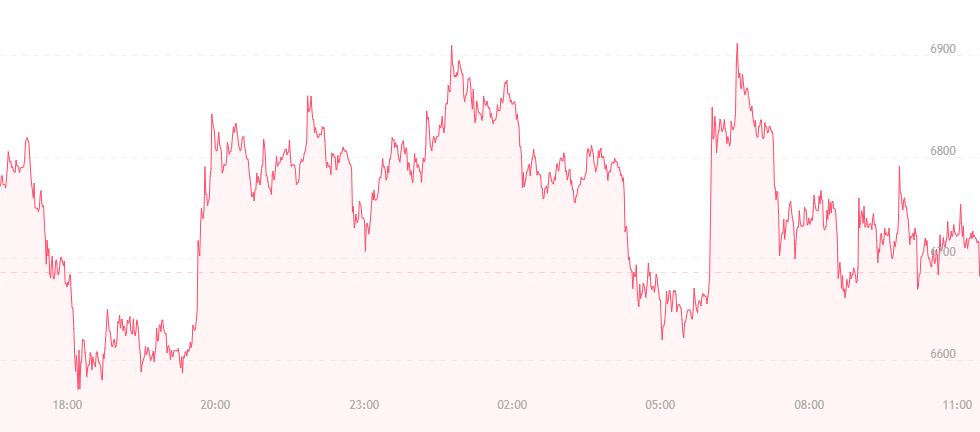

Bitcoin has taken a small tumble since yesterday’s figure of $6,800. At press time, the price has fallen by about $100 and bitcoin sits at just over $6,700.

The fall may have occurred for several reasons, one being the recent hack of privacy-oriented cryptocurrency Verge. The attack was noticed by a bitcointalk.org user, who claimed that “several bugs” were used to infiltrate Verge’s code. The hacker than rewarded himself (or herself) with anywhere between $15,000 and $1 million worth of coins.

Verge later tried to downplay the attack on Twitter, reporting that the problem had been removed and all was resolved, but several experts claim the problem is bigger than the post makes it out to be, calling it a “51 percent attack.” This is particularly disturbing considering this kind of attack is potentially possible on other “blockchains which rely on a proof-of-work (POW) validation mechanism.” Unfortunately, this includes both Bitcoin and Ethereum.

In addition, the Reserve Bank of India – the nation’s central bank – has hinted that it is in the process of banning bitcoin, and may be looking to create its own digital currency.

In a statement, executives explained:

“It has been decided that, with immediate effect, entities regulated by RBI shall not deal with or provide services to any individual or business entities dealing with or settling VCs. Regulated entities which already provide such services shall exit the relationship within a specified time. A circular in this regard is being issued separately… Internationally, while the regulatory response to these tokens are not uniform, it is universally felt that they can seriously undermine the AML (anti-money laundering) and FATF (Financial Action Task Force) framework, adversely impact market integrity and capital control. If they grow beyond a critical size, they can endanger financial stability as well.”

Naturally, this led to some concern. Many believe that panic is sure to spread amongst the country’s central bitcoin users, and that if the bank wants to create its own digital currency, it doesn’t need to ban others. Presently, India accounts for roughly 10 percent of the world’s cryptocurrency transactions.

And amidst all the hoopla, analysts seem to be split right down the middle (isn’t that surprising). Capital Economics in London, for example, feels that the coin is “essentially worthless,” and will continue to plunge along with stocks in the coming months. The organization feels that the coin has largely been correlated to the S&P 500 considering its price has been plummeting since December of last year.

On the other hand, BRD CMO and co-founder Aaron Lasher feels that the current volatility bitcoin and other cryptocurrencies exhibit is part of a process in which the technologies are fixing themselves and adapting to ongoing change. He stated that we’re in “the initial stages of a multi-decade trend towards the tokenization of assets.”

Eventually, regulation will not be an idea simply floating in the wind, but a set of policies set in stone. Sure, the steps taken to get there might be a little painful, but in the end, bitcoin will be a mainstream currency, and the swings we now witness in the crypto arena could ultimately come to an end.