Cryptocurrency markets are trading sideways today after Bitcoin and Ethereum prices struggled to hold support yesterday, dipping below the $20k and $1.1k levels. The release of CPI data showed rising inflation, and tech stocks tumbled yesterday, causing further market uncertainty. The good news is that stocks remained relatively steady yesterday, with the NASDAQ and S&P 500 closing a few points above the opening on Wednesday.

Bitcoin Price Looking To Establish Support at $20K

Trading at $19,790 at the time of writing, it’s clear that Bitcoin is attempting to establish support at the $20k level, both an emotional and technical range significant for providing crypto investors and altcoins with confidence in the market. Bitcoin price is up over 3% in the past 24 hours, signifying an attempt to breach the $20k level again.

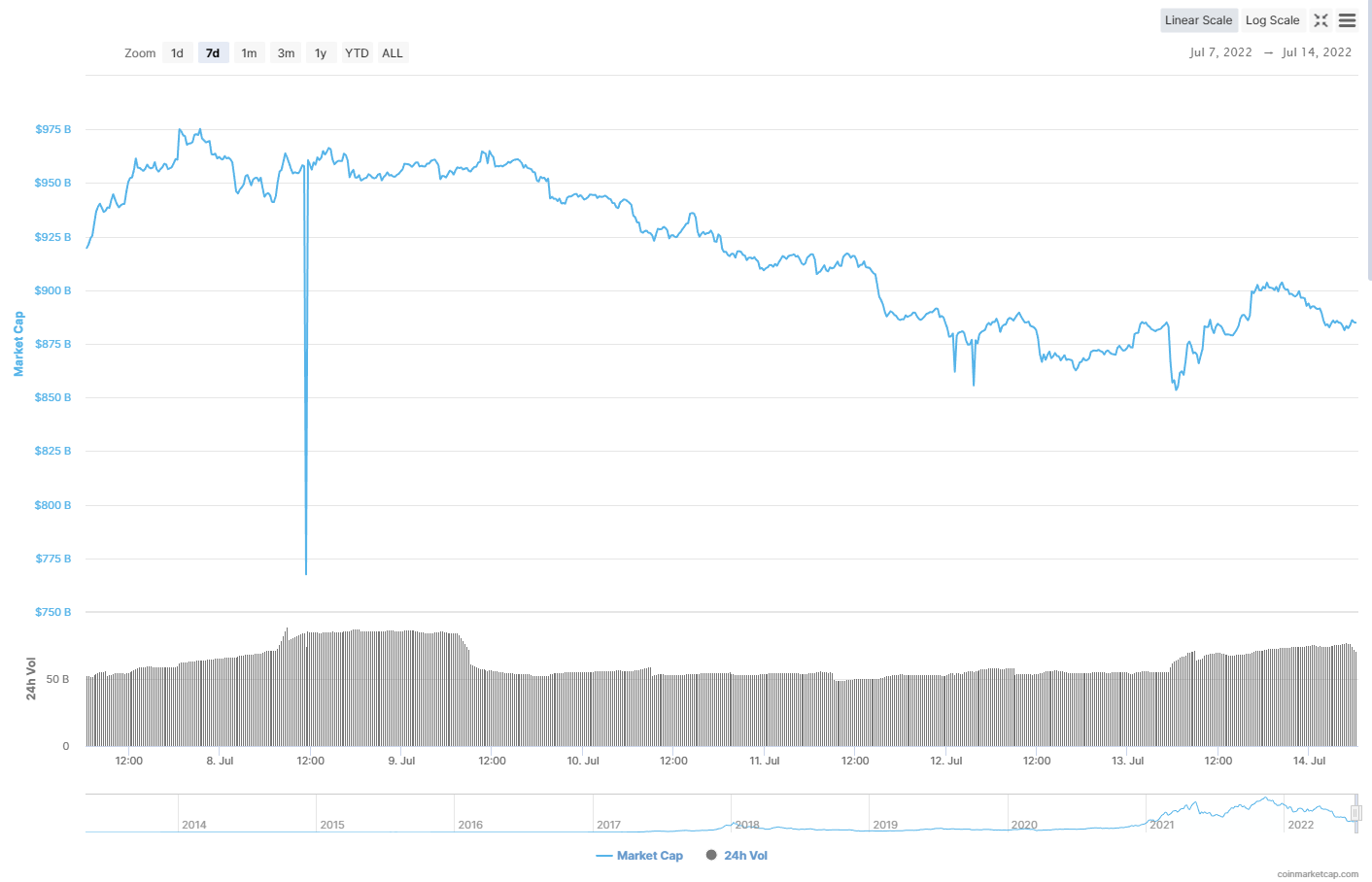

As BTC prices registered a slight gain, the global crypto market cap remained at the $880 billion level, rising only 0.18% in the last day. Crypto’s market cap peaked at $901 billion yesterday, dropping to a low of $882 billion shortly after.

Source: CoinMarketCap

Moving above the $1 trillion global cryptocurrency market cap would provide newfound bullish momentum for the crypto market, which hasn’t seen a global valuation of over $1 trillion since early June.

Ethereum Price Up Over 5% Today

While Bitcoin price managed to register a 3% gain as the second-highest-valued altcoin, Ethereum amplified BTC’s slight price gain and rose by over 5% in the past 24 hours, trading at $1,086 and attempting to establish support at the $1.1k range.

