After a relatively mellow week of sideways trading and cryptocurrency prices managing to hold support despite mounting bearish momentum, the global crypto market is up over 5% today, with the overall capitalization at over $930 billion at the time of writing. Bitcoin is up over 5% trading above $20k, while Ethereum and Solana prices soar over 12% in the past 24 hours, with ETH trading above $1.2k and SOL price at $37.79.

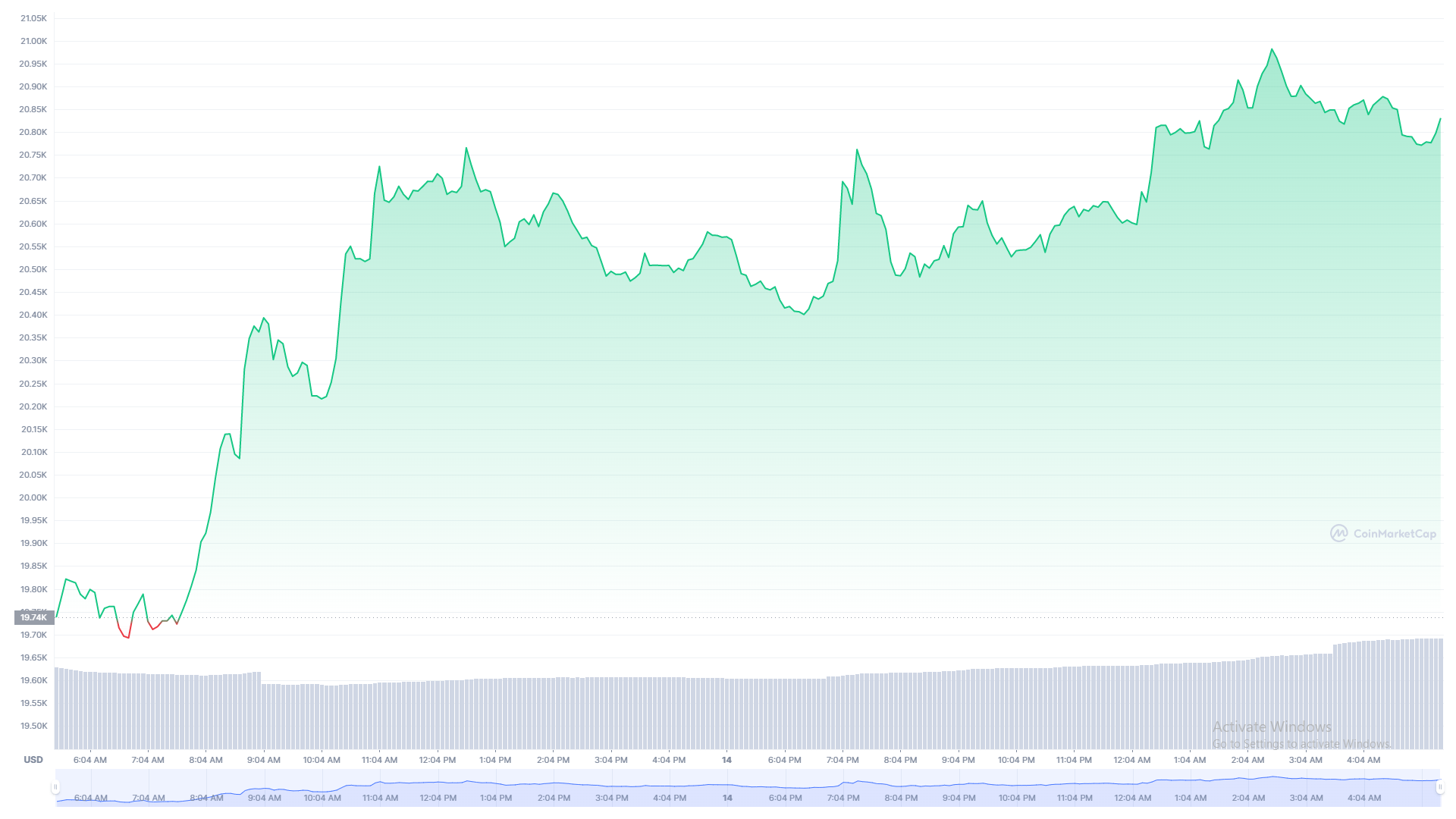

Bitcoin’s Price Above $20k Once Again

Bitcoin is once again in safe territory as it managed to climb above the $20k level once again, currently trading at $20.8k. Last night, BTC’s price dropped to a low of $19.7k, only to rebound to $20.7k by midday.

1D BTCUSD // Source: CoinMarketCap

There are several stark reports regarding the short-term price action for Bitcoin, so don’t get your hopes and wallets out just yet. CNBC released a report that if global macroeconomic factors don’t improve soon, Bitcoin could plummet as much as 30% before seeing a “true” bottom.

Since Bitcoin is following the stock market price action, it’s clear the cryptocurrency has been hurt by the state of the economy and the rising increase in inflation. Fears of an upcoming recession will undoubtedly further destabilize the market, and while Bitcoin’s tokenomics make it inherently immune to inflation, investors are likely to pull funds out of volatile crypto markets.

To add to the bearish price predictions for Bitcoin, JPMorgan says Bitcoin’s drop in production cost could significantly decrease its value in the coming weeks. According to a Yahoo Finance report:

“The drop in the production cost estimate is almost entirely due to a decline in electricity use as proxied by the Cambridge Bitcoin Electricity Consumption Index. [] They also say it could be seen as an obstacle to price gains.”

As the production cost for Bitcoin was predicted to be roughly $13,000, it wouldn’t be surprising to see BTC drop toward the $15-16k range in the coming weeks/months. If that happened, that would be a genuine bottom and could spell an incredible buy opportunity for long-term investors looking to Dollar-Cost Average their crypto investments for the long haul.

After Wednesday’s CPI number release, inflation is clearly on the rise and could cause additional strain on the market in the coming weeks. Moreover, the Euro is starting to lose its value compared to the U.S. dollar, causing substantial strain to the European economy, which could spill into crypto markets.

The good news is that Bitcoin’s price is holding exceptionally well today, despite the state of global markets.

