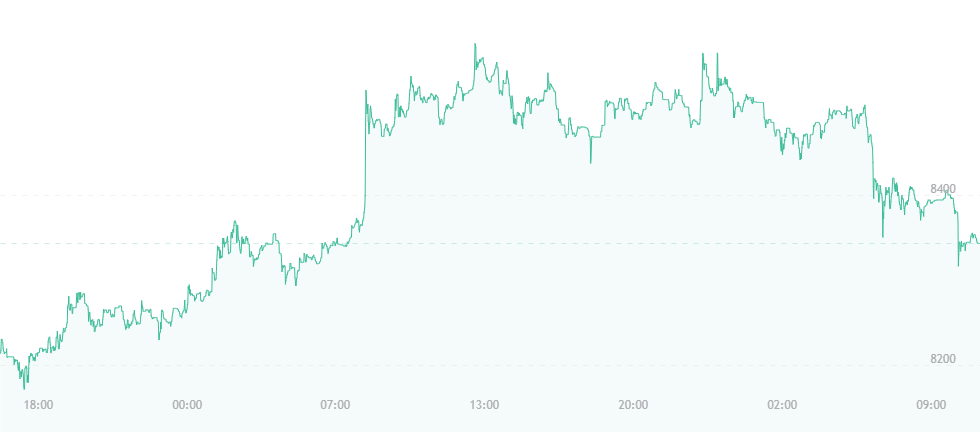

At press time, bitcoin is trading for roughly $8,350. That’s about $150 less than where the currency stood yesterday. Bitcoin has been marred by ups and downs for the last 1.5 weeks, and it appears they aren’t ceasing anytime soon.

Since May 5, bitcoin has been on shaky ground. The currency was originally slated to hit $10,000 after it reached a $9,800 high, but sadly, this never occurred. In fact, bitcoin has undergone steady drops ever since and is now trading for $1,500 less.

Fundstrat’s Tom Lee attributes this to what he calls a lagging “trifecta of progress.” The cryptocurrency analyst states that for cryptocurrency to succeed, it requires:

- Institutional custody and tools;

- Buy-in by banks and investment managers;

- Regulatory clarity.

At press time, it appears only the first two requirements have been satisfied. In terms of classifications, many cryptocurrencies are still trapped in the dark and unsure of where they stand or what regulations they should adhere to.

Still, however, a lack of regulatory clarity isn’t getting in the way of some analysts’ predictions regarding bitcoin’s future. Rodrigo Marques, for example, is chief executive of Atlas Quantum, one of Brazil’s largest crypto-trading platforms. In a recent interview, Marques made the bold prediction that bitcoin would strike $20,000 territory within the next six months, and that $8,000 was an interim low for the father of cryptocurrencies. That means we can all expect bitcoin to more than double in value by the time Thanksgiving rolls along.

In addition, the regulatory uncertainty that Tom Lee says is plaguing the cryptocurrency market could be about to diminish, as the U.S. Commodities Futures Trading Commission (CFTC) is set to provide “tighter guidance on the digital currency market” in the future.

While speaking at the North American Securities Administrators Association Conference in Washington, CFTC chairman Christopher Giancarlo said the financial body is on the verge of publishing what he calls a “staff directory” that will ultimately provide further guidance to both clearinghouses and cryptocurrency exchanges that list derivative contracts based on digital assets.

“This advisory will reflect CFTC staff’s current thinking based on our growing experience with virtual currency derivatives,” Giancarlo explained. “As new products are brought forth, staff will re-evaluate and revisit the advisory, as necessary, to address any new and emerging issues.”

It is difficult to accept that bitcoin and cryptocurrencies in general are still birthing technologies. While entitles like bitcoin have been around for some time, the systems behind them are still adapting to news, trends, forks, software changes and other elements. Thus, it’s difficult for governing financial bodies to garner the experience they need to regulate and control them.

On one hand, this kind of regulation and control goes against what bitcoin and its crypto-cousins originally stood for. Then again, with threats like hackings and thefts consistently showing their ugly faces in the virtual currency space, regulation may be the one thing that could set concerns to rest, and put the values and prices of these cryptocurrencies where they deserve to be.

It will be interesting, to say the least, to see if bitcoin and cryptocurrency prices do wind up benefiting from newfound regulation attempts in the coming months.