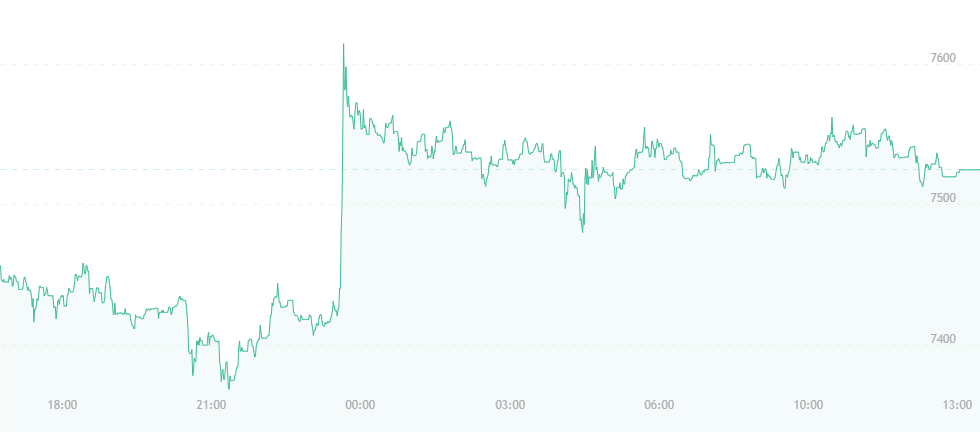

At press time, bitcoin has incurred a small rebound, and is now trading for roughly $7,500. This marks a $100 spike from yesterday’s price, though that, in turn, marked a $100 fall from 48 hours ago, when bitcoin had previously been trading for $7,500. Thus, while bitcoin’s new position is a move in the right direction, it’s hardly something to get super excited about.

Previously, the currency had broken key support levels in the $7,000 range, but while the bears still have primary control, sentiment does suggest that this is only temporary, and that one uptrend is all that’s really needed for the bulls to step in and take the reins.

One of the reasons behind bitcoin’s latest price drop may stem from India. The country isn’t exactly known for being entirely friendly towards crypto (the RBI has already banned banks from working with companies that deal in bitcoin and digital assets), but now, the government is considering an 18 percent goods and services tax (GST) on cryptocurrency trading.

A new report is being considered by India’s Central Board of Indirect Taxes and Customs. A hearing is set to take place on July 20; until then, all courts in India are barred from hosting any case related to the matter.

India seems to have a solid grip on cryptocurrencies. Back when the RBI first announced its ban on bitcoin business-bank relationships, the asset took the first of several nasty falls that would ultimately bring it down to the $6,000 range, where it hovered for quite some time. Now that recovery has begun, it appears India is once again stepping into the mix and enforcing its power. Bitcoin just can’t seem to catch a break…

However, one source suggests that the long-winded price bends of the last few weeks (or months, considering bitcoin’s high of $19,000 in December) may finally be coming to an end. A new theory suggests that many institutional investors bought stakes in bitcoin just before the launch of bitcoin futures. Futures trading – which many now believe may have been the cause for bitcoin’s subsequent price drops – allowed these holders to short their coins with ease. From there, fake-out dumps, failed rallies and major price dumps could occur accordingly.

The theory was suggested in a series of tweets by a cryptocurrency community known as the Crypto Fam. Analysts in the group suggest that the bears’ hold on bitcoin may be coming to an end relatively soon, as institutional bitcoin holders’ stashes are starting to run short.

“The bear market is running out of gas,” the researchers said. “This is a very simplified explanation of how markets work. A great deal of the total BTC supply is not traded. Some is lost forever in idle or forgotten wallets, while other bitcoins are hodled by strong hands who never sell. This gives [market markers] greater power with their share of BTC.”

The researchers further claim that despite falling to $6,000 in March, bitcoin has ultimately failed to test new lows, and suggest that rallies to $10,000 and $12,000 could occur sooner than investors anticipate.