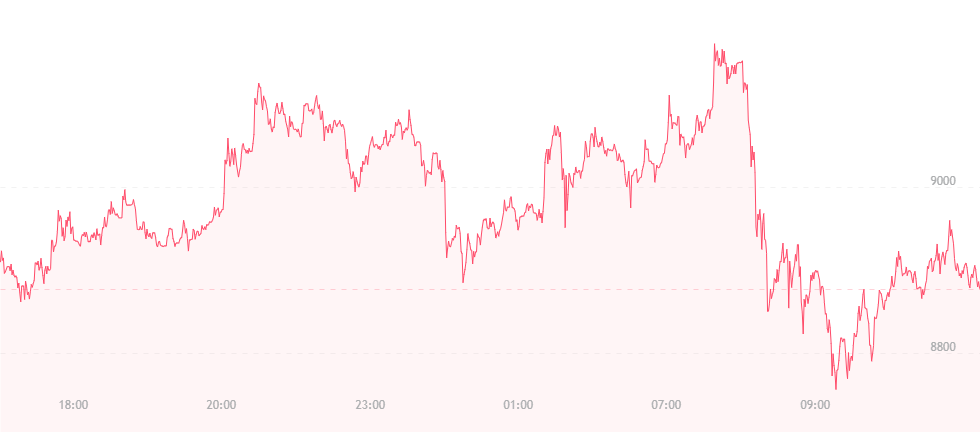

Bitcoin is allegedly entering a recovery phase, and is now trading for just under $9,000. Following two harsh weeks of negative sentiment from both Google and Twitter, bitcoin is once again showing an ability to surpass the latest resistance levels and spike through new territory.

Many allege that a positive response to this year’s recent G20 summit has a lot to do with bitcoin’s recent “high.” While $9,000 doesn’t seem like much – especially in comparison to last year’s December figures – it remains strong when compared with bitcoin’s low point of roughly $7,600 witnessed earlier this week. The 2018 event – which took place in Buenos Aires – and its aftermath likely have much to do with bitcoin’s gradual, but noticeable rise.

Figures like Mark Carney, who were long-term, cautionary opponents of bitcoin and cryptocurrency, arrived at the conclusion that bitcoin and virtual money were not presently in need of global regulation. Though popular, they still account for a very small percentage of the modern financial infrastructure, and thus didn’t present serious threats to the industry’s status.

Sentiment remains that the financial arena is bound to change and alter with time, particularly as more is known about cryptocurrencies and their overall effects on the global economy, but for now, not much will be done. This has led to many bitcoin advocates breathing a huge sigh of relief – one that was likely heard around the world, and wherever cryptocurrencies are traded.

While discussing the summit with reporters, governor of the Central Bank of Argentina Federico Sturzenegger commented that the “spirit of the discussion was very productive.” He stated that everyone left “very pleased,” and that overall, it was a “very good meeting.” Ultimately, G20 members are likely to speculate on how to regulate cryptocurrencies without completely banning them through early July, but strong proponents of bitcoin probably shouldn’t expect anything until then.

Positive reinforcement was also witnessed in the altcoin world, as per one source, currencies like ether and even Cardano are performing at a higher level. Thus far, the entire market has managed to regain nearly all its losses from early March, suggesting that the “altcoin war” may finally be over. Fundstrat’s Thomas Lee had previously mentioned that while bitcoin may have been affected, the recent price corrections and drops witnessed in the virtual currency arena were predominantly aimed at altcoins and their respective counterparts.

The cryptocurrency market has since added about $70 billion onto its overall market cap, jumping from $250 billion to $350 billion in just a matter of days.

Furthermore, analysts explain that while bitcoin’s present status still seems a little scary, users should not be too concerned. It’s true that bitcoin suffered its third worst correction in history last January. It’s also true that the crypto market cap dropped by insurmountable figures, but unlike its two previous events, bitcoin has managed to endure several rebounds. Though they haven’t necessarily brought the currency back to its original state, they have nonetheless offered evidence of bitcoin’s speed and promise, especially when compared to its behavior during past corrections.