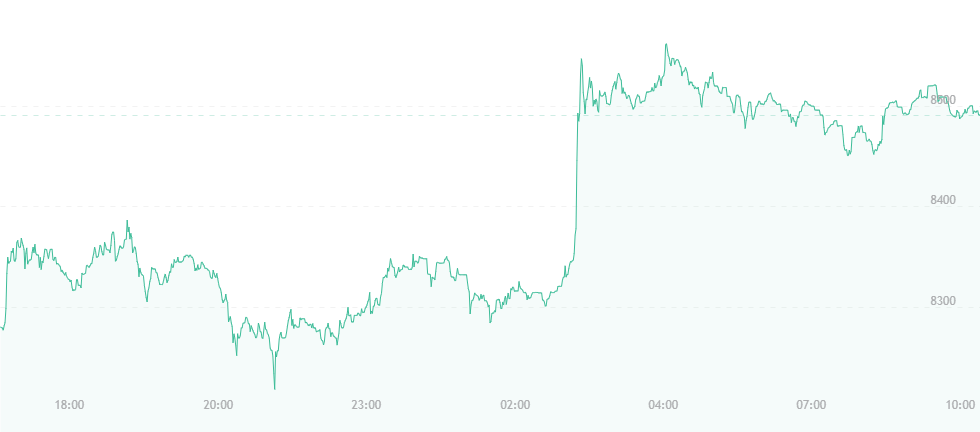

The price of bitcoin has shot up by roughly $300 in the last 24 hours, spiking from its previous $8,200 position. The news marks a massive turn away from the downward spiral bitcoin was enduring just over a week ago, when it’s price stood at a measly $6,600 – approximately 25 percent lower than where it currently sits. Naturally, the next move is for bitcoin to push past the $9,000 mark and strike $9,500 or possibly $10,000 by next week.

As good as this may be, bitcoin’s price jump is nothing compared to the surges enjoyed by competing altcoins like ether and bitcoin cash, whose rises stand between 10 and 19 percent since yesterday. Bitcoin cash has jumped by an impressive 15 percent, for example, and now qualifies as the fourth largest cryptocurrency with a total market value exceeding $18 billion. Ripple, on the other hand, boasted an even higher surge of 19 percent, and trades for roughly $0.83 at press time, while ether is trading for almost $570.

While major news has not preceded any of the recent steps, small maneuvers have been made since the beginning of the week that could have potentially assisted the currency in its recent ascension. IMF boss Christine Lagarde, for instance, recently composed a blog post detailing the benefits and advantages of bitcoin and the blockchain technology supporting it.

Shortly after its publication, Smart Valor CEO Olga Felmeier (affectionately known as the “bitcoin queen”) stated:

“I believe that we will see a comeback to the height achieved at the end of 2017 this year. Was bitcoin the start of the cashless society? Probably not the start alone, but it will be part of the evolution towards it. In Sweden, only one in four people now pay with cash in their day-to-day lives. In other countries with well-developed banking and payment infrastructures, we will see a similar development. On both sides, cryptocurrencies could accelerate this trend.”

So far, she appears to be on the right track, and the notion of “cashless societies” doesn’t seem to be too far away.

One headline that could have potentially led to the recent bitcoin spike is Cambridge Analytica’s sudden departure from the cryptocurrency scene. The infamous enterprise (now known predominantly for its central position in the Facebook data reveals) states that it was ready to release a new digital currency in the coming months.

According to former employee Brittany Kaiser, the asset would have been issued to customers who would then use it to store their online personal data or exchange it to advertisers.

“Who knows more about the usage of personal data than Cambridge Analytica?” Kaiser questioned. “So, why not build a platform that reconstructs the way that works?”

The information was not well-received by most spectators, including Jill Carlson – a consultant who has worked with several blockchain companies and has attended meetings with Cambridge executives. Speaking with the New York Times, Carlson said:

“The way Cambridge Analytica was talking about it, they were viewing it as a means of being able to inflict government control and private corporate control over individuals, which just takes the whole initial premise of this technology and turns it on its head in this very dystopian way.”