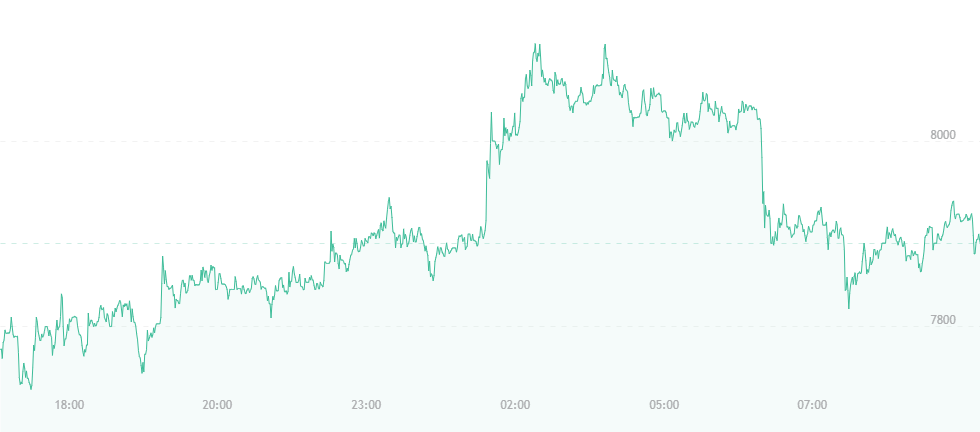

Bitcoin is holding its ground at $7,900. There is no news to report regarding its price – only that it seems to have developed new levels of resistance and could remain here over the coming weeks.

This isn’t necessarily a bad thing; bitcoin is showing strong defense against recent trends and backlash, particularly that which was delivered by Twitter. The company recently announced that it was suddenly banning all cryptocurrency and ICO-related ads after previously stating that changes weren’t likely to hit the industry for a minimum of two weeks. Either Twitter executives felt fear and decided to act quickly, or the original announcement was meant to throw off scammers or crypto-impersonators.

Surprisingly, the bitcoin price has not been affected much. When Twitter first brought forth news of its plans, bitcoin dropped by nearly $700 from its previous weekend mark, though it later began showing small signs of recovery. Advocates were witnessing very small jumps – $100 here, $100 there. Nothing major, but it was enough to calm things down.

Now, Twitter’s second announcement has seemingly hit home, though nothing seems to have changed. It can be argued, in a sense, that Twitter’s ban was partially expected to occur, and that the resistance developed by bitcoin inherently reflects the resistance and defense of its traders. In preparing themselves, investors were likely able to prepare bitcoin, and thus further drops have yet to be recorded.

Even LinkedIn recently stated that it will be removing cryptocurrency ads from its platform, and still bitcoin’s price is remaining the same. Either LinkedIn isn’t as strong a platform as one would think, or this is a surefire sign that bitcoin is growing stronger as regulation and pushbacks take center stage.

This could explain why so many analysts are remaining bullish despite the present odds against bitcoin. In previous “price watch” articles, we’ve discussed that figures like Fundstrat’s Thomas Lee remain positive about the currency. Despite everything that’s seemingly working against it and the slowing progress of crypto, Lee has stated several times that bitcoin will undoubtedly reach $25,000 by the year’s end.

Now, his sentiment is joined by that of Abra CEO Bill Barhydt, who at one point in his career, designed trading systems for Goldman Sachs. He explained that in his line of work, he repeatedly talks with hedge fund managers and other major players in the financial industry, many of whom are beginning to view crypto-assets as not only worthwhile, but essential to one’s investment portfolio. He says that a price boom is certain to occur later this year, and that “all hell will break loose” once it does:

“I talk to hedge funds, high net worth individuals, even commodity speculators. They look at the volatility in the crypto markets and they see it as a huge opportunity. Once the floodgates are opened, they’re opened.”

He later stated he’s been examining “upticks” in Japan, a country where interest in crypto grows nearly every day. According to Barhydt, financial trends in Japan are huge indicators of what will come, and if interest in crypto is getting stronger, it is certain to spread rapidly in the coming months.