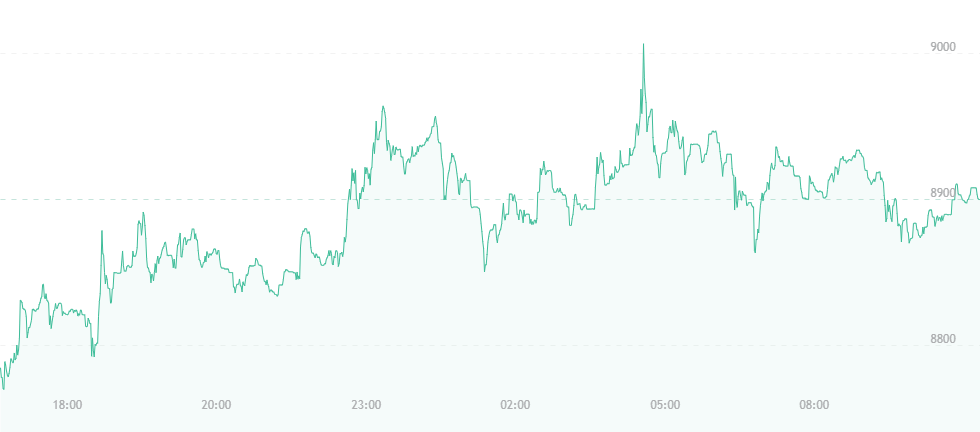

Bitcoin’s price remains virtually unchanged from yesterday’s $8,900 mark. While $9,000 hasn’t been reached just yet, sentiment remains that the currency could strike this territory in the coming days.

What’s interesting is that despite certain regulatory maneuvers inching forward, bitcoin and cryptocurrencies remain popular enough to fight ongoing resistance levels. In the past, when bitcoin was younger, the slightest move against its decentralized nature was known to make its price suffer, but now, things appear to be stabilizing somewhat.

RBI, for example, recently made headlines when it announced that it would no longer support cryptocurrency ventures, thus leaving several businesses in India to look for alternative solutions to complete transactions. This appeared to seal the fate for cryptocurrency in southern Asia, though things haven’t turned out that way.

Since the ruling, crypto-trading has, in turn, become more popular than ever, and digital currency usage in the nation remains solid. Furthermore, the price only dropped a few hundred dollars rather than a few thousand, and has continued to show promise ever since. It seems that all one must do nowadays is say that a person can’t do something before they seek out alternative ways to do what they’ve been “barred” from.

Taking things even further is Kali Digital Ecosystems, which recently filed a court case against RBI after collecting roughly 40,000+ signatures in a petition asking the establishment to reverse its ruling. Kali had been planning to launch CoinRecoin, a new cryptocurrency exchange platform, but its plans were dashed to the side following the Reserve Bank’s newfound regulation.

Rashmi Deshpande, associate partner of the representing law firm Khaitan & Co., explained:

“The circular appears to be arbitrary and unconstitutional since it does not give strong facts as to why RBI is against the business of cryptocurrencies. Logical and well-though arguments backed by solid facts are the primary requirements under the constitution to put a stop to any business in India.”

The same situation has been witnessed with Venezuela’s petro. In ruling that the coin cannot be traded in the States, President Donald Trump has allegedly made the currency more popular according to Venezuelan officials, though these words need to be taken with a grain of salt. Venezuela’s statements regarding the petro haven’t always been truthful, and it’s hard to imagine that many people being interested in a currency like the petro to begin with – one that’s reportedly backed by the country’s oil reserves, yet holders possess no stakes in Venezuelan oil.

Overall, the price of bitcoin has risen by approximately 27 percent since the beginning of April, and the total crypto market cap has hit $400 billion.

Pantera Capital CEO Dan Morehead has commented that “bitcoin has been growing at 165 percent a year for six years,” and that something growing that fast “hardly ever gets down below its 200-day moving average.” This suggests that while dips have been experienced in the past and may occur again, the currency isn’t going to fall below a certain average, so traders can rest assured that the currency will stay in the green for some time.

Rodrigo Marques – CEO of investment platform Atlas Quantum – also believes that a serious bull run is imminent. He explains that cryptocurrencies have taken a large step towards mainstream acceptance this last spring, and that “it’s hard to argue against everyone benefitting from cryptocurrencies.”