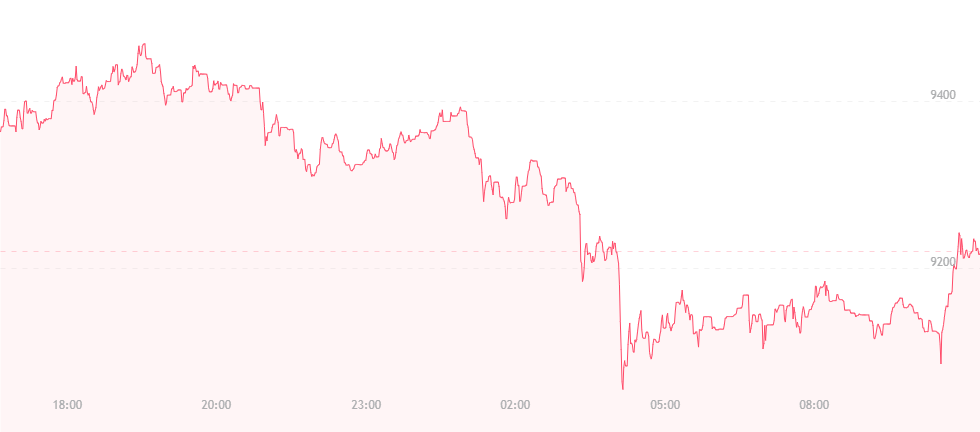

Bitcoin has continued to drop consistently over the last 48 hours. After a weekend high of roughly $9,800, many analysts and users thought bitcoin would strike the $10,000 mark in the coming days, though that figure laid out some serious resistance that bitcoin was unable to surpass. Since then, it has subsequently dropped to $9,500 and then $9,300, and is sitting at $9,100 at press time.

The drops may have been brought on by negative comments from billionaires Warren Buffett and Bill Gates. Both figures have made their feelings about cryptocurrency clear in the past, though it seems a billionaire’s mark on the financial world will have consistent repercussions on surrounding entities. Buffett ultimately said that he didn’t understand bitcoin and would never hold any dealings in the crypto arena, while Gates was quick to comment that he would short bitcoin if he could.

Another theory is that bitcoin is tightly attached to stocks. When money is being poured into the market – as it was last week, bitcoin is going to go up. The Dow can be an interesting indicator of when and how bitcoin will incur both price spikes and drops in the sense that it is a much older system than bitcoin. The Dow can instantly react to liquidity, while bitcoin is affected later, and requires some time for the change to hit.

Still, the currency’s future does appear tied to stock market behavior, and if the arena is experiencing slower trading as it is now, bitcoin becomes a victimized accessory.

But despite these recent drops, many remain bullish on bitcoin and predict massive surges in the coming weeks, months and years. Fundstrat’s Tom Lee – who has always been quick to suggest that bitcoin’s future is bright – recently commented that the currency will undergo a massive price bump following the upcoming Consensus Conference. Lee notes that following each conference in the past, bitcoin has jumped significantly into green territory. In 2017 for example, bitcoin’s price increased by a solid 69 percent, which in turn led to a 138 percent increase just a few months later.

He also mentions that this year’s event is slated to be larger than it’s ever been before, and will experience twice as many attendees as it did last year. Overall, Lee expects something along the lines of 2,750 visitors in total. Granted the trends of the conference continue, bitcoin could potentially reach even stronger highs.

Lee is not alone in his sentiment. Fran Strajnar – CEO of cryptocurrency research firm Brave New Coin – sees “strong fundamentals and an improving infrastructure” for bitcoin, and feels the currency could reach $200,000 by the year 2020. It’s a prediction to outlast even the most bullish analysts.

“The adoption rates are continuing to be quite steady, and adoption rates heavily correlate to the price, so therefore, unless for some reason people just simply stop continuing to adopt bitcoin, we should see $200,000 per bitcoin by January 1, 2020 at the latest,” she explained. “Hashrates, the number of wallets, apps – all that infrastructure is just steadily increasing, so adoption is most definitely happening and a lot easier to quantify.”