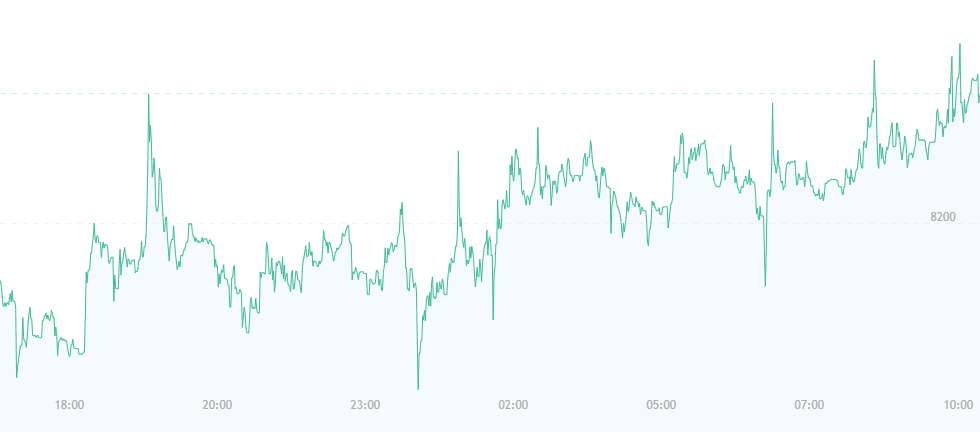

Bitcoin’s price has risen by another $100 and presently stands at $8,200. According to one source, the next spike may take the currency all the way to $8,500, in which the next goal will be to reach $9,400.

Other cryptocurrencies also seem to be “infected” with bitcoin’s rising spirits. Ethereum, for example, is trading at $544 at press time – a $7 hike from yesterday’s $537. Ripple has crossed the $0.70 line, and now trades at $0.72, while bitcoin cash has jumped nearly $60 and is trading at $940. Lastly, litecoin is enjoying new leaps and bounds and is trading at $142.

No serious news seems to have preceded the moves, though several analysts remain bullish. However, some are still encouraging caution amongst investors, including Tone Vays, who hosts a regular bitcoin trading podcast.

“If we can get into an area of $8,600, it’s very possible the price would be exhausted,” he claimed in his April 18 presentation.

In addition, Mark Karpeles – the former CEO of doomed cryptocurrency exchange Mt. Gox – is entering “gloom and doom” territory when it comes to crypto. The entrepreneur recently landed a C-level executive position with a U.S.-based tech corporation, though he’s being forced to work remotely from Japan where he awaits trial for alleged embezzlement and data manipulation.

Karpeles commented that bitcoin is “doomed,” and that it’s not the future of finance like so many experts think. He’s had enough of cryptocurrency for the time being, citing his problems with the former exchange and polarization of the crypto community.

In addition, Mt. Gox has been selling off its remaining stash of roughly 200,000 bitcoins since September of 2017. Many traders believe doing so could potentially affect the bitcoin price and thus cause a crash.

For the most part, bitcoin appears to be remaining in “high spirits” in comparison to last week, but it’s unclear if the coin still holds the same prowess it did four months ago. A new report suggests bitcoin miners aren’t likely to make any profit if bitcoin stays under $8,600. Unless a rise to this figure occurs immediately, the business of extracting coins could remain unstable.

Head analyst and co-author of the report Charlie Chan explains:

“We estimate the break-even point for big mining pools should be US $8,600, even if we assume very low electricity cost (US $0.03 kW/h). We think the injection of new mining capacities will further increase the mining difficulty in 2018. Even if the bitcoin price stays the same, we believe mining profits would drop rapidly, according to our simulation. Therefore, we think the Bitcoin mining hardware demand and price will decline further and affect TSMC’s wafer demand.”

Still, many exchanges note newfound trading highs and investor presence. London Block Exchange (LBX) CEO Benjamin Dives, for example, says his firm is now responsible for millions of dollars in bitcoin, ether, litecoin and XRP trades:

“The common assumption is that institutional investors shy away from new asset classes like cryptocurrency, but that’s not what we are seeing here at LBX. We’ve seen a huge uplift in institutional interest, recently. We’re now handling many millions in trades each month. From hedge funds to pension funds, institutional investors are taking cryptocurrency seriously.”

Granted the enthusiasm remains unchanged, we’re likely to see the bulls hold onto the financial reins for the time being.