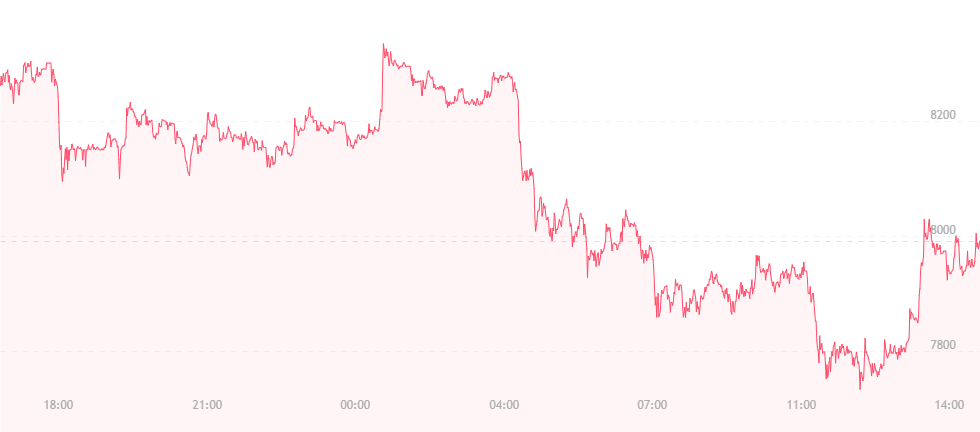

At press time, bitcoin is trading for just over $8,000 – a solid dip from yesterday’s high of about $8,500, though it is a step above today’s previous low of $7,700. Bitcoin is struggling to stay afloat, but many outside factors are looking to prevent this.

One involves ongoing regulation in South Korea. The country accounts for over one quarter of the world’s bitcoin and cryptocurrency trades, making it a very important candle-holder in the digital asset arena.

However, as activities in South Korea grow and bitcoin continues to garner popularity, regulators are seeing a stronger need to interfere. The coin’s price fell earlier this year following South Korea’s announcement that it would ban all further anonymous trading, and now it appears three separate cryptocurrency exchanges are under scrutiny from the nation’s FSA for alleged money laundering and other illegal behavior.

Current evidence suggests individual customer accounts may have been sold to other platforms as a means of avoiding tax reparations. In addition, it appears funds were also sent to accounts held by proxy representatives. These transactions have been stopped, but it has caused the FSA to step in and enter a discovery phase.

The good news is that the three platforms in question are relatively small, and lack the size of other South Korean exchanges like Upbit and Bithumb. This likely accounts for why bitcoin was prevented from hovering at $7,700 all morning, and ultimately experienced a $300 rise. While the current price is nothing to celebrate, it is substantial proof that bitcoin is sustaining all bends to its reputation and remaining stable, despite ongoing threats and jabs from regulators.

Previously, The Merkle introduced its readers to the upcoming Mt. Gox sell-off of its remaining bitcoin stash. While sentiment remains that the announcement of the sale (currently scheduled for late September) affected the bitcoin price, Mt. Gox trustee Nobuaki Kobayashi is denying any such idea.

However, Mt. Gox’s previously staged sell-off took place last January. Kobayashi sold over $400 million in BTC from the company’s collection. Ironically, it appears the sale occurred on or around the time when bitcoin dropped from its near $20,000 high (first recorded last December) to roughly $6,000. While Kobayashi insists the sale occurred through private means that would leave the market largely unaffected, many experts say the evidence says otherwise.

Granted Mt. Gox remains a strong influencer on the bitcoin and cryptocurrency arenas, another massive drop could occur in September when the fallen exchange’s final sale is scheduled.

Despite what seem like continued negative vibes, not everyone has lost hope in bitcoin. Jack Dorsey – often classified as a “Twitter billionaire” – recently announced that he poured an investment nearing $3 million into the blockchain startup Lightning Labs, a company seeking to hasten bitcoin transactions. Moving money from one bitcoin account to another can often take anywhere from several hours to several days, and the fact that companies continue to garner such investments is substantial proof that the crypto-craze is not quite dead yet.

Perhaps bitcoin has a fighting chance in the coming months after all.