The global cryptocurrency market cap is down by 1.42% today, currently at $931 billion during this indigenous people’s day. After remaining relatively unchanged throughout the weekend, Bitcoin dropped below $20k, and Ethereum is struggling to stay above $1,300. The good news is that the trading volume is up significantly this Monday, with BTCUSD’s 24-hour volume up 45% and ETHUSD’s volume up 51%. Let’s look at any relevant news affecting prices this today.

Key Points:

- Crypto markets are showing slight bearish momentum this Indigenous People’s Day.

- Bitcoin is down below $20k, and Ethereum is struggling to hold support at $1,300.

- Reports of North Korean hackers amassing billions of crypto assets to funnel into nuclear weapon research, making the rest of the world uneasy.

- The community continues to praise CZ for his quick action regarding last week’s BSC Bridge hack and for preventing a disaster.

- While prices remain weak, the rising trading volume suggests plenty of momentum for markets, and a bullish run could ensue later this week.

Crypto market update

There is some bearish news today. Specifically, a report by CNET highlights that North Korea has quietly become a cryptocurrency superpower, stealing billions worth of crypto assets and funneling profits to nuclear weapons programs.

One of the most prominent hacking groups associated with the North Korean government is The Lazarus Group, which managed to steal over $600 million in crypto from Axie Infinity, along with $200 million worth of assets stolen in 2020 and 2021.

North Korean hackers quietly amassed billions of dollars worth of crypto via unsavory ways, utilizing their advanced tech knowledge.

This shows that cryptocurrency will remain the wild west as long as the industry continues to push innovation at an incredible rate. There will always be another zero-day exploit that could put a project’s funds at risk.

In other news, a report from Coindesk suggests that the Binance Smart Chain bridge hack’s fallout could’ve been much worse if the validators hadn’t acted in time. In fact, many in the community are thankful to CZ for reacting as quickly as he did and preventing hackers from moving the funds off-chain.

While some believe that having such centralized control over a blockchain goes against the ethos of the crypto industry, CZ shows that a delicate balance could prevent disastrous consequences from mostly unpreventable problems.

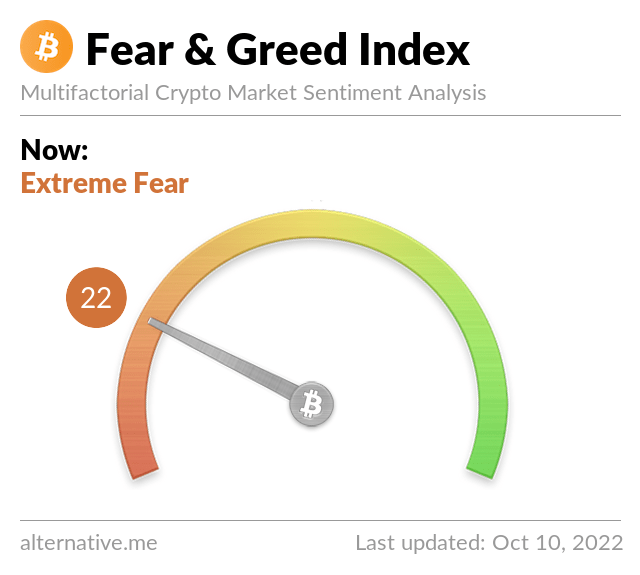

Today’s Crypto Fear & Greed index is at 22, signaling extreme fear but not as low as last week’s 20 points. The market has been in a fear state for several months in a row, with the previous month reaching 28 points, moving from Extreme Fear to the Fear level.

Source: Alternative.me

While crypto prices aren’t doing so hot, the rising trading volume suggests that the market is building momentum, which could create a bullish run next week.

The fact that prices hold support relatively well is another bullish sign for this week. The primary reason for Bitcoin’s and Ethereum’s underperformance today is due to the stock market’s weak performance.

The S&P 500, NASDAQ, and Dow Jones opened in the red, pulling Bitcoin down and affecting the rest of the crypto markets. While the Fed did suggest they may ease on their monetary policy to let the economy catch up, so far, the stock market continues to underperform.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news!

Image Source: bulgn/123RF // Image Effects by Colorcinch