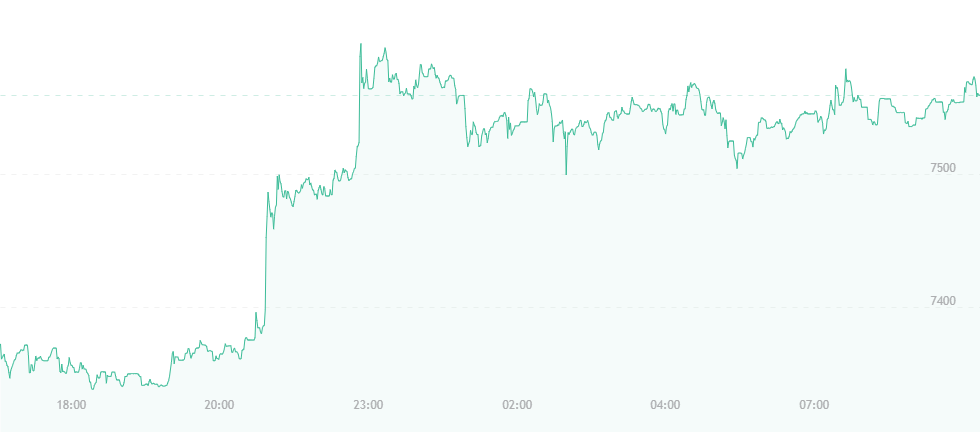

Bitcoin is now trading for roughly $200 more than where it stood yesterday, reaching the $7,500 mark in less than 24 hours. Prior, bitcoin had been trading for this amount during the late evening of Tuesday, May 29, only to fall to $7,400 and then $7,300 the following day. While it’s not worth breaking out the champagne just yet, investors are breathing a sigh of relief now that the market is showing small signs of recovery.

Bitcoin has been under serious pressure over the last few days, with new resistance developed at the $7,600 level. One source predicted that the currency could have easily reached a low of approximately $7,040 before any bullish signs showed their heads, but now it appears those signs are emerging sooner than anticipated.

One reason for the alleged spike could be the upcoming Russia World Cup. The event is slated to boost the bitcoin price back into the $8,000 range, or possibly even the $9,000 range due to specific financial restriction that may require bitcoin use. The game is currently scheduled to take place in two weeks on June 14, and Russia will face off against Saudi Arabia.

Digital payments in Russia have become something of an enigma in recent years. U.S. payments giants like Visa and MasterCard have ultimately denied many citizens in the region credit card services due to U.S. sanctions implemented roughly four years ago. At press time, both companies have found ways around these sanctions and account for nearly 90 percent of Russia’s overall transactions, but there’s still plenty of friction.

Thus, many have simply turned to bitcoin and various cryptocurrencies to pay their way to the sporting event. Some hotels in the Russian city of Kaliningrad, which is a host city for many of the tournament’s upcoming games, are accepting bitcoin along with various airlines and travel agents. Bars will also be accepting cryptocurrency payments for customers looking to enjoy celebration drinks.

In the long run, bitcoin payments have decreased over the last year due to increases in transaction fees. Overall, the number of payments has fallen by half from 400,000 to 200,000, but there’s still a powerful customer ratio.

Thorsten Koeppl, professor of economics at Queen’s University in Canada, recently commented:

“The value of bitcoin is partly driven by its potential as a payments tool, and before the fees rose along with the price, there were people using bitcoin for international transfers. This has become more expensive to do now, but the price is still being supported.”

Granted people continue to use bitcoin as a means of payment and exchange, the price could continue to go up. Despite growing fees and a slow transaction rate, if there is a need (and above all, a demand) for bitcoin, we will continue to see relevant price spikes and bursts in the coin’s value. One of the reasons bitcoin’s price has dropped significantly since December of last year could be its fall in payments usage, and if investors and enthusiasts want to see these numbers change, they’ll look to bitcoin over cash and plastic to take care of their purchase requirements.