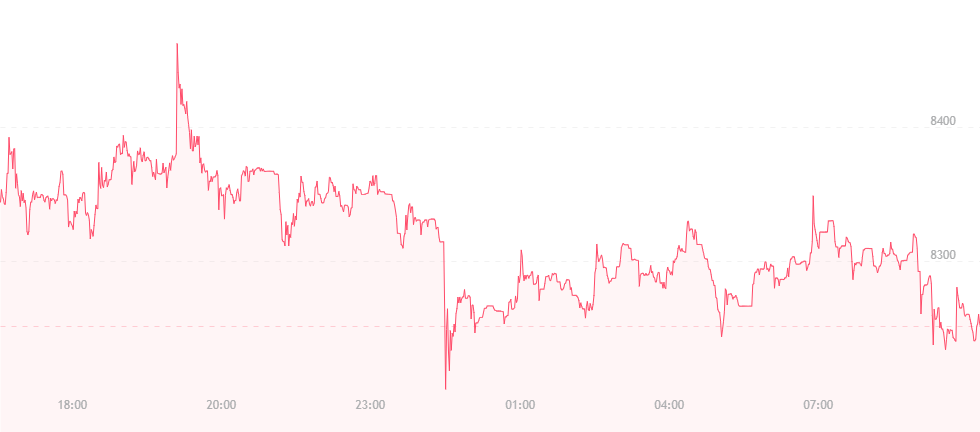

Bitcoin has incurred a slight price jump in the last 24 hours. The currency was trading at a measly $8,200 during yesterday’s afternoon hours, but has since spiked by roughly $100 to trade at its current price of $8,300. It’s nothing huge, but it’s a step in the right direction.

Bitcoin had previously started a journey that many of us originally thought would ease the currency closer towards recovery. A price bump had initially occurred after the start of the Coindesk Consensus Conference on Monday, and bitcoin was trading for as high as $8,500.

With the Conference now over, bitcoin incurred another $300 spike to $8,800 about 48 hours ago, though it has since slumped by $500, suggesting that the hoopla surrounding the Conference and the prospects of learning about bitcoin may have been short-lived. As a three-day event, it was probably silly on our part to assume that any sort of craze or bitcoin boost would last beyond that point.

One source discusses the Conference’s inability to push bitcoin any further. It states that the currency ultimately encountered hardcore resistance at $8,400, which it was unable to pass. It states that the coin has now entered a stalling period, and likely won’t incur growth in the immediate future.

“After holding $9K support for several weeks, bitcoin finds itself under this widely watched support level,” explained Jani Ziedins of Cracked Markets. “As I warned readers two weeks ago, there comes a point where support turns into stalling. This is what happened here. I’m skeptical of BTC at these levels, and it needs to recover to $9K as soon as possible to prove me wrong. Otherwise, expect nervous selling to return and push us back under the $6K lows.”

Bitcoin last graced $6,000 back in March before incurring a $1,200 rise in 48 hours to bring it up to the low $8,000 range.

We’re also witnessing more bearish attitudes amongst analysts, like one who claims that Fundstrat’s method for understanding and predicting bitcoin’s price is completely outdated. Known as the “Labor Theory of Value,” it says that the price of a good or service is ultimately determined by the work required to produce it.

Fundstrat allegedly uses the expected path of break-even bitcoin mining costs to forecast the price, which will reportedly stand at $36,000 by the end of 2019. Many sources and competing analysts cite this method of decision-making as popular amongst Marxist economists, and believe it is ineffective when one is truly trying to determine the coin’s future. These analysts are much more reliant on what they call “subjective valuation,” which states that the value of a good or service is whatever someone pays for it, regardless of the effort that went into it.

In basic terminology, bitcoin will always be worth whatever the “other person” is willing to pay. If you’re able to find someone who will pay more for bitcoin, the price can rise. If traders begin purchasing bitcoin at lesser prices, the total value of the coin will fall, suggesting that the crypto market is probably more speculative than many of us would like to think.