After testing support at $405, Bitcoin’s price rebounded and is still feeling the bulls’ 4 month momentum which started at $230 and has since more than doubled the price. Currently bitcoin is trading at $422, after breaking the $420 resistance line and turning it into a support zone. After this past weekend’s panic it seems that once again volume has died down, traders are cautiously waiting on the sidelines for the next whale to dump some btc or the next investor to buy up some coin.

Don’t get too exited yet, while it may seem like we have tested the $420 support, the volume has been so low that the next move will really determine whether we head north or south. Fanatik_ from tradingview suggests to play safe with a short positiong and watch for the $425 support.

Daily candle makes it look like there’s going to be continuation, watch out for 425.4 though. If 425.4 breaks we have enough confirmation for a real bounce.

On the upside, BenoitMilnerGroup from tradingview suggests to play a long position. If you look at the 4 month long chart you can see a clear bullish trend. Furthermore, it is no secret that Bitfinex continuously has more open long vs short order. Using BTC_Markets’ comment history we compiled a chart showing this past week’s long vs short order distribution for bitfinex:

| Date | Long | Short |

|---|---|---|

| 12/28/15 | 73.0% | 27.0% |

| 12/27/15 | 60.0% | 40.0% |

| 12/26/15 | 64.3% | 35.7% |

| 12/25/15 | 71.3% | 28.7% |

| 12/24/15 | 82.5% | 17.5% |

| 12/23/15 | 79.6% | 20.4% |

| 12/22/15 | 94.6% | 5.4% |

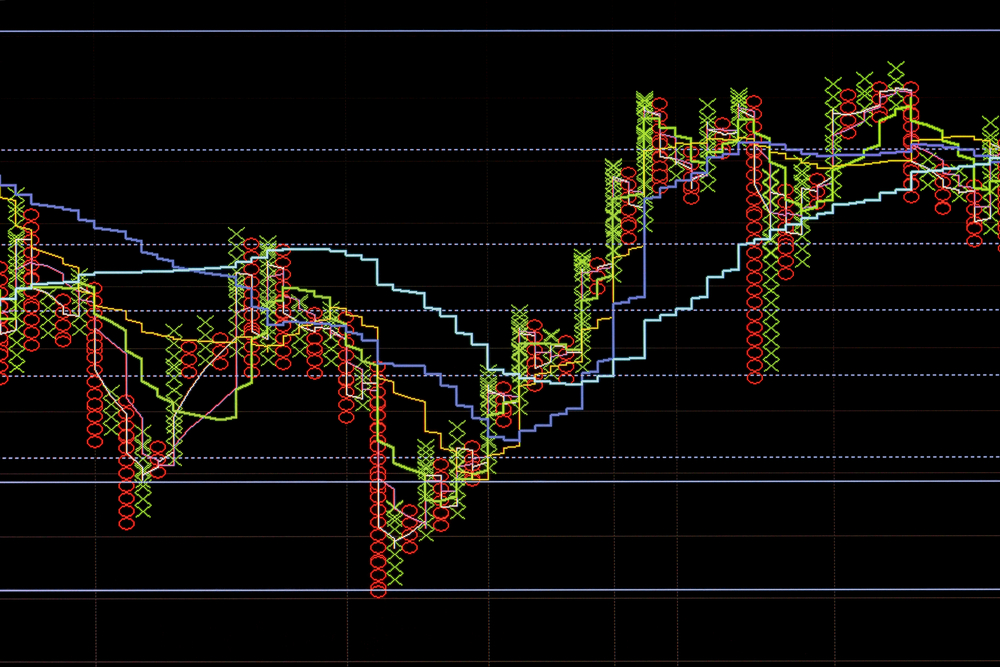

Using basic technical analysis indicators BenoitMilnerGroup provided the following chart:

He provided 3 reasons as to why Bitcoin’s price will exhibit the above movement. Firstly, because btc continuously has had more long positions, it is an indicator that the bullish momentum is present. The second reason is because of Boxing Day which was celebrated on Saturday, December 26th. It is a holiday where employees receive gifts called “Christmas Box” from their bosses. BenoitMilnerGroup suggested that due to Christmas and Boxing day bitcoin saw a decrease of transactions, signaling “lack of use”. Furthermore, many traders closed their positions in order to reenter next year, China lead the dumps as CNY markets dropped lower than USD. Last but not least, Bitcoin is booming in Africa and Asia and is considered a safe haven as an alternative investment, BenoitMilnerGroup writes:

Great News is BTC becoming a safe haven could cause it to see some real value ($5000-10000) in the next few years. Sounds Crazy? not really if you understand that BTC only has a market cap of 6bn? which in currency or safe haven terms is truly pathetic. Bad News it takes the “currency” away from BTC . If we see more holders than users we will see less and less transactions which could have a negative effect on BTC . But Overall Asian/African Buyers considering that BTC as a safe haven is definitely more positive than negative. Adding up all of these points and then some Technical Supports/Resistances. We see BTC hitting $650 by February, BTC has to Break $500 soon to confirm then full move but as 2016 starts we should see a lot of buyers.

An interesting observation about the latest price is how closely the main exchanges are synced. BTC-E and Bitstamp never agree on the price as BTC-E’s price is always considerably lower than the other major exchanges.

![]()

Since China led the Boxing Day dumps, we can conclude that Bitstamp and Bitfinex felt the dumps as they have a much higher Chinese trading population and because they are easier to arbitrage. On the other hand, BTC-E’s market didn’t feel the Chinese dumps as much and stayed above water.

[interaction id=”568164483a731d3e71890dc4″]

If you liked this article follow us on twitter @themerklenews and make sure to subscribe to our newsletter to receive the latest bitcoin and altcoin price analysis and the latest cryptocurrency news.

Disclaimer: This is not trading/investment advice.

No Responses