After struggling with prices all week, Bitcoin and Ethereum remain flat as trading volume drops this Saturday significantly. The global cryptocurrency market cap remains below the $1 trillion level, currently at $943 billion. This signals the bears are on the playing field, and with last week’s 0.75% interest rate hike by the Fed, the market sentiment remains bearish.

Key Points:

- Unsurprisingly, crypto markets remain flat this Saturday as trading volume drops significantly.

- Despite the bear market, Michael Saylor continues to make bullish predictions for Bitcoin, speculating that BTC will surpass $500k in the next decade.

- Ethereum prices also struggle with declining trading volume as post-merge market conditions remain grim.

- Despite the adverse market conditions, crypto projects remain dedicated to blockchain tech and Web3 and continue to BUIDL.

Bitcoin News

Since it’s the weekend, there aren’t any major developments for Bitcoin that could affect prices in the next few days. Miners continue to struggle as the 9-month-long bear market con. Since the global state of the economy is still in the gutters, chances of a recovery anytime this year seem slimmer and slimmer.

Not all is grim, though, as Michael Saylor continues to make bullish predictions for BTC when looking at 2-4 year terms. Saylor predicts that Bitcoin could hit its peak of $68k again in as long as four years and rise above $500k within a decade.

The game’s name is patience, and those holding long-term bullish positions will see profits. However, many crypto traders are used to quick gains of as little as one year, and the crypto cycle seems to take longer and longer each time. Regardless of the short-term bearish sentiment, current low prices provide an excellent opportunity to dollar-cost average and purchase the leading crypto assets at low prices.

Bitcoin is trading at $19k, up 2% in the past 24 hours. The 24-hour trading volume is at $30 billion, down 19% in the past 24 hours. The global market cap for BTC is $366 billion, with a fully diluted cap of $401 billion.

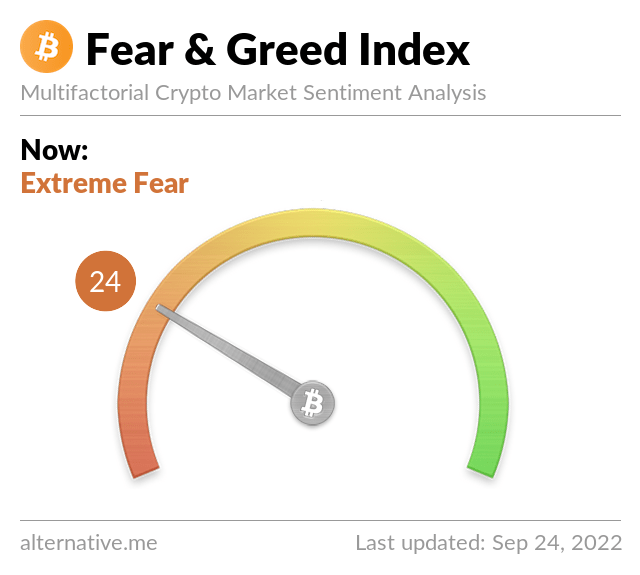

Source: alternative.me

The current Bitcoin fear and greed index is at 24, signaling extreme fear but not as bad as yesterday’s 20-point mark.

Ethereum News

Ethereum is also struggling this Saturday as it trades at the $1,300 range after falling from the $1,700 range since the merge. While many thought that the merge would push ETH prices above $2k, in fact, it seems that ETHUSD has been dealing with bearish sell pressure over the past week.

One likely reason for Ethereum’s price drop post the merge is the fact that miners have left Ethereum and are likely selling off their coins in hopes of recouping some losses before finding a new token to mine.

While one option for miners is to switch to Ethereum Classic, even ETC has been struggling with low prices as the overall crypto market is in shambles.

There’s no doubt that many investors are waiting on the sidelines for the crypto market to recover and for the global state of affairs to improve before contributing significant capital and opening bullish positions.

Despite these adverse conditions, many Ethereum, NFT, DeFi, and Metaverse projects continue to build and improve their ecosystems in preparation for the next bull run.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news!

Image Source: weedezign/123RF // Image Effects by Colorcinch