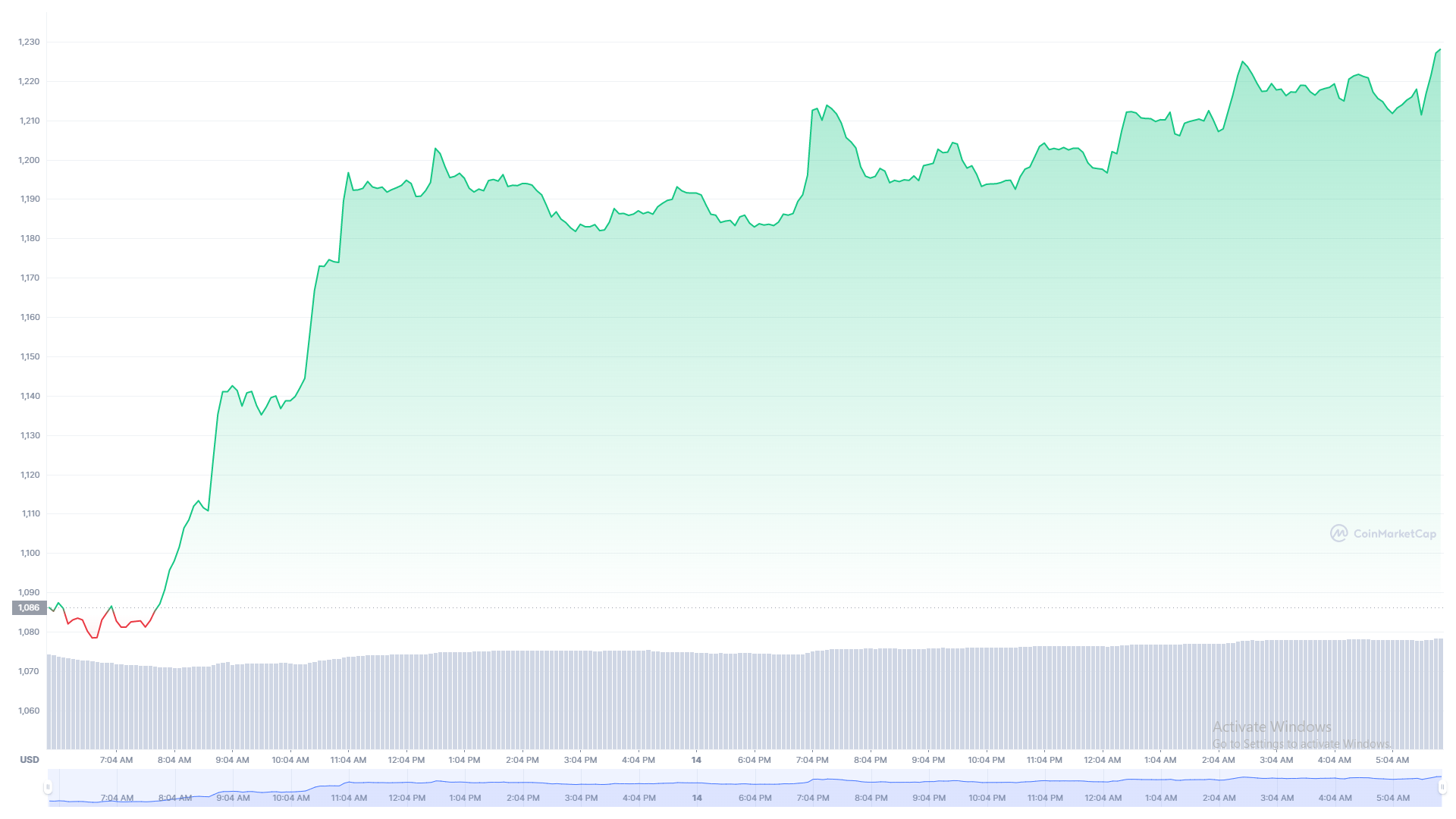

Ethereum Price Soars Amid Shadow Fork Deployment

Ethereum is the top-performing top-10 crypto asset today, rising by over 12% in price to a current price of $1.2k. The bullish momentum for ETH is likely the deployment of Ethereum’s Shadow Fork 9, in preparation for the Merge. Developers are testing updates to their recent hard fork and ETH’s ninth shadow fork went live earlier today.

1D ETHUSD // Source: CoinMarketCap

The upcoming Ethereum update will transition the network from a proof-of-work to a proof-of-stake consensus mechanism, contributing to an environmentally friendly network with a significant reduction in the carbon footprint as Ethereum miners won’t need to waste electricity to secure the network.

As the recent shadow fork deployment went with no issues, the market reacted positively to the update. The final merge is expected later this month which will transition Ethereum’s network to a forward-looking, environmentally-friendly proof-of-stake network.

In other Ethereum news, Gamestop’s NFT marketplace went live on July 11th and saw over $3 million in trading volume in several days, greatly surpassing Coinbase’s NFT platform which went live in May. Gamestop’s NFT marketplace saw higher trading volume in two days than Coinbase saw in two months, signaling the market’s approval of Gamestop’s venture into NFTs and speaking to the substantial community still surrounding NFTs and digital crypto art.

The Calm Before the Storm?

There’s no denying that crypto markets are performing suspiciously well today, despite the stock market continuing its meltdown and recession fears gripping Wall Street.

Could this be the calm before the storm for crypto markets? Chances that Bitcoin and Ethereum prices drop significantly over the weekend are low, but next week could spell yet another correction if stock markets continue their freefall.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any stocks.

Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news!