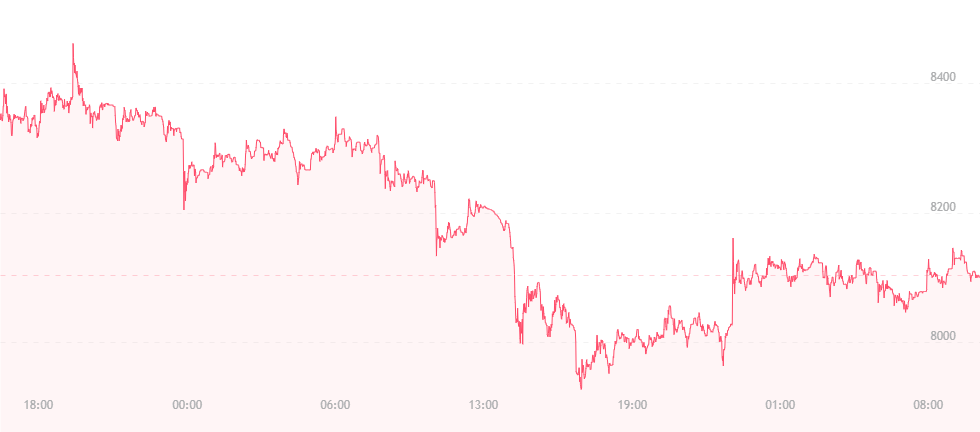

The price of bitcoin has fallen again over the last 24 hours. This time, the currency is trading for roughly $8,100 – a $200 drop since yesterday’s $8,300 mark.

Since the beginning of the week, bitcoin has repeatedly been hit with price slumps. The Coindesk Consensus Conference – which lasted from Monday to Wednesday – ultimately failed to garner any lasting publicity for the currency, and following a brief spike to $8,800, the currency has incurred a four-day series of $200 to $300 slips.

The good news is that bitcoin has slumped to $8,000 several times in the past and always jumped back. Analysts suggest that the coin has developed solid support at this level, and newfound defense against ongoing resistance.

Senior market analyst for E-Toro Matt Greenspan has examined bitcoin’s long-term trendline. He’s concluded that the currency’s strongest support level is at $7,100, and says that while any level can snap, bitcoin isn’t likely to drop below this position in the immediate future.

While $7,100 isn’t anything to be excited about, it’s still better than where the currency stood last March (we’re sure investors would like to avoid grazing $6,600 again).

Cryptocurrency investor Marius Rupsys is still advising people to stay cautious when deciding on which cryptocurrencies to trade. When discussing bitcoin, he mentioned:

“There might be some support at $8,000, but any price level can be broken. I would sit on the sidelines to see where the price goes next.”

Interestingly, the price of Ethereum has jumped significantly over the last 48 hours, and investors are now turning their attention to the bitcoin competitor and the world’s second-largest cryptocurrency. Why? Because ether is garnering newfound respect in China – a country that outlawed residences from trading cryptocurrencies on exchanges back in September. The country is now ranking the world’s largest cryptocurrencies with its latest index, and Ethereum has landed the number one spot.

It’s an unexpected twist – especially considering bitcoin sits at the 13th position. It’s disappointing for the father of cryptocurrency, but impressive for the second-in-command. Many investors see this as a huge sign that China – a country once hostile towards cryptocurrencies – is keeping an open mind regarding changes in the trading market.

Daniele Bianchi, assistant professor of finance at Warwick Business School says the move is “basically a government-led assessment of blockchain experts which will be based on feedback and reviews from academics, industry operators and governmental agencies.”

He added:

“The reason why this is important is twofold. First, it makes it clear that a massive market like China is openly considering blockchain technology to boost productivity. Second, it relaxes the view that the Chinese government is openly against cryptocurrencies and their use.”

CEO of cryptocurrency exchange CoinMetro Kevin Murcko claims that China’s position on crypto is adapting, as authorities are realizing the country must be ahead in the digital economy era to qualify as a global superpower.

“China wants to be the frontrunner in the digital economy era,” he commented. “And as the nation readies for the Fourth Industrial Revolution, it sees cryptocurrency and blockchain – a technology with enormous potential to remove pain points and inefficiencies – as an economic game changer.”