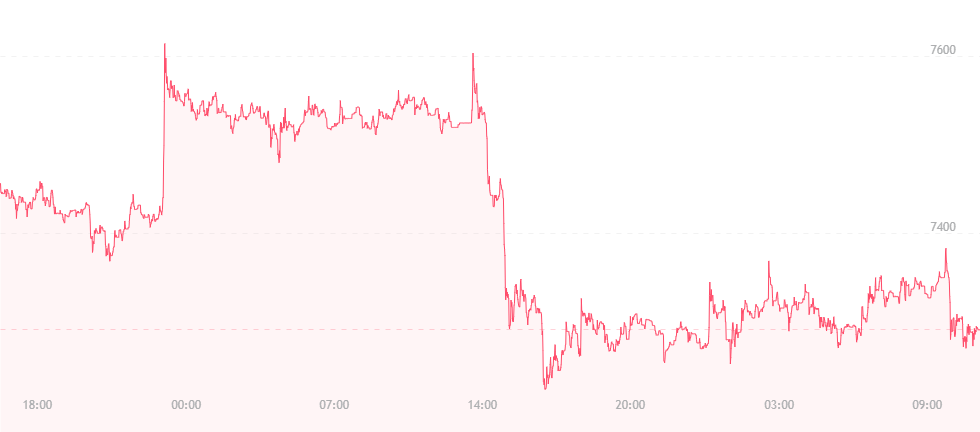

At press time, bitcoin is trading for just over $7,300. This is a near $200 drop over the last 24 hours, and the bears are still having their way.

The current sentiment is that bitcoin could fall to as low as an even $7,000 over the next few days. The currency has been dropping gradually since Sunday May 13, after it spiked to a new high of roughly $9,800. Maybe bitcoin just doesn’t like Mother’s Day…

Still, others remain skeptical that bitcoin will stay at the $7,000 position or spike soon after that. Willy Woo, for example, is a cryptocurrency and digital currency analyst. He believes bitcoin could potentially fall below the $6,000 mark in the short term, and test both the $5,700 and $5,500 marks respectively. He cites a high NVT signal, continuously high volatility, an overly high standard NVT, and a volume profile cliff below $6,800 as the four main reasons for his prediction.

“NVT signal is still too high,” he explains. “We need more blockchain transactional activity to justify the current price, or the price to drop to reconcile the difference. To drive up transactional activity in a bear slide is very unlikely. Furthermore, volatility is still too high. I’m looking for a sustained low band of volatility, which tends to be a signal for the end of the detox and the next accumulation phase. It’s still got some time to ride down.”

NVT signal is a trading indicator that Woo, himself, developed. It is a standard NVT ratio-network valuation divided by transaction value on the blockchain. The figure is then smoothed out using a moving average, which is then applied to the transaction value, creating a more responsive chart.

Woo did mention, however, that bitcoin isn’t likely to strike the bottom half of the $5,000 range, and that a price correction as steep as the one witnessed in 2014 would not happen. He further stated that a cryptocurrency bull rally would occur again, though not until the third quarter of 2018.

“So, in summary, my best guess – slow bleed down to $6,800, then a steeper slide to $5,700, then a leveling out of the drop, then a flat zone,” he explained. “This is an educated guess based on volume profile and fundamental data framing the rate of movement.”

It’s hard to accept the idea of bitcoin suddenly sinking into oblivion when so many countries are beginning to explore its technology and benefits. Great Britain, for example, has recently published a working paper on the subject, while the Bank of England’s governor Mark Carney states that the institution is open to the idea of a central bank-issued digital currency.

This marks a massive change in sentiment, as prior to the G20 Summit in Argentina last March, Carney had been very vocal about the negative side of bitcoin, repeatedly calling the currency a “failure.” He also said that it needed to be “held to higher standards,” and that cryptocurrencies were part of “speculative mania.”

Carney now believes a central bank digital currency (CBDC) could potentially heighten the region’s presence in the crypto space and assist Britain’s economy.