After trading sideways at the $22k level through the weekend, Bitcoin’s price finally broke through its support level, dropping by over 3%, and currently trading at the $21k range. Ethereum also failed to hold support at the $1,600 level, falling to the $1,500 range on Monday. While support levels could not hold, the global cryptocurrency market remains above $1 trillion; whether that will continue is up for debate.

Key Points:

- Bitcoin fails to hold the $22k support level and drops to the $21k range.

- While crypto prices drop, trading volume increases, suggesting plenty of potential market momentum.

- Upcoming Fed interest-rate hike could cause additional strain on global and crypto markets.

- Long-term sentiment for Bitcoin remains bullish, now is an excellent time for Dollar-Cost Averaging.

Crypto Bull Market Momentum Slows Down, Trading Volume Increases

While the crypto bull market momentum is slowing down, after Bitcoin’s price dropped from $22.8k to $21.8k, the trading volume for BTCUSD saw a substantial increase of over 13%. The 24-hour trading volume for Bitcoin is at $29 billion, compared to Ethereum’s $18 billion, which also saw an increase of 16% in the past day.

The sharp increase in trading volume following the breakdown of support suggests that plenty of traders are waiting on the sidelines and are looking for buying opportunities when the BTC price dips below short-term support.

Moreover, the increase in trading volume suggests that BTC and ETH are likely to hold the current price ranges of $21k and $1,500k, respectively.

Interest Rate Hike May Slowdown Crypto Market Growth

One relevant piece of news that will likely negatively affect crypto markets is the Fed’s next rate-hike decision which will potentially increase interest rates by another 75 basis points. While still better than the rumored 100 basis point rate hike increase, the three-quarters of a percent hike will cause substantial pain to the stock market, which may cascade into bearish momentum for crypto markets.

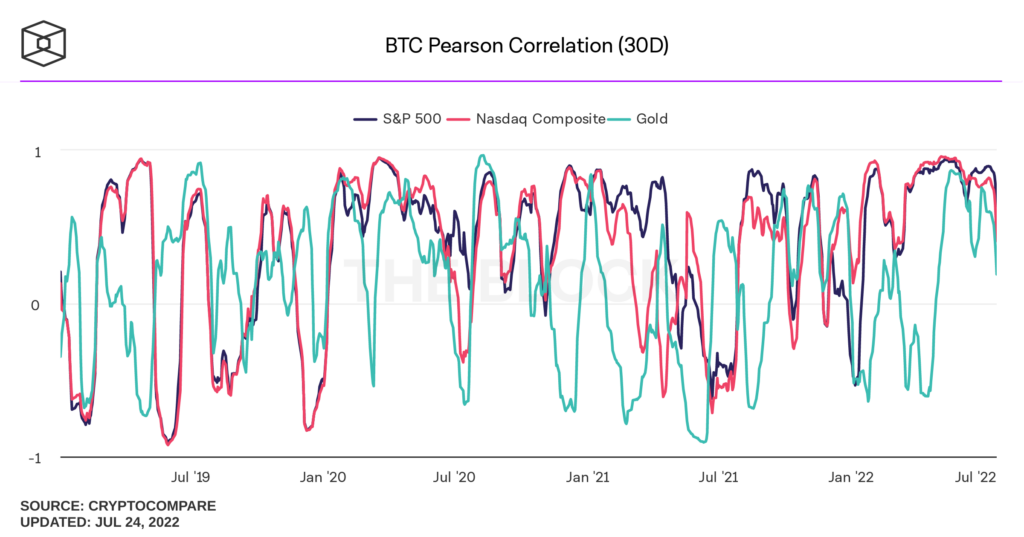

The good news is that Bitcoin is starting to depeg from the stock market, with the 30-day Bitcoin and S&P correlation dropping significantly over the past couple of weeks.

BTC Pearson Correlation // Source: theblock.co

The best hope for cryptocurrency markets is to de-correlate from stocks like the NASDAQ, S&P 500, and Dow Jones and make their moves independent from global markets.

After all, Bitcoin, Ethereum, and other crypto assets are inherently resistant to inflation, and rate hikes shouldn’t affect crypto markets all that much.

Bitcoin’s long-term sentiment remains highly bullish, and it’s only a matter of time before the global and cryptocurrency bear market reverses. Until then, the low prices provide an excellent opportunity to Dollar-Cost Average your long-term investments and purchase of NFTs, virtual real estate, and other niche crypto assets are record-low prices. The last thing you want to do is FOMO into a bull market.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any projects.

Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news!

Image Source: jozefmicic/123RF