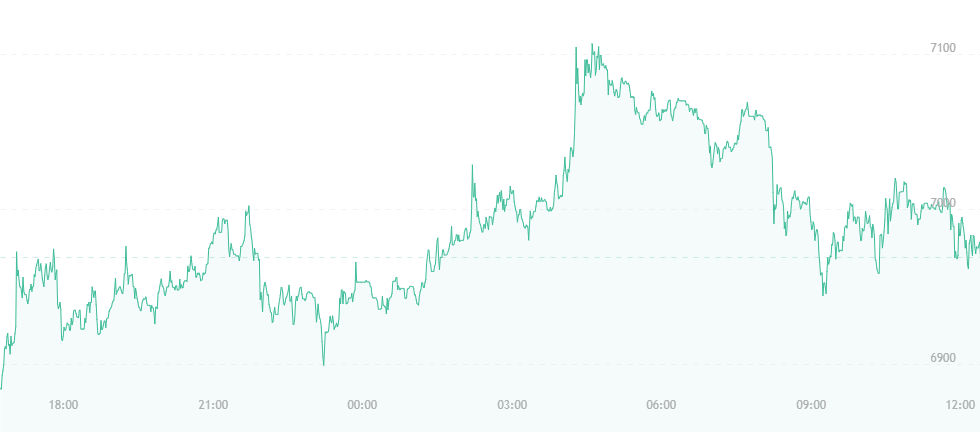

Bitcoin seems to be on an ascending path. After incurring a $300 jump yesterday and trading at roughly $6,900, the currency has hit the $7,000 point – a welcome move for many hungry enthusiasts.

One of the reasons may be the recent influx of major financial players – some of which had originally turned their backs on cryptocurrency or rejected its notions of legitimacy – who are suddenly becoming more involved. One of these figures is legendary hedge fund manager George Soros. The head of his company Soros Fund Management recently announced that the enterprise had received permission to begin trading cryptocurrencies within the next few months.

This marks a massive change of heart, as Soros has repeatedly referred to bitcoin as mere “speculation,” and dismissed it as a financial trend that was likely to disappear within the next few years. Naturally, his words were hard to take considering his power and status in the financial community.

Now, the legendary Rockefeller family is looking to get in on the crypto action. Venrock, the venture capital firm of the Rockefeller Foundation, has partnered with Brooklyn-based cryptocurrency firm Coinfund. The partnership will ultimately bring Coinfund closer to large companies and assist in its general product growth.

With so many swings happening, one can’t help but wonder if individuals like Warren Buffett – one of bitcoin’s largest opponents – will follow in Soros’ path and seek to make their mark in the crypto arena.

Naturally, this raises questions about where bitcoin will go in the coming weeks. Thus far, it appears that recovery may be on the horizon, but it’s hard to tell for sure if these past two jumps are short-term, or indications of something much larger.

Chief Strategy Officer for NYNJA Marshall Taplits remains bullish regarding the currency’s price:

“Speculation on price is always difficult, but the trend for Bitcoin is clear – up, going to about $20,000 USD from zero in 10 years. Each time Bitcoin corrects, the media wrenches. However, anyone who has been watching cryptocurrency since the beginning knows to bet on $30,000.”

Taplits is not alone in his sentiment. Daniel Worsley – COO of LocalCoinSwap – acknowledges that the battle for bitcoin and the blockchain is ongoing, and that there will always be enemies working to stand against their respective growth. However, he feels out that for the most part, both entities have managed to sway all attacks, and that he “wouldn’t be surprised” if the currency reaches a price exceeding $20,000 by the end of the year.

“Given the amount of negative press which is now priced in and investor expectation of another bull run, it will only take a couple of positive developments to set off the train,” he states with confidence.

On the other hand, some figures, like digital partnerships manager at OTE & COSMOTE Dimitris Ioannides, lean more towards the bearish end of the spectrum. He says that bitcoin is about to face its “biggest battle of all,” as regulators, banks and financial authorities will continue to seek out new laws and limits for cryptocurrency users. He’s also confident bitcoin’s volatility is here to stay – even after its technology has settled and the coin has gone deeper into mainstream status.