While there is weight to the argument that the success of one cryptocurrency promotes the success of all cryptocurrencies, there are certainly a number of coins whose communities and even development teams have adopted a position of spite and rivalry toward competing projects. Here are five of the best rivalries throughout cryptocurrency.

5. Binance Coin vs KuCoin Shares

While Binance emerged as the premier altcoin exchange in 2017, high withdrawal fees, dust issues, and registration closeouts led many traders to seek something better than even Binance. From this search, KuCoin emerged late last year. Binance Coin (BNB) and KuCoin Shares (KCS) are the tokens that provide privileges to and represent the exchanges in contention.

Currently, BNB, with a market cap of almost US$900 million, is worth more than three times as much as KCS. As an exchange, Binance’s 24 hour volume, which currently leads all cryptocurrency exchanges with close to US$2 billion, is magnitudes larger than that of KuCoin. However, the daily dividends accrued by KCS have attracted a number of investors, and could potentially overtake BNB if KuCoin saw a significant increase in trading volume.

4. EnjinCoin vs GameCredits

Since EnjinCoin (ENJ) began to rebound from all-time lows in November of last year, the holders of the coin that emerged have been out for blood. EnjinCoin doesn’t just want to beat other gaming currencies; ENJ wants to be the gaming currency. Its biggest roadblock is GameCredits (GAME), the first gaming cryptocurrency and only project that has consistently been valued higher.

While GAME has largely ignored the ENJ rivalry, EnjinCoin’s continued growth to a current market cap of US$108 million is only about US$20 million less than that of GameCredits, and if GAME doesn’t fight back, it may see its market cap overtaken by ENJ in the immediate future.

3. Ripple vs Stellar Lumens

Ripple (XRP) has faced consternation from the overall cryptocurrency community for quite some time due to its being a centralized coin for the benefit of bankers, two concepts that go against the core values of cryptocurrency. While XRP has maintained a position as a top currency since its inception, at one point even overtaking Bitcoin in terms of market cap, it’s now being challenged by a friendlier, decentralized alternative, Stellar (XLM).

Fundamentalists support XLM as an ethically superior approach to payment processing, and its close ties with IBM have caught the attention and enthusiasm of cryptocurrency speculators across the board. With a market cap of US$5.8 billion, XLM still needs to see significant growth to eclipse that of Ripple, but its recent strength suggests this is not impossible.

2. Bitcoin Cash vs Litecoin

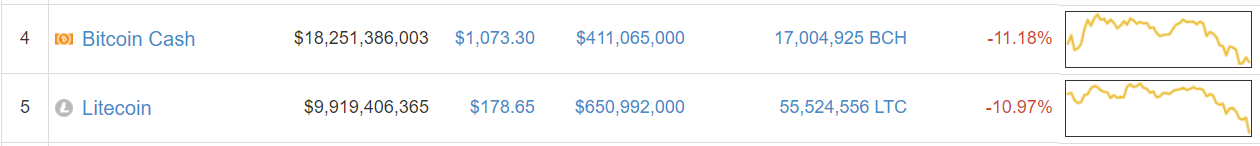

Once upon a time, Bitcoin Cash (BCH) supporters were calling for “the flippening” – a reality in which Bitcoin Cash was valued higher than Bitcoin, and therefore would shine as “the true Bitcoin”. However, the more likely future that others are calling for is “the flappening”, where Litecoin (LTC) surpasses the value of Bitcoin Cash.

The 2011 Bitcoin fork known as Litecoin is far older than that of BCH, and it has played a supplementary role to BTC for many years. With recent developments of Litepay and pushes for greater exposure as a payment option, LTC can be seen as technologically superior to BCH. The coins are very close in value, and a “flappening” may happen soon.

1. Bitcoin vs Ethereum

Ethereum (ETH) is another coin that has many times vied to overtake Bitcoin. Its market cap has exceeded that of Bitcoin on a couple of instances, and Ethereum maximalists would suggest that the fundamental values and functions of the coins do not even compare. While ETH has proven itself as a legitimate, widely used, and valuable cryptocurrency, these discussions took place even when it was worth very little.

Cryptocurrency supporters active on Reddit early in 2016 likely remember the private message campaign undertaken by the Ethereum community when the coin was trading at less than US$1. Depending on your position at the time, you were either very supportive or annoyed by the unsolicited messages sent to /r/bitcoin participants explaining why Ethereum was superior. Below is one of a dozen messages I personally received urging me to check out Ethereum.