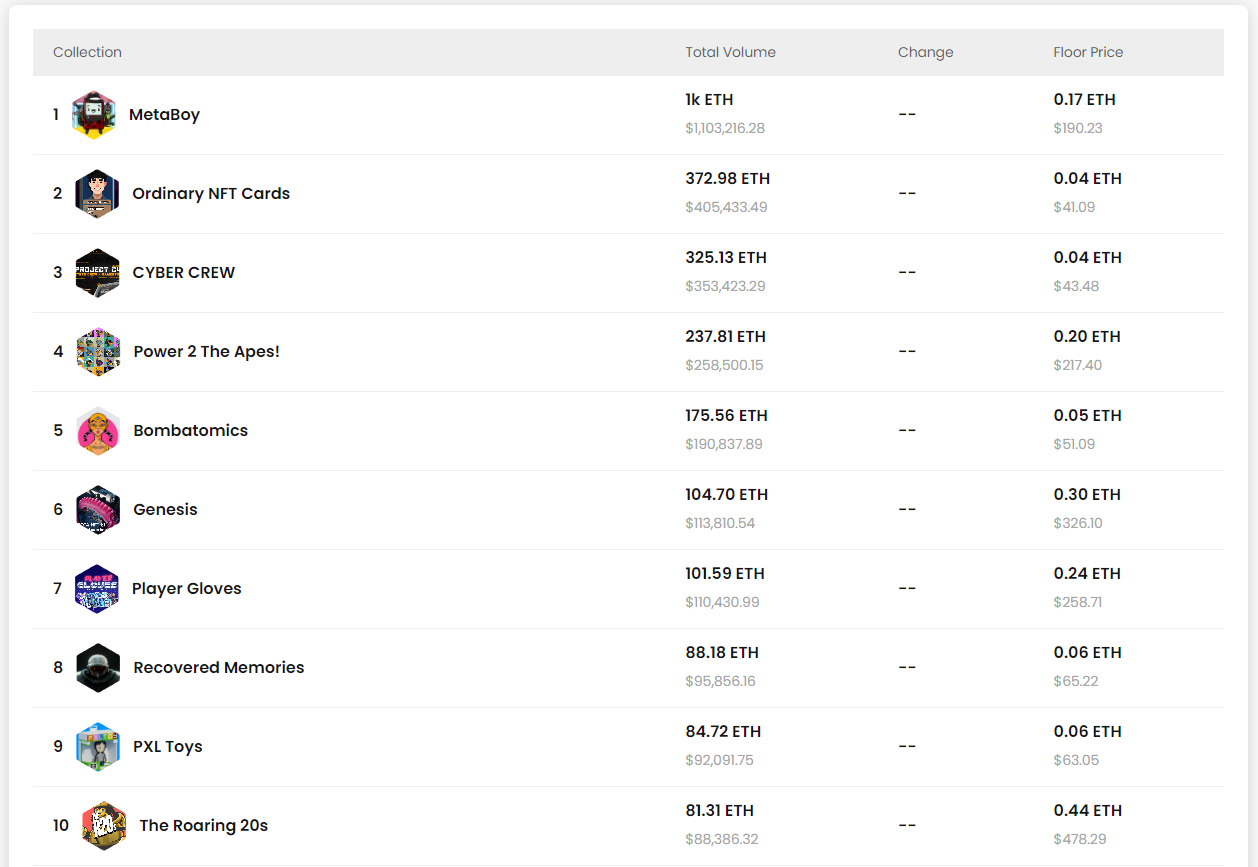

The big news regarding Ethereum is Gamestop’s new NFT marketplace, launched on Monday, July 11th. The marketplace is in open Beta, enabling anyone to explore and purchase the various collections. In addition, users can apply to create NFTs on the platform by filling out a form on Gamestop’s official NFT website.

According to stats published on Gamestop’s NFT marketplace, the platform moved over 3.1k ETH (roughly $3.1 million) from its top-30 collections.

The substantial trading volume is almost double that of Coinbase’s NFT marketplace, which only generated roughly 1.7k in ETH trading volume since its launch on May 4th.

The NFT hype is still very much alive despite the bear market weighing on the prices of Bitcoin and Ethereum, suggesting excellent long-term potential for NFTs and Ethereum when the next bull market does hit.

Stocks Continue to Underperform, Fed Likely to Raise Interest Rates

After releasing the latest CPI data from the U.S Bureau of Labor Statistics showing rising inflation and prices, stocks underperformed on Wednesday, with futures contracts dropping by 1% for NASDAQ 100 and S&P 500. While the stocks themselves closed slightly higher than open, the overall sentiment for the market remains uncertain.

In addition, according to a report from Yahoo Finance, Louise Dudley, a global equities portfolio manager at Federated Hermes Ltd, said:

“The likelihood of a Fed 1% move has now increased and with it comes greater concern for a more near-term slowdown of the US economy.”

If the Fed continues to raise interest rates, that will cause additional strain on the market as the economy will be forced to slow down. This might cause a ripple effect in the prices of stocks and cryptocurrencies, which could correct once again, providing additional buy opportunities for those looking to capitalize on the bear market and the low prices for various crypto projects, virtual real estate, and other investments.

While the short-term signals might be bearish, the U.S. economy isn’t in freefall. If the markets can continue to fight the extended bearish pressure, a recovery could be looming around the corner.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any stocks.

Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news!

Image Source: markoaliaksandr/123RF