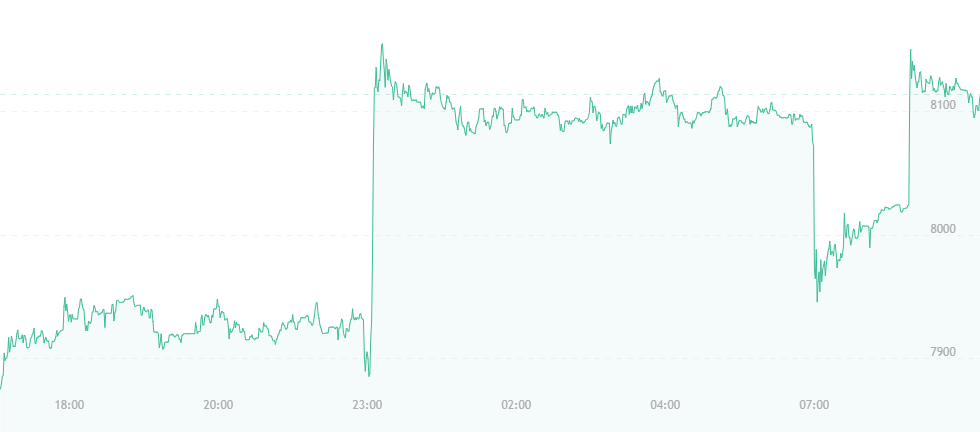

The father of cryptocurrencies is holding its mark at $8,100. Following a small drop just 48 hours ago, the currency has risen to its present spot, and has held its ground since yesterday.

Bitcoin has allegedly developed a new stronghold following its worst quarter since 2011, and for the most part, analysts remain confident that it will continue to rise through the ranks and strike new highs in 2018. Broker Jim Iuorio, for example, recently commented:

“I think it’s going to go higher from here. There have been a lot of regulatory headlines, and bitcoin held in. Now, I think if it trades at $8,200, a little bit above where it is right now, I think that’s a spot to stop in with a target of $9,400 on the downside… I come in week after week and say that people are confused with falling in love with blockchain and are using bitcoin as a proxy for that love – I still think that exists, but within the framework it still can have some pops, and I think this could be one.”

In addition, others remain positive about bitcoin’s technology, and deny that it consistently lures criminal or illicit activity. Chief scientist for a government office in Quebec Remi Quirion has recently published a new report exploring the notion of money laundering through bitcoin. The document suggests that there is no link between the two, as bitcoin transactions are not as anonymous as previously suggested, and can ultimately be tracked by law enforcement organizations.

“Bitcoin is not above the law,” the report states. “Nor is it a magnet for illicit transactions. It forms only a tiny part of the criminal money circulating around the planet. The reason: it is less attractive for anyone who wants to make transactions without leaving a trace.”

The report diminishes or outright dismisses several previously-held (and potentially false) beliefs that bitcoin or related cryptocurrencies could allow criminals to stay hidden in the shadows and pursue a long career of crime and misdeeds without being noticed. Furthermore, several major ventures in the financial industry continue to pave the way for blockchain technology by incorporating it into their operations.

Financial and technology services group True Potential, for example, is slated to become the first U.K.-based fintech organization in the field of asset management to implement the blockchain into its in-house trading platform to record future transactions. The company’s partners include top players like Goldman Sachs, UBS and Allianz Global Investors.

Director of the Finance & Technology Research Center Ian McKenna explained:

“Blockchain technology is beginning to come of age, so it is really good to see all it can offer being embraced by a forward-thinking financial advice firm that has a long track record of delivering technology enhancements ahead of the rest of the market. Driving out cost is a key element in platforms remaining competitive, so embracing the blockchain and the benefits it can bring is a logical step.”

All these moves and more could potentially assist bitcoin in shifting gears and continuing its upward momentum in the coming days. The patterns are also rubbing of on neighboring altcoins, as ether has jumped to $515, while Ripple’s XRP is staying strong at $0.67 from yesterday.