Last Friday, the overall trend of major currencies has been volatile. Except for the price trend curve of BNB, other currencies have shown significant fluctuations, and the overall price has dropped significantly compared to last week’s closing stage. This article will study the performance of major assets, explore the factors that affect their price trends, and conduct corresponding analyses to predict their future short-term price trends.

Bitcoin(BTC)

Bitcoin has fallen by about 4.89% this week and is currently closing at around $41,659, with a noticeable upward trend within a week. The highest point of Bitcoin this week was at the opening price of $43,676. The overall trend has shown a downward trend of rapid daily fluctuations, with more severe fluctuations. Currently, the Bitcoin price remains above $40,000. Although the lowest point of the week’s price dropped to $40,534, it still maintains a basic key price support level.

Analysis suggests that the price trend of Bitcoin will usher in a new round of volatility this week, mainly with reasonable price fluctuations, which can be seen as a slight correction to the market’s overheated response in the previous two weeks. At present, the key price support of Bitcoin is still strong, and it is almost impossible to see a diving trend in the short term. Earlier, it was predicted that the price of the currency would fall this week. Currently, the expected trend is more in line with the market’s volatile cycle. Maintaining such market trends in the short term should be a more obvious market theme.

Bitcoin Price Data (Data Courtesy of CoinMarketCap)

Ethereum(ETH)

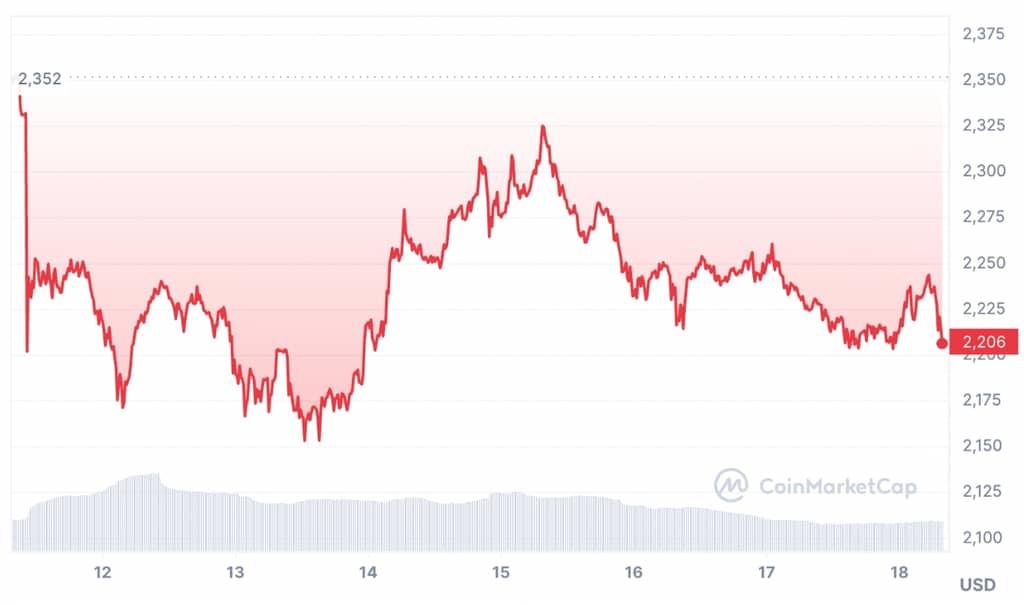

Ethereum fell 6.06% this week and closed near $2,207. The price trend of Ethereum has once again maintained a strong correlation with that of Bitcoin this week, but the daily trend is smaller. The high point of Ethereum’s weekly price is around $2,352 at the opening stage, while the low point is around $2,153. The slight fluctuation and correction are more obvious, but it still maintains a key price support.

The price trend of Ethereum is similar to that of Bitcoin this week, both of which were affected by market fluctuations and a pullback trend, resulting in a rapid rise and fall in the price curve. Although a new market cycle has arrived, Ethereum still maintains a key price trend above $2,100 and is currently fluctuating around $2,200. Maintaining the current state in the short term and continuing to fluctuate within a fixed price range will be a highly probable event.

Ethereum Price Data (Data Courtesy of CoinMarketCap)

Binance(BNB)

BNB price rose 0.23% this week and closed around $240, which is basically the same as last week’s closing price. This week, BNB has been affected by various high-frequency actions of the platform, and its price has begun to rebound. However, market confidence is still lacking, and the currency is still in a critical transitional stage. Therefore, its price trend is not significant from a weekly perspective. Overall, BNB is still mainly in a volatile market, with prices reaching a high point of around $256 and a low point of around $232 within a week. The influence of the Binance platform itself is still ongoing, and the currency will continue to fluctuate in the current price range for a period of time.

The trend of BNB is slightly unique, as it did not achieve a significant increase during last week’s general market rally. Therefore, the pullback range this week is relatively small. However, the platform’s various high-frequency actions have provided some support for the currency’s price, keeping it at its current key price level. The subsequent volatile market will continue, and the price of BNB will depend more on the platform itself, The impact of market cycle trends on it is temporarily limited.

BNB Price Data (Data Courtesy of CoinMarketCap)

Ripple(XRP)

XRP fell 7.50% this week and closed near $0.61. The price of XRP experienced a price drop after the opening of this week, and it did not break through to above 0.65 US dollars in the following week, basically maintaining a sustained fluctuation trend within the range of 0.60 to 0.64 US dollars. The high point of the XRP price within a week was 0.661 US dollars, and the low point briefly fell below 0.6 US dollars.

Analysis suggests that the overall market volatility this week is evident, with mainstream currencies beginning to experience significant price corrections, mostly in a volatile market. The price trend of XRP also aligns with this, but its daily changes are more gradual compared to Bitcoin and Ethereum. In the current volatile market, the price of XRP n has remained more stable, and it is difficult to see the momentum and possibility of breaking through the 0.7 US dollar again in the short term. Continuing to fluctuate above 0.6 US dollars in the future will be the main market fluctuation.

XRP Price Data (Data Courtesy of CoinMarketCap)

Solana(SOL)

Solana price fell 4.23% this week and closed near $70.96. Although the price of SOL has rebounded this week, it remains one of the stronger-performing mainstream coins. The high point within a week is around $79, while the low point is around $65. SOL benefits from the excellent status and performance of various projects in the Solana ecosystem, which makes the overall price support of the currency very strong.

The price of SOL has experienced a relatively small pullback this week. In this new cycle of volatility, the currency is unlikely to experience a significant drop in price but instead will exhibit a sustained trend of volatility. Long-term bullishness is also the mainstream judgment of current market users, but in the short term, one or two weeks, it is mainly characterized by sustained small fluctuations.

SOL Price Data (Data Courtesy of CoinMarketCap)

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any project.

Image Source: OpenAI. (2024). ChatGPT [Large language model]. https://chat.openai.com