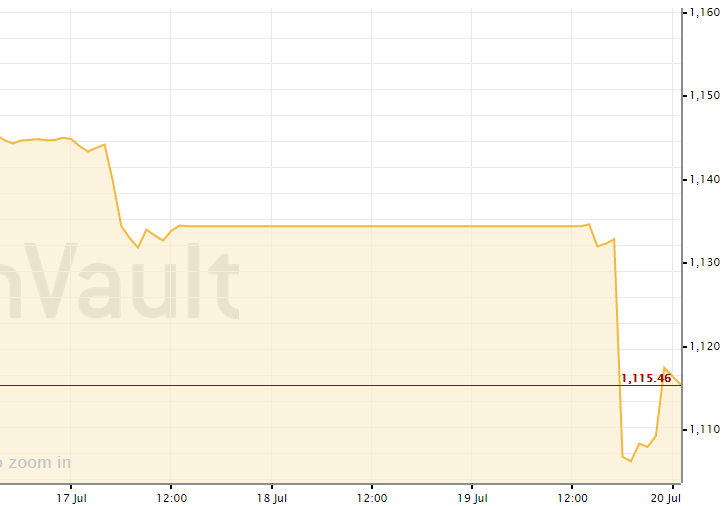

Today the price of gold fell more than 4% to $1,088.05 an ounce. The main cause of the mega sell was because of China’s markets. Earlier this month China made it illegal for big investors to dump shares over the next six months. According to Bloomberg:

China’s securities regulator banned major shareholders, corporate executives and directors from selling any of their stakes for six months, the latest effort to stop a $3.5 trillion rout in the nation’s equity market. Controlling shareholders and investors holding more than a 5 percent stake in a company will be prevented from cutting their holdings over that time period, the China Securities Regulatory Commission said in a statement.

As a result, China is now selling gold as opposed to buying it on price dips. It is the perfect recipe for weak prices. More than 3 million lots were traded on a key contract on the Shanghai Gold Exchange, compared to less than 27,000 lots on Friday, Reuters data showed. This puts the recent selloff in perspective volume wise.

As a trader a good option is to short gold to the $1050 range. As Amir_El_Araby pointed out on tradingview:

1-Bearish harmonic AB=CD is in play now after clearing 1142.00.

2- A breakout below 1130.00 will accelerate.

3- trend and momentum indicators are negative despite RSI entering oversold regions.

4-Fibonacci projection of 200 % for the BC leg is at 1053.00.

Bitcoin holding steady

Meanwhile, Bitcoin prices are holding steady in the high $270s after a slight $15 fall earlier this week. Unlike traditional currency and other centralized stores of value no government can limit Bitcoin users and prevent them from selling or buying assets. If you liked this article follow us on twitter @themerklenews and don’t forget to subscribe to our newsletter to receive the latest updates on market analysis and related cryptocurrency news!

No Responses