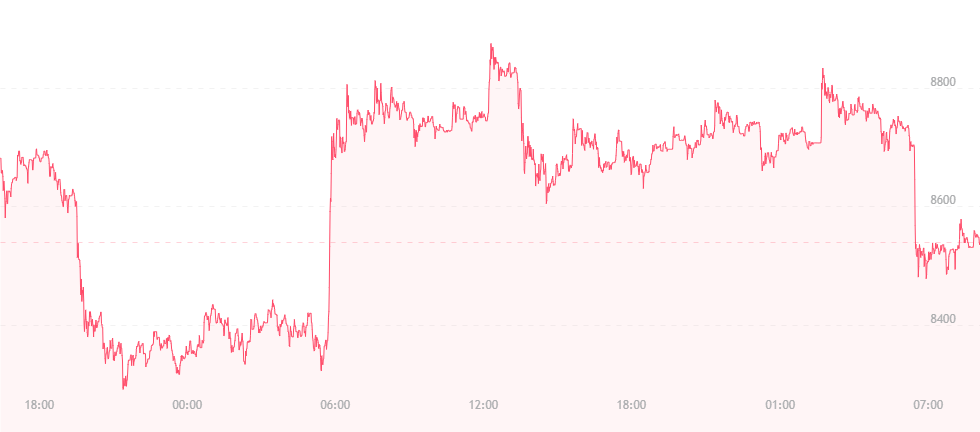

At press time, bitcoin is trading for just over $8,500. This is a near $300 drop from yesterday’s price of $8,800, and the recovery many of us likely believed to be right around the corner is again sinking into hiding for the time being.

The price did manage to rebound a bit following Monday’s start of the Coindesk Consensus Conference in New York. After falling roughly to $8,400 from the $9,000 price range last week, bitcoin ultimately rose to $8,800 as organizers were selling tickets for as high as $3,000 to last-minute attendees, though most could be garnered for an even $2,000.

Lines were out the door, and many visitors reported waiting well over an hour to gain entry. It was clear that despite ongoing volatility, investor interest in cryptocurrencies wasn’t waning anytime soon.

As the Conference enters its second day, it appears some of the hype has allegedly died down. It’s unclear if this is a lasting effect or if the bitcoin price is only down in the short-term, but again, we are entering an unclear space where everyone seems to be on opposite sides of the spectrum.

Matthew Cochrane of The Motley Fool, for example, suggests that bitcoin could drop by another 50 percent due to four potential reasons, the first being that the currency’s network is unusually slow when compared with other coins like Ethereum and Ripple.

Second is the currency’s high transaction fees. Trading coins or moving them to different exchanges or platforms usually causes users to incur relatively heavy costs, and other competing altcoins have looked to remedy this by enforcing lower fees on their networks. Furthermore, bitcoin is continuing to incur high levels of competition (it seems a dozen new altcoins pop up every week nowadays), and most companies and institutional investors are primarily interested in bitcoin’s technology rather than the actual currency. When it comes down to it, he suggests there’s far more interest behind the blockchain than the asset itself.

Yet at the same time (and this should come as no surprise), bitcoin is retaining its list of potential followers, who refuse to see anything but bullish trends in the coin’s future. One of those followers is Arthur Hayes, the CEO of mega-crypto exchange platform BitMEX.

A graduate of the Wharton School of Business in Pennsylvania, Hayes has been living in Hong Kong for many years as the “main man” behind the exchange, which currently holds the record for most bitcoin traded in a single day (140 BTC).

In a recent interview, Hayes made a bold prediction: that bitcoin would hit the $50,000 mark by the end of the year. What’s the reason? Asia. Hayes says trading and digital currency understanding is considerably higher in Asia than anywhere else in the world, and that continual cryptocurrency activity in countries like China, Japan and South Korea will increase demand and hike prices up:

“Asia dominates cryptos because they’re very used to trading digital assets. South Korea has been trading digital goods related to gaming for two decades. When you move to a purely money-based digital currency, they understand that culturally, so they get on board quickly.”