In its 12 years of life, Bitcoin has often been thought of as a diamond in the rough. Now as its value breaks past expectations and shows no sign of fading from prominence, it is a bona fide treasure. To understand the place cryptocurrency in general and Bitcoin in particular have in today’s society, an overview of its volatile and eventful history is in order. Let’s explore the Bitcoin bull run.

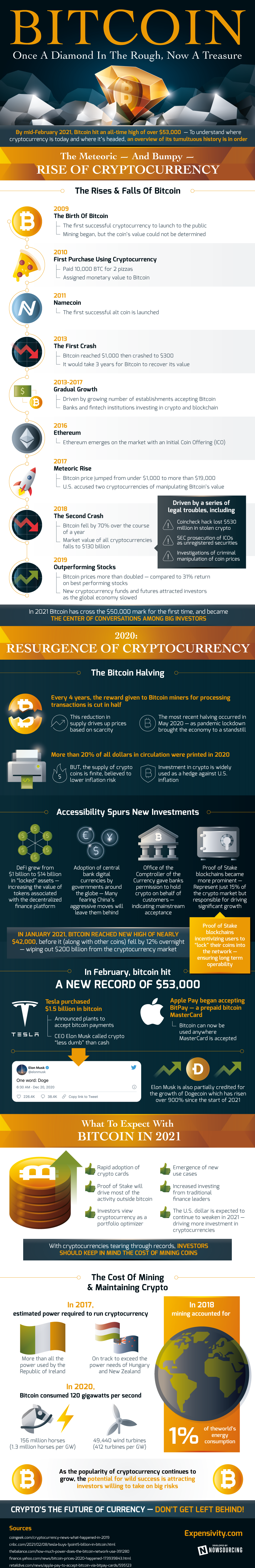

As mentioned, Bitcoin has been in existence for 12 years. Launched in 2009, Bitcoin was the first successful cryptocurrency to be made available to the public. Mining began that same year, but the coin’s value had yet to be determined. The first purchase using cryptocurrency came in 2010 when someone paid 10,000 BTC for 2 pizzas. This transaction assigned monetary value for Bitcoin for the first time and is fascinating to revisit today. With the current value of Bitcoin, those pizzas would be worth over $265 million each.

The following year in 2011, Bitcoin had its first competition on the cryptocurrency market. Namecoin was the first successful alt coin to launch and is worth $2.37 per coin today. While the crypto market is crowded in 2021, Bitcoin maintains a clear dominance.

Moving forward to 2013, Bitcoin reached $1,000 per coin for the first time. Sadly, this peak did not last; soon after reaching that high, Bitcoin crashed to $300 in the same year. It would take 3 years for Bitcoin to recover. While Bitcoin was regaining its value, Bitcoin’s reputation became more mainstream thanks to more establishments, banks, and fintech institutions accepting and investing in crypto and blockchain. Prior to the mid-decade, cryptocurrency was seen largely as an oddity. Also during the mid-decade period came the release of Ethereum with an Initial Coin Offering (ICO). The acceptance and usage of ICOs indicate how far the crypto market has come since 2009, but it was not without backlash.

In 2017, Bitcoin’s price jumped from under $1,000 to more than $19,000. Once again, the peak did not last. Later that year and continuing in 2018, the cryptocurrency market faced a series of legal troubles in the US. The US accused two cryptocurrencies of manipulating Bitcoin’s value. The SEC prosecuted ICOs as unregistered securities. Taken together, these actions drove the value of Bitcoin down by 70% and the market value of all cryptocurrencies dropped to $130 billion.

Unlike before, however, Bitcoin’s recovery from the fall was rapid. In 2019, Bitcoin prices more than doubled, outperforming even the best stocks on the market. By the time the global economy slowed in 2020, Bitcoin was in a prime position to attract investors looking for high returns and don’t fear the risk of investing. Swings still occurred; in April 2021, Bitcoin reached an all-time high of $63,000 before falling to nearly half of that today. Despite individual movements, the upward trajectory of the cryptocurrency is undeniable. Investors know better than to focus on the daily changes. Those expecting to make money on their investments look for long term trends in the market and the item at hand; at this time, the signs point to bright futures for Bitcoin in particular and blockchain more generally.

Today, interest in Bitcoin and other cryptocurrencies is driven by more than pure speculation. The pandemic-induced recession spurred the US money supply to expand a great deal in a short period of time. More than 20% of all dollars in circulation were printed in 2020. Additionally, multiple stimulus packages have come out of the federal government in recent months, risking an overheated economy as people return to employment and regular life. As the US economy recovers, fear of inflation is on investors’ minds. Where gold traditionally served as a hedge against inflation, some are using crypto for the same purpose. Like gold, the supply of crypto coins is kept finite, making them safer against inflation.

Contributing to this insulation from inflation is the Bitcoin halving. Every 4 years, the reward given to Bitcoin miners for processing transactions is cut in half. This reduction in supply drives up prices based on scarcity. The most recent halving occurred in May 2020, when the pandemic lockdowns had the global economy at a standstill.

As cryptocurrency grows more accessible and widely used, new investments are coming to the market. DeFi grew from $1 billion to $14 billion in “locked” assets, increasing the value of tokens associated with the decentralized finance platform. Adoption by central banks of digital currency is growing around the globe after China became the first to make the move. Back in the US, the Office of the Comptroller of the Currency gave banks permission to hold crypto on behalf of customers. Furthermore, Proof of Stake blockchains became more prominent. Proof of Stake blockchains incentivizes users to “lock” their coins into the network, ensuring long term operability. This variation of blockchain represents just 15% of the crypto market, but it has been responsible for driving significant growth.

More than new innovations, new companies are hopping on the Bitcoin craze in a major way. Tesla recently purchased $1.5 billion worth in Bitcoin and vowed to accept the cryptocurrency as payment for their products. Tesla CEO Elon Musk has been vocal about the decision to embrace cryptocurrency on his social media. He is also credited for the 900% growth of Dogecoin this year after he tweeted about it in December 2020. Tesla is not alone, Apple Pay also began accepting Bitcoin as payment through a secondary medium. A prepaid MasterCard known as BitPay is now usable on Apple’s platform. Bitcoin may now be used in transactions anywhere that MasterCard is accepted.

While Bitcoin’s volatile days are not over, rapid adoption of crypto cards is to be expected in 2021. With it will be the emergence of new use cases for cryptocurrency and increased investment from traditional finance leaders. The US dollar is currently projected to weaken in 2021, driving more investment into the cryptocurrencies.

Still, the story isn’t only good news for crypto users. As cryptocurrency grows ever more popular in usage, so too do the costs to mine and maintain the system. In 2017, the estimated power required to run cryptocurrency exceeded the amount used by the entire Republic of Ireland. It is on track to exceed the power needs of Hungary and New Zealand. In 2018, mining accounted for 1% of the world’s energy consumption. 1% may not seem extreme until one remembers how much electricity the world uses. Moving forward to 2020, Bitcoin alone consumed 120 gigawatts per second. That amount of energy is equivalent to 156 million horses or 49,440 wind turbines running at once. There are 86,400 seconds in a day. Bitcoin is a powerful actor in the crypto market and in driving demand for electricity.

As the popularity of cryptocurrency grows, the toll the system takes on the world’s already over-exerted energy system should not be forgotten. Crypto may well be the future of currency, so it’s on each individual to find ways to make sure neither they nor the planet get left behind in the mad scramble for blockchain.