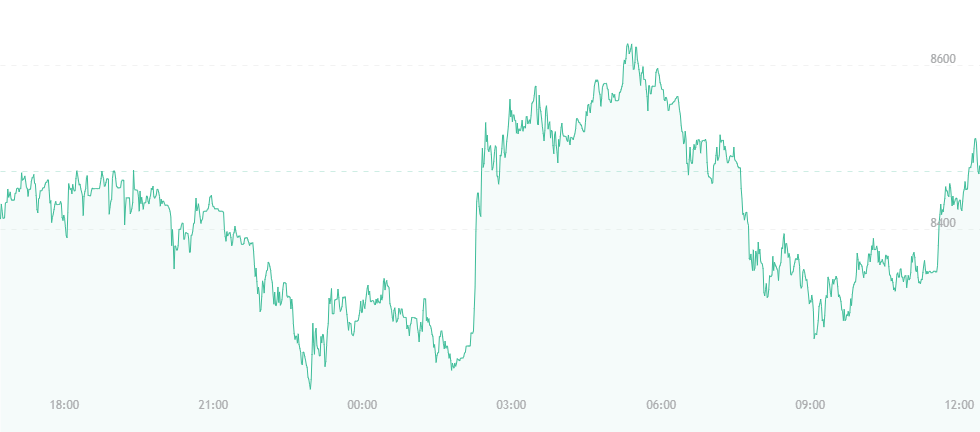

The price of bitcoin has sunk even lower during the past 24 hours. Yesterday’s price stood at $8,600 – a nasty drop from last weekend’s high of $9,800. Many were expecting bitcoin to test the $10,000 mark, which didn’t occur. In fact, last week has been the worst in bitcoin’s history since early April, when the currency dropped to $6,600. Bitcoin has fallen from $9,800 to $9,500, and then $9,300. This, in turn, led to slides to $9,100 then $8,600 respectively.

Now, bitcoin stands at $8,400, which believe it or not, is an improvement over where it was trading during the morning’s early hours ($8,250).

During yesterday’s price piece, we discussed the probability that Mt. Gox trustees had moved several bitcoin funds to approximately four separate wallets, which may have affected the price in the long run. In the past, these trustees have admitted that their actions of moving funds and selling off their stashes do, in fact, bear repercussions on bitcoin’s price and overall value, yet this hasn’t necessarily stopped them from performing such actions, which they’ve been doing since last September.

We’re almost certain the questions everyone has for these trustees are, “What the hell?” and “Why do you continue to move funds in such a way that the price is easily manipulated?” They clearly admit that what they’re doing has consequences, yet they haven’t stopped. Haven’t bitcoin enthusiasts and traders suffered enough from their actions? Is it that hard to relinquish power? Is this all part of a scheme to mold the bitcoin price to their liking so they can somehow cash in further on their respective sell-offs?

Another reason behind the recent drop may be Nvidia Corp, which recently broke out its cryptocurrency sales for the first time in quarterly earnings. Sadly, the company didn’t strike a particularly bullish tone. While prices have moved up initially during the year’s first quarter, the company’s executives claim that prices are now starting to come down, and thus revenue could diminish by approximately two-thirds during the present period.

“Crypto miners bought a lot of our GPUs during the quarter, and it drove prices up,” Nvidia CEO Jensen Huang claimed in a recent interview. “And so, we’re starting to see prices come down. We monitor spot pricing every single day around the world, and the prices are starting to normalize.”

This isn’t a great sign, considering the price of bitcoin is once again below the $8,600 mark. This, according to Fundstrat’s Tom Lee, is the final price edge where bitcoin mining can remain profitable (which we’ve discussed in past price articles), but a drop to $8,400 where it currently stands, and any additional falls after that could potentially bring the profitability of bitcoin’s mining sector down to new lows. We’ve already seen enough damage to the industry when bitcoin stood at $6,600 about a month ago. Could we see further struggles in the immediate future?

Aside from bitcoin, the digital currency appears to be taking all its crypto-cousins along for the ride. At press time, Ethereum is down by approximately seven percent. Ripple has dropped by 10 percent, while smaller coins like EOS are down a whopping 15 percent.