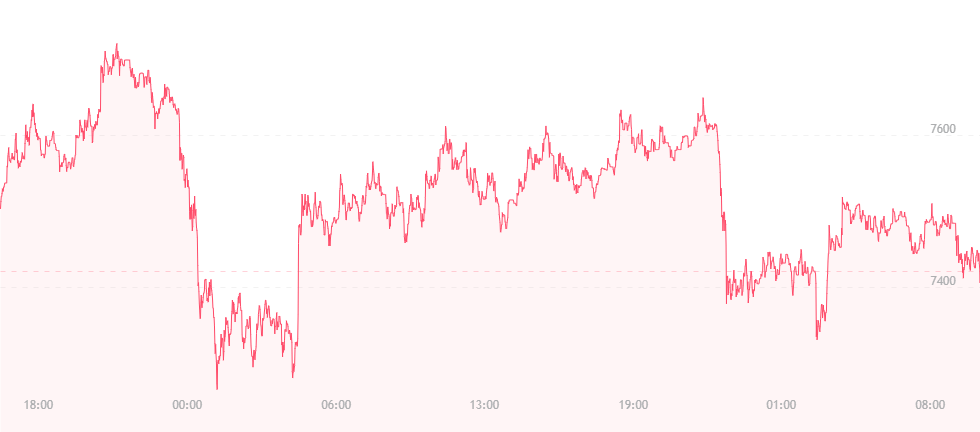

Bitcoin has experienced another price drop over the past 24 hours and is now sitting at just over $7,400. While the price falls have been small over the last two days (about $100 each), bitcoin remains on shaky ground, and the bears have not yet given up the reins.

Analyst John Navin from Forbes says that for bitcoin to really enter an “uptrend,” it would have to strike the $18,500 mark. At press time, the currency cannot be labeled as a spiking coin, particularly because its December range was so high ($19,000+), so either way one looks at it, bitcoin will always be in a slump unless it surpasses that level.

He further states that the next support position for bitcoin is $6,500, which is where it stood during early April. This suggests that bitcoin has the potential to fall even further before it incurs future spikes.

Michael Sonnenshein is the managing director of Grayscale Investments, as well as one of the world’s largest cryptocurrency asset managers and a sponsor of eight digital currency trusts for investors. He believes there’s no middle ground for bitcoin, and that people will either go big or go broke with it. There’s no in-between to be had, here…

“As we begin to look at assets like bitcoin and the unbelievable adversity it has faced over the last ten years, every day that bitcoin doesn’t go away, every day that bitcoin overcomes a new challenge – for me, that makes me feel that bitcoin will do either one of two things,” he comments. “It will either survive and become all these amazing things that we think it can be, which will cause its price to be a lot higher, or it is possible something else may come along that will displace it, and bitcoin will go to zero. It likely will have a binary outcome.”

While he refuses to offer any predictions regarding future prices, he did mention that if developers can continue to make advancements and changes to its technology, thus making it more desired and useful in the financial space, its value will continue to rise. If developers fail, bitcoin could sink into oblivion faster than one might anticipate.

“You have to think about bitcoin, again, as an open source protocol,” he explains. “Any other currency that comes along that allows for another feature – another attribute that maybe bitcoin does not have – as an open source protocol, [bitcoin] is able to accommodate, to integrate, to add that aspect, into it. I hope and continue to believe that as new features are added into bitcoin and other digital currencies, they can continue to thrive and grow and not be displaced.”

This, to a degree, is something we can still look forward to. Institutional capital is starting to make its way into the bitcoin and cryptocurrency space, and players from Wall Street and other financial hubs are now making their marks on digital currencies. We are witnessing solid, albeit slow, pushes towards mainstream acceptance, which could potentially lead to further technological adaptions. Granted we continue to see trends like this expand, bitcoin could potentially hold its ground in the immediate future.