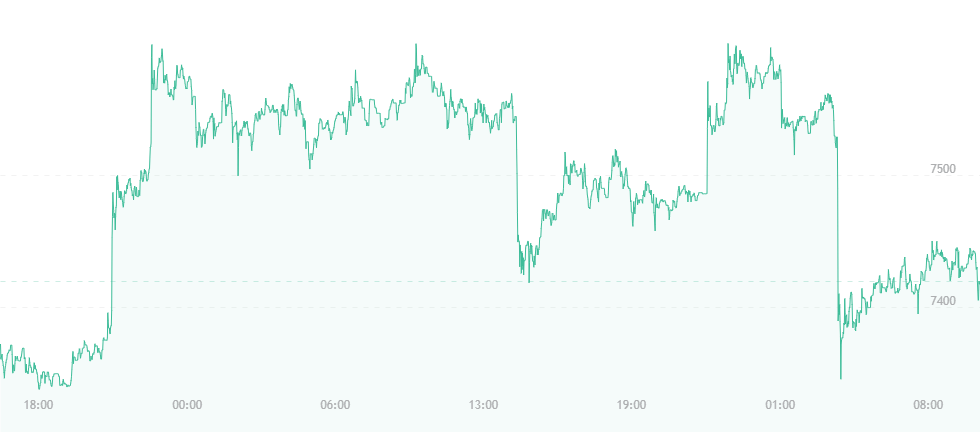

Bitcoin has fallen by $100 since yesterday, and is now trading for just over $7,400. Many analysts claim that bitcoin’s long-term effects will take it to new highs, though a bull run doesn’t lie in the coin’s immediate future. For now, the coin doesn’t appear capable of jumping beyond the $8,000 mark.

According to one source, bitcoin is having trouble moving beyond $7,500. A recent sell-off that ultimately “ran out of steam” brought the currency down to $7,270 during the early morning hours, though a later rally brought the currency up to its present $7,400 position. This source suggests the $200 rise in question is a sign that the bulls are once again taking control. It also says that bitcoin could potentially reach as high as $7,800 early next week, but would have to strike $7,700 by Sunday to test and obliterate its current resistance.

“Bitcoin will likely soon rise to $7,870 (descending trendline hurdle) in the next 24 hours. A high-volume break above that level would allow a re-test of the 50-day moving average, currently located at $8,522. Bearish scenario: the moving averages are maintaining a bearish bias, so a drop to $6,900 could be on the cards if the bulls fail to capitalize on the break above $7,500 and the price drops below $7,270 in the next 24 hours. Bitcoin (BTC) is working its way through the key supply zone above $7,500 and could test resistance at $7,870 in the next 24 hours, the technical charts indicate.”

Following Chinese President Xi Jinping’s comments regarding the power of the blockchain, China is beginning to walk a different route when it comes to cryptocurrency and its respective technology, and it’s interesting to see one of the most stringent countries towards bitcoin and the blockchain suddenly loosen up a bit.

Jinping has explained he’ll be opening national laboratories to better develop and research the blockchain infrastructure, as he wants China to be prepared for any further technology revolutions in the coming months. In addition, the Chinese State Council’s 13th five-year economic plan, released in 2016, mentions blockchain technology twice, and several startups within the region are now partnering with local government branches to perform what they call “necessary” blockchain research and implementation.

Further support for the blockchain and bitcoin came from the Bank of England’s governor Mark Carney, who in the past, has been particularly harsh towards these technologies, going so far as to call bitcoin a “failure” and part of a “speculative mania.” Speaking at a conference in Sweden, Carney reiterated the power of the blockchain to his listeners, and called it crucial to the future development of the globe’s economic infrastructure:

“Is our role going to be changing the payment systems and helping private providers of digital money, or will we go all the way to a central bank-issued digital currency? This is one of the most exciting and important areas, and certainly the most important area to get right.”

Very unlikely candidates are now shifting their focus from negative to positive, and see the blockchain as a powerful entity that could hold the key to the world’s financial future.