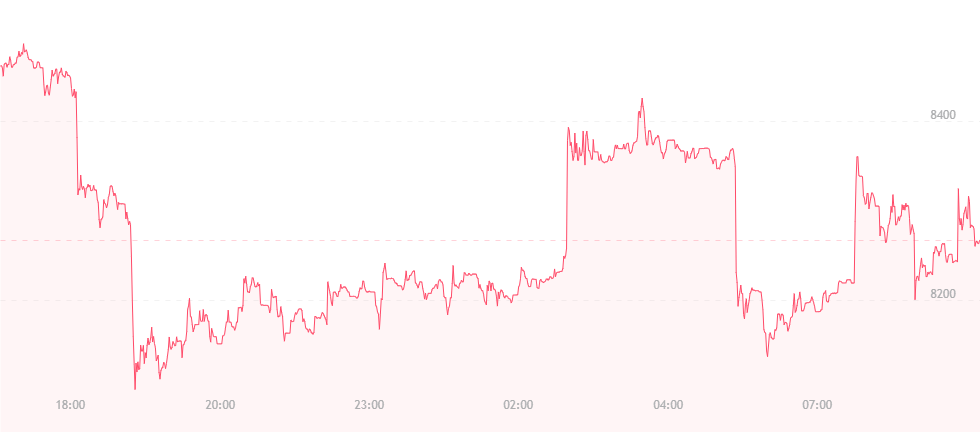

Another drop is in the books. After falling to $8,500 yesterday from its previous mark of $8,800, bitcoin is once again stumbling down the staircase and is now trading for $8,300 – just a sliver above last week’s low of $8,250.

The Coindesk Consensus Conference – which potentially gave bitcoin a boost over the last 72 hours – ends today, and it appears the hype it garnered for cryptocurrency is ending with it.

No doubt, most investors are annoyed with bitcoin’s lack of strength against its newfound resistance. Many analysts now wonder if the currency will drop back down to the $7,000 range, which it last skimmed in March.

One of the alleged reasons for the recent drop may be Bing’s recent ban of cryptocurrency ads. Powered by Microsoft, Bing is the world’s second-largest search engine behind Google, and apparently doesn’t see safety in cryptocurrency usage. The platform made the announcement on its Bing Ads blog, and expects the ban to be fully integrated by either late June or early July.

Advertising policy manager for Microsoft Melissa Alsoszatai-Petheo explained:

“Because cryptocurrency and related products are not regulated, we have found them to present a possible elevated risk to our users, with the potential for bad actors participating in predatory behaviors or scamming consumers. To help protect our users from this risk, we have made the decision to disallow advertising. We are always evaluating our policies to ensure a safe and engaging experience for our Bing users and the digital advertising ecosystem.”

Facebook made a similar ban last January. Representatives explained that they could no longer promote unregulated financial options as they potentially put investors and their money through unsafe conditions. Company product management director Rob Leathern later commented, “We want people to continue to discover and learn about new products and services through Facebook ads without fear of scams or deception. That said, there are many companies who are advertising binary options, ICOs, and cryptocurrencies that are not currently operating in good faith.”

Google took a similar route in March, explaining that all cryptocurrencies would be banned from its AdWords platform given that they were not regulated, and investors were offered no guarantees that digital currencies or ICOs operated in a clean or decipherable manner.

According to one source, bitcoin is the victim of weak “technical setup.” It’s explained that bitcoin is back to the diamond formation it had escaped last week, and the price could potentially fall as low as $7,850 or $7,800 in the coming days. The source did say, however, that if bitcoin broke above $8,500, it could develop newfound resistance levels. Perhaps $9,000 isn’t far off the mark after all…

And still, many analysts remain bullish towards the coin. Jeremy Liew and Peter Smith – a Snap venture capitalist and the CEO of Blockchain, respectively – believe that the currency could hit the half-a-million mark by the end of 2030. Granted we still have 12 years to wait, but both men believe bitcoin adoption will explode in the coming years, and that bitcoin transactions will account for roughly half of the world’s non-cash transactions, pushing the price to new heights.