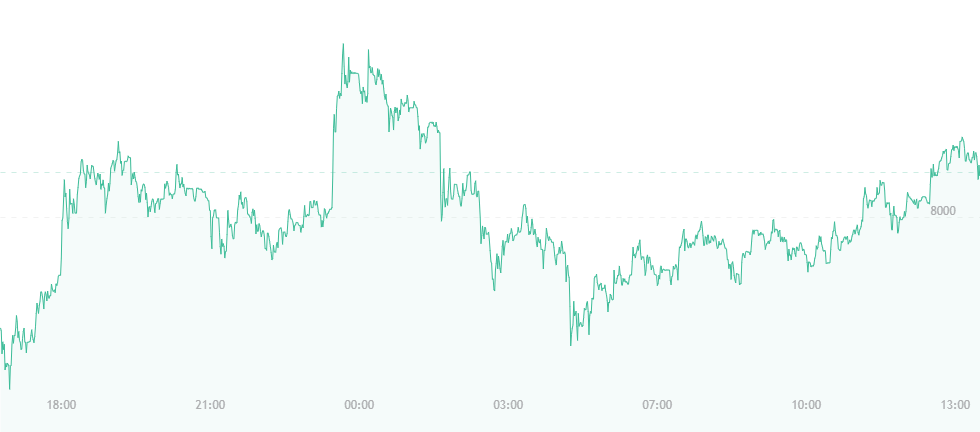

The bitcoin price has fallen by roughly $100, but this isn’t necessarily something to fear or a sign of another impending bear run. The currency has spiked by approximately $1,200 since mid-week, jumping from $6,900 to $8,100 in just under 48 hours, and a small drop in the records isn’t something to get one’s hat in a twist.

At press time, most analysts are unanimous in their thoughts that bitcoin and its crypto-cousins are in line for some “monster gains” in the coming weeks. Perhaps the biggest enthusiasm comes from tech billionaire Tim Draper, who recently stated that he believes bitcoin could reach a quarter of a million dollars by the year 2022.

“I’m thinking $250,000 a bitcoin by 2022,” he recently exclaimed to an enthusiastic crowd outside Draper University in California. “Believe it, it’s going to happen. You heard it here first. They’re going to think you’re crazy, but believe it. It’s happening. It’s going to be awesome.”

Rodrigo Marques – CEO of cryptocurrency investment platform Atlas Quantum – is also convinced bitcoin is about to strike very bullish territory. He suggests that the last few months of low prices have somehow been “preparation” for bitcoin and related altcoins to come back stronger.

Speaking with The Independent, Marques confidently stated:

“Bitcoin deflationary characteristics are an indication that in the long run, the market is bullish. We believe the price could be set to go up and has the potential to reach December 2017 levels again.”

Others are even more excited, claiming bitcoin won’t require excessive periods of time to reach allotted goals. As the CEO of fintech firm Smart Valor, Olga Feldmeier suggests that bitcoin could reach last year’s highs within the next eight months, and believes that one bitcoin could be worth as much as $100,000 by the year 2020.

One reason for the sudden price surge is that bitcoin trading may have greatly increased on April 12 and 13. One source suggests the “biggest hour of trading in bitcoin’s entire history” took place, with nearly $300 million moving through exchange platforms in less than one hour. That’s a total of roughly 38,500 coins.

Head of fintech startup Revolut Ed Cooper explains, “In this scenario, traders with short positions started to lose money and liquidate their positions by buying bitcoin. This caused the price to rise further, and as more people started to notice the rise, they bought in for a quick gain. This continues the cycle.”

He further states that enthusiasts and traders shouldn’t get too amped up just yet, and that even though bitcoin may be moving in a positive direction for the time being, investors should think beyond the “short term.”

“We’d need to see a sustained rise over a number of weeks to signal the end of the bear market,” he mentions. “We’re definitely not there yet.”

Bitcoin was not alone in its newfound bull behavior. The currency was joined by fellow altcoins ether and XRP, which experienced impressive gains of roughly 13 percent each in just a matter of hours. Bitcoin cash is trading at nearly $750 at press time, while litecoin has expanded by just over $3.