After rising in trading volume last night and stagnating in price, the cryptocurrency market is gaining momentum as Bitcoin trades above $19k, and Ethereum remains above $1,300. The 24-hour trading volume continues to rise, with BTCUSD’s 24-hour volume up 19%, currently at $59 billion, and ETHUSD’s trading volume up 32%, currently at $20 billion. The rise in trading volume suggests that the market is building momentum for a potential bull run this week, especially if the global cryptocurrency market cap surpasses $1 trillion soon.

Key Points:

- Cryptocurrency markets remain healthy after Bitcoin surpassed its 2-week high on Tuesday.

- Despite BTC’s inherent immunity to inflation, there’s a high correlation between crypto markets and stocks.

- Ethereum’s merge significantly reduced ETH’s inflation rate, which could contribute to a substantial bullish momentum in the next few months.

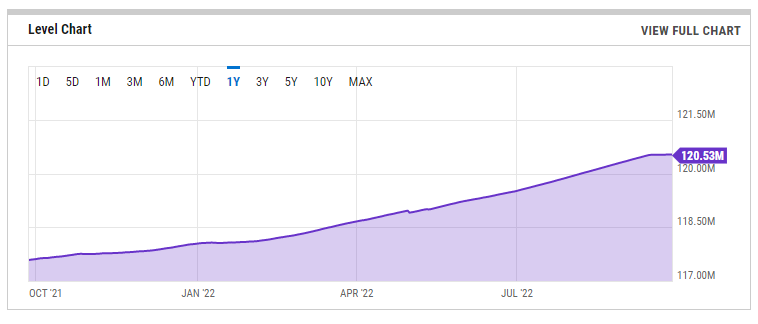

- Already there has been a drastic decline in the rise of Ethereum’s circulating supply post-merge.

- ETH remains healthy above $1,300 and will likely stay at this range for the next several weeks.

Bitcoin News

A hopeful report by CNN suggests signs in the crypto market that the hard crypto winter is beginning to thaw. After a bull run on Tuesday, when Bitcoin’s price reached $20.2k and surpassed its 2-week high, crypto bulls are hopeful that we could see additional bullish momentum soon.

With the current chaos in the global economy, Bitcoin remains a safe haven for investors looking to hedge against inflation. Since Bitcoin has a fixed supply of 21 million, it’s inherently immune to inflationary conditions. However, even though BTC has a fixed supply, that doesn’t mean it’s not affected by global markets, especially stocks.

There is a high correlation between cryptocurrency, the S&P 500, and tech stocks like the NASDAQ. As such, when stocks experience significant bearish momentum, Bitcoin usually also faces bearish pressure. Luckily, both the S&P 500 and the NASDAQ are in the green today and are the likely cause of Bitcoin’s positive outlook today.

Ethereum News

Ethereum’s merge is still the center of attention regarding the second-largest crypto asset on the market.

A Coindesk report outlines one substantial benefit of the network upgrade, which eliminated mining rewards, thereby reducing the net inflation rate of Ethereum drastically.

“In the days since the Merge, the annualized net issuance rate of Ethereum’s native cryptocurrency, ether (ETH), has fallen to a range of 0% to 0.7%, estimates Lucas Outumuro, head of research at crypto data and analysis firm IntoTheBlock. That compares with about 3.5% prior to the Merge.”

This means that Ethereum effectively reduced its inflation rate by roughly 3% by upgrading its network to a proof-of-stake model. While Ethereum doesn’t have a fixed supply like Bitcoin, ever since the merge, there has been a substantial decline in the production of new coins.

Looking at this chart from ycharts.com, you can see the flattening of the circulating supply level since the merge on Sep 13th.

Source: ycharts

While it may take several months for the market to feel the reduction in the minting of new ETH, the long-term outlook for Ethereum remains highly bullish.

Ethereum is trading at $1,325, down 3% in the past 24 hours. Its market cap is $162 billion, with a 24-hour trading volume of $20.7 billion, up 31% in the past 24 hours.

It seems the $1,300 level is a major support range for Ethereum, and we’re likely to see ETH remain at the current level throughout this week before attempting its move next week.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news!

Image Source: nicescene/123RF // Image Effects by Colorcinch