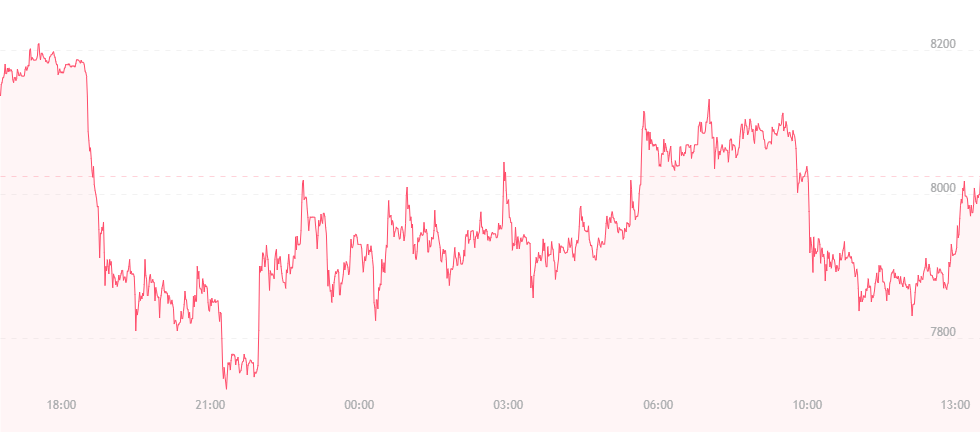

Bitcoin is holding firm at $7,900. While this is a serious drop from its weekend mark of $8,600, there have been no significant changes since March 26, though it was trading for about $8,100 in the evening hours. A $200 rise and fall window is nothing to be terribly concerned about, though it does suggest the currency is experiencing a stronger point of resistance than in has in recent weeks.

Today, the ban of cryptocurrency and ICO-related ads takes full effect on social media giant Twitter. The company is following in the footsteps of Google and Facebook, and has become the third-largest company to take such action. Every time an enterprise of considerable size has made such a “bold” maneuver, bitcoin’s price has inherently dropped anywhere between seven to ten percent, and new levels of resistance are subsequently being developed.

Additionally, bitcoin incurs small, yet noticeable rises throughout the following weeks, but has yet to recover the stamina and growth it experienced last December, leading to a serious decline in general interest for cryptocurrency and concerns over whether the digital asset industry will be damaged permanently.

What is different, however, is that there has been no noticeable change from one day to the next. It is ironic that 24 hours would pass between Twitter’s initial announcement and the actual enforcement of its ban. Twitter first mentioned its plans on March 26; it was then that we noticed bitcoin’s first major drop in over a week to its present mark. Now that the ban is in place, bitcoin’s price isn’t moving much, which leaves room for argument that the currency’s strength is increasing gradually, and developing a thicker base for working against such blockades.

The news of Twitter’s stance is disheartening at first glance, but it may not mark the end of bitcoin or cryptocurrencies just yet. In Korea for example, where digital assets have retained their popularity despite strict regulation changes, the death of anonymous trading and exchange raids, popular trading platform Bithumb and mobile payment service provider Pay have joined hands to bring cryptocurrency payments to several thousand retail stores and locations throughout South Korea by the end of 2018.

The partnership would allow consumers to purchase virtually anything and everything with digital currency, granted its accepted at one of the several thousand participating stores. This is just one of many recent ventures designed to bring widespread cryptocurrency acceptance and adoption to South Korea. Others include Kakao Corp, the “internet giant” that’s working to integrate cryptocurrency payments for over 10,000 separate merchants.

As of late, South Korea accounts for over one-quarter of the world’s cryptocurrency trades, making it a strong player in the digital asset industry. Not only does the region warrant further attention, but it is likely regulation within Korea will have a bolder influence on the regulatory tactics of outside regions. We won’t know until further implementation, but the idea is growing that Asia has a powerful hand in the cryptocurrency arena, and things will likely remain that way for some time. Regions like the U.S. and Europe are going to have to work hard if they wish to keep up and remain current.