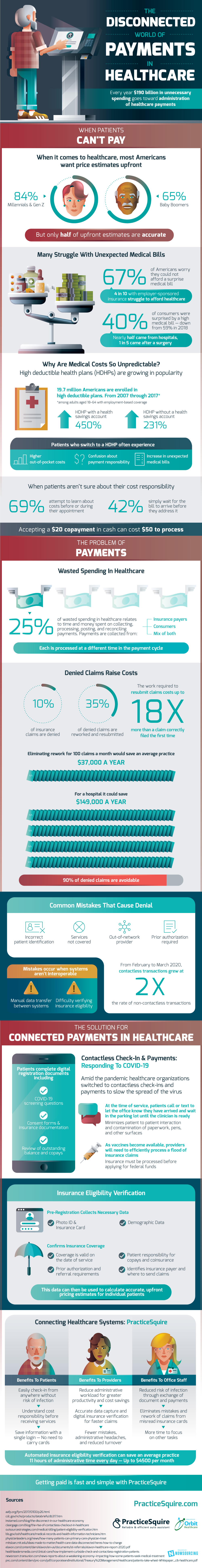

Healthcare is often very confusing, perhaps especially for patients, but perhaps not since $190 billion is spent on unnecessary costs in healthcare payments administration every single year. 25% of wasted spending in healthcare relates to collection, processing, posting, and reconciling payments. It stands to reason that perhaps the insurance community is as confused as patients are when it comes to what the actual cost of any given medical procedure is going to be.

When it comes to medical procedures 84% of Gen Z & Millennials, and 65% of Baby Boomers want to know the cost up front. The problem is that only about 50% of estimated costs are accurate. Of course, the result is that many Americans received unexpected medical bills. This happened to 40% in recent years, which is actually down from 59% in 2018. At the moment 67% of Americans worry about not being able to pay an unexpected medical bill and 4 out of 10 with employer-sponsored insurance are struggling to afford healthcare.

The rise of high deductible healthcare plans (HDHP) is partially to blame for the unpredictability of medical bills. Enrollment in HDHP’s with a healthcare savings account grew by 450% from 2007 – 2017 and enrollment in a HDHP without a savings account grew by 231% in that same time. Patients with a HDHP usually experience higher out-of-pocket costs, confusion about payment responsibility, and therefore an increase in unexpected bills.

Fortunately, there are already some steps the healthcare industry can take to make a better connection between procedures, bills, patients, and payments. The COVID pandemic brought on the use of contactless check-in for healthcare and payments to slow the spread of the virus. As it turns out, contactless methods are also a great way for information to pass between patients, their doctors, and insurance providers. Patients are able to sign consent forms on their own devices and can review outstanding balances and copays. Remote check-ins also give the opportunity for insurance eligibility verification before any medical costs are incurred.

Using an automated system for check-in, eligibility verification, and payments can save medical practices thousands of dollars in administrative costs.

Source: PracticeSquire