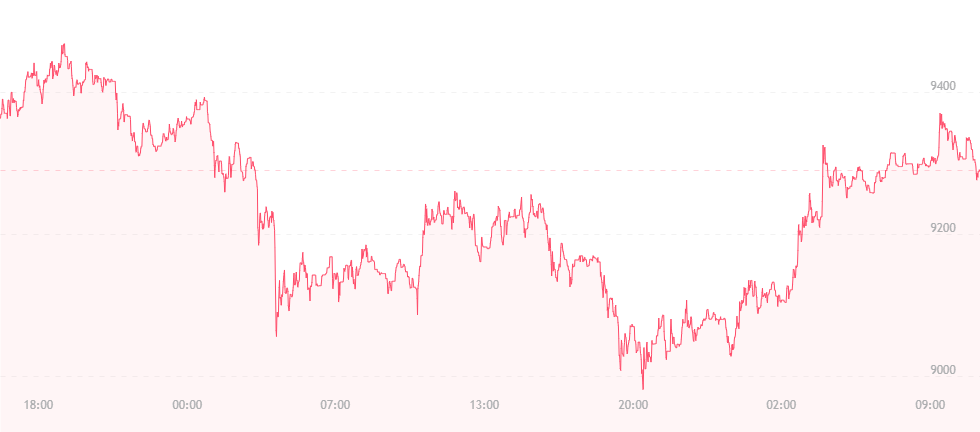

Bitcoin has jumped back to the $9,300 mark. The currency had recently been tested at $9,800, and was unable to surpass $10,000 mark over the weekend as so many analysts and users were hoping. It fell to $9,500 the following day, $9,300 after that, and ultimately settled at $9,100 during yesterday’s early morning hours. Overall, the total drop amounted to $700 over the course of three days.

Now that the currency has moved up, many are wondering if the bulls have once again taken the reins and are pushing bitcoin back up the financial hill. One source verifies that this might be true, and predicts that the coin could move beyond $15,000 by the end of the year. This is largely attributed to the new bitcoin trading desk up by Goldman Sachs. The sentiment remains that other Wall Street entities will follow in Goldman Sachs’ footsteps and try to pave the way for further cryptocurrency trades in the “big leagues.”

In fact, this is already starting to occur. Intercontinental Exchange (which owns the New York Stock Exchange) has been developing plans for a new trading platform that could potentially allow investors to buy and hold multiple forms of crypto. Digital currency trading could suddenly move from “obscure” to the “norm” in the coming months, and hike up both awareness and the present market cap’s value.

It is also mentioned that many cryptocurrency exchanges must now register with the Securities and Exchange Commission (SEC), which may seem scary at first, but is likely to bring further legitimacy to the industry in the long run. This legitimacy is certain to up both the price and the value of bitcoin and its many crypto-cousins, pushing the arena into further mainstream territory and carving a path that leads to spikes in trading.

The source forecasts changes in both the number of users and transaction volumes for each month over the rest of 2018. By examining the present data, it suggests a much stronger fundamental value for bitcoin, and believes that the price of the coin will grow steadily over the coming months as mainstream financial institutions continue to show acceptance.

In addition, many analysts and financial experts are boosting bitcoin’s reputation by promoting its benefits and working against the actions and words of figures like Warren Buffett and Bill Gates. One of those people is Mark Wright, a BBC Apprentice winner and bitcoin investor. As a huge advocate for cryptocurrency, Wright completely disagrees with Buffett’s recent claims, commenting:

“Despite its volatile nature, the cryptocurrency sector has soared in recent years, with experts predicting it will hit a market valuation of $1 trillion by the close of 2018. This figure proves that Buffett is wrong, particularly when one accounts for how the value of bitcoin has developed since 2014 – the time when Buffett first expressed negative opinions on the sector. Despite his years of experience in business, Buffett’s comments show a terrible lack of engagement in technology and innovation.”

Bob Loukas – founder of Bitcoin.Live – agrees with Mark Wright. He mentions that bitcoin is beginning to gain trust in the financial marketplace, and that over time, healthy regulation will set it on the right path and allow for the currency to grow significantly.