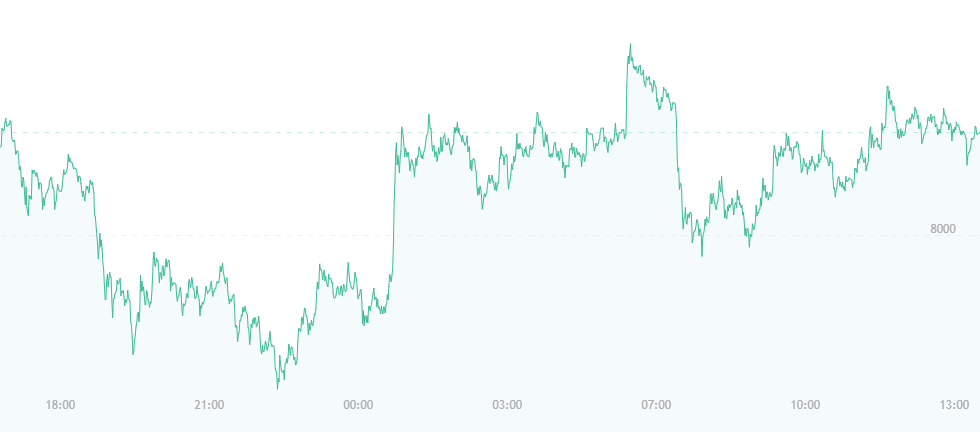

The price of bitcoin fell in dramatic fashion yesterday following Google’s announcement that it would no longer support cryptocurrency and ICO-related ads. Prior, bitcoin had been trading for approximately $9,100, though following the search engine’s sudden decision, the price fell nearly $1,000 (eight percent), and it has been hovering at $8,200 ever since.

For the most part, bitcoin is managing to hold its ground despite several resisting factors. Per Coindesk data, the asset fell to a new low of $7,676 late last night (the lowest it’s been since February), but it has since experienced a near $600-rise to place it at its current trading level.

This news suggests that while the bears have the upper hand, they are not holding all the cards. Bitcoin may have stumbled, but it hasn’t necessarily crashed. Small incremental jumps have been witnessed throughout the day as bitcoin continues to recover and gain traction a mere 24 hours after Google’s nearly fatal decision.

Fundstrat’s Thomas Lee is still bullish on the coin, maintaining his sentiment that bitcoin could strike the $25,000 mark by the end of the year. He is, however, doubtful about its short-term movements, and believes the price could fall as low as $6,000 before another bull run strikes.

At press time, nearly $60 million has been erased from the cryptocurrency market, and bitcoin is not alone in its fall from grace. Other virtual assets, like ether coin, are trading for just over $600, though the currency briefly dipped into the high $500 mark early this morning. Litecoin is currently trading for about $162 (a fall from its recent $200 figure), and Ripple is trading for about $0.69 – down a few cents from yesterday.

The primary reason behind bitcoin’s continual drops could be the now constant threat of regulation. As bitcoin and related cryptocurrencies become more mainstream and garner mainstream public support, officials are seeing a stronger need to take a stand.

In Asia – where impending regulation appears stronger than it does in the United States or North America – South Korean authorities spent Monday through Wednesday raiding three individual bitcoin exchanges, where it is believed the companies purchased new coins through other platforms using funds from consumer accounts. Among the materials and equipment taken were numerous hard drives, money transfer receipts, accounting files and even employees’ mobile phones to see if evidence of fraud could be uncovered. South Korea is also seeking to ban all future anonymous cryptocurrency trading.

The growing presence of ICO-related scams also seems to be a solid factor behind bitcoin’s fluctuations. Events like those involving Giza – which is under scrutiny for allegedly operating an ICO scheme that swallowed over $2 million USD in investors’ money – are becoming more commonplace, thus birthing regulation’s growing presence.

Lastly, another source suggests that worldwide interest in bitcoin is just phasing out. Hitwise, which monitors the online searches of nearly three million U.K. residents, says that total bitcoin searches have dropped by nearly 61 percent in 2018, and that less exposure to information about bitcoin through Google could do even further damage.

The Merkle will continue to bring you price-related coverage as it arises.