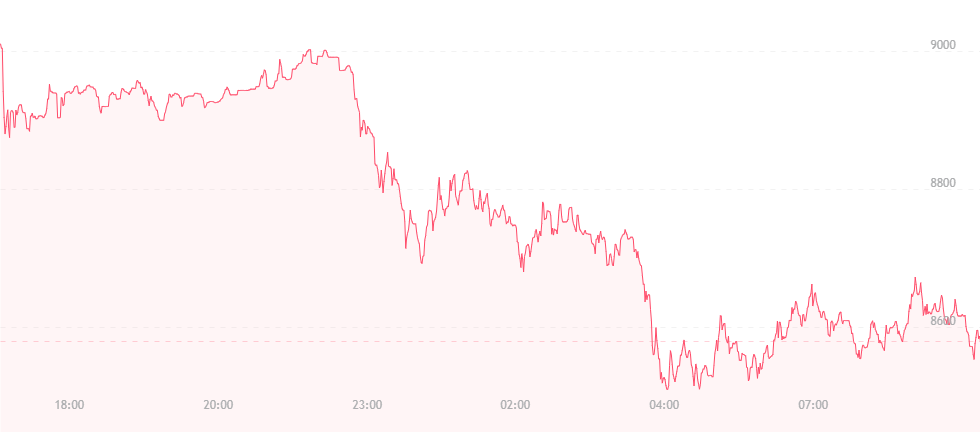

The price of bitcoin has fallen dramatically over the last 24 hours. The currency is now trading for about $500 less than where it stood yesterday afternoon. At press time, the currency is wallowing in the $8,600 range after previously hovering at $9,100. Prior to that, the currency had experienced a weekend high of $9,800, but subsequently dropped to $9,500 and $9,300 respectively within a 48-hour period. This ultimately marks a $1,200 drop in only five days.

No doubt many investors are pulling their hair out of their scalps right about now. It appears there are several reasons for the price drop – one stemming out of Asia where digital trends are allegedly set, especially in the crypto arena. One of South Korea’s largest cryptocurrency exchanges, Upbit, has been raided by government authorities, once again renewing the notion that South Korea is heightening its regulatory scrutiny. Should this occur, bitcoin and its crypto-cousins will undoubtedly suffer. Enthusiasm is likely to drop significantly, and digital asset enterprises around the world will be feeling the heat.

Upbit is suspected of illicitly moving customer funds to the accounts of its executives. While an official report has not yet been released, authorities state that if evidence is discovered that points to any illegal activity, the exchange could be temporarily or permanently shut down. At press time, general sentiment remains that Upbit had no reason to make such a move, and The Merkle will bring you more on this story as it comes along.

In addition, it appears we just can’t seem to get away from Mt. Gox. It is widely suspected that a Mt. Gox trustee has moved some heavy bitcoin funds into four separate wallets, which may have triggered a sell-off and contributed to the price drop. Since last September, trustees of the now infamous Japanese cryptocurrency exchange have continued to move large sums of bitcoin despite their own personal acknowledgements that such action may contribute to wide price swings in what is already a very unstable and volatile market.

It has been indicated that as many as 2,000 bitcoins were placed in each wallet over a 24-hour span.

And yet despite all the hype and drama, many remain loyal to bitcoin and suggest its price is about to surge higher than ever before. One of those figures is financial strategist Robert Sluymer, who says that while bitcoin is likely to suffer a turbulent month, it will undoubtedly get stronger from here.

Sluymer attributes the present drops to ongoing attempts to regulate the currency, but feels this is on the verge of thinning out. “The regulatory risk, the fundamental risk around what’s happening with cryptos has hit a bottom, and now we’re in a state of general recovery,” he assures.

Other figures, like head of the Federal Reserve Bank of San Francisco John Williams admit that while there are benefits to bitcoin use, the currency is plagued by issues that need to be fixed. While discussing the setup or institutional arrangement around bitcoin and other cryptocurrencies with CNBC, Williams exclaimed, “They have problems with fraud, money laundering and terror financing. There are a lot of problems, there.”