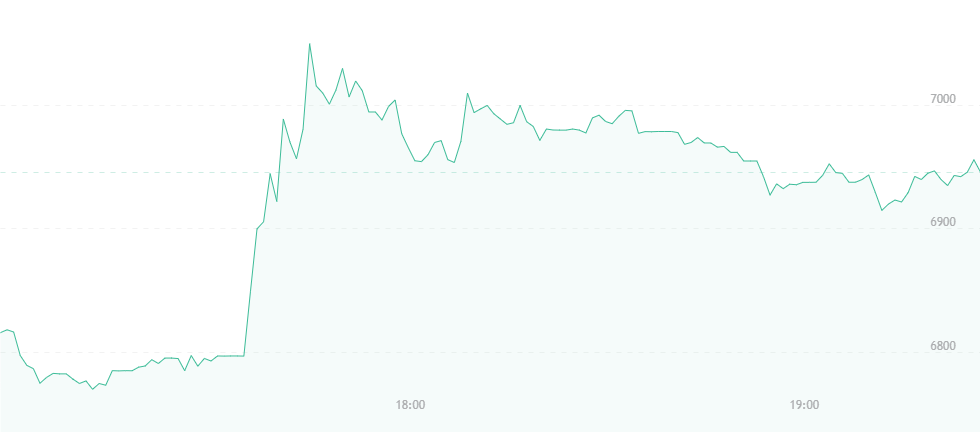

Bitcoin has endured another small slump. After spending nearly 24 hours at $7,100, bitcoin’s price has dropped by $200 and now stands at $6,900.

This has become something of a routine over the past two weeks. Bitcoin jumps a bit, then falls a bit. While nothing huge appears to be happening, bitcoin resistance levels seem stronger when compared to just three years ago.

Previously, Thomas Lee of Fundstrat fame claimed that bitcoin mining was no longer profitable, and that miners were simply “breaking even” between what they were spending to extract coins and what they were officially earning. That, however, was when bitcoin’s price was meandering along the mid-$8,000 range. At $6,900, bitcoin has endured a serious drop since that time, and it appears bitcoin miners are spending more now than they’re slated to earn once their business is complete.

Recently, we discussed the notion of a bitcoin “death cross,” in which the short-term average dropped lower than the coin’s long-term average. Many sources have claimed that the death cross struck earlier this week, and that bitcoin was in a slump it may not survive.

In addition, new sources are claiming that the trends forecasted by the death cross have allegedly become realities. One such prediction involved the $20,000 mark that bitcoin hit last December. It is believed that the terms “bitcoin dead” and “bitcoin is dead” were more often searched via Google and neighboring searching engines during the December 2017 hype than during the present, which is nonetheless odd considering how many new users were jumping aboard.

Current Google trends suggest that while bitcoin’s price has shown continued vulnerability, many still believe in the strength and resilience of the coin, and that recovery is right around the corner. As the cryptocurrency becomes more mainstream, the public is experiencing boosted confidence not only in the digital asset arena, but in the blockchain technology that supports it.

Chief trader Jordan Hiscott at Avondo Markets is on the opposite end, and predicts the bitcoin price may require another six months before it returns to numbers first seen in early January.

His theory is “based around the situation regarding the liquidation of the Mt. Gox exchange, and the appointed trustee to handle the bankruptcy. Colloquially, this individual is known as the ‘Tokyo Whale,’ and having already sold around $400 million worth of both bitcoin and bitcoin cash, he is likely the main catalyst for this year’s move down.”

Despite the prediction, bitcoin and cryptocurrencies in general continue to attract investors. Prices are constantly falling, and the volatility is affecting customers’ relations with their banking institutions, yet investors are not turning away. The fact that prices are falling so drastically may be a driving force behind the continued interest. People see that there is now a chance to buy more at lesser prices. Thus, they can get in on the action before things strike up yet again.

Furthermore, many recognize the benefits of the blockchain, and understand that while things appear bleak for the time being, the respective technology will make a lasting mark in the coming future, and those who get in and stay in could reap major rewards later down the line.