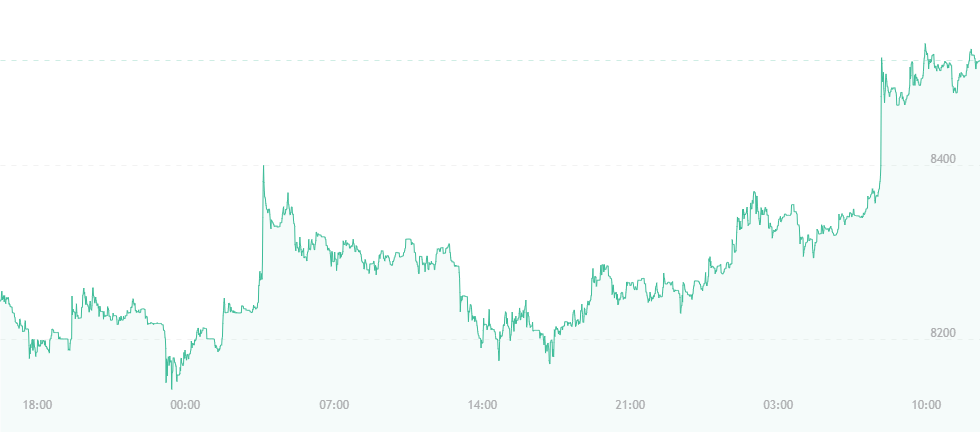

At press time, bitcoin has risen $200 higher from where it stood yesterday. Signs of recovery are now showing themselves as we inch away from the repeated drops of last week. At $8,500, bitcoin is at its highest point since Monday, when it briefly rose to $8,800 following the start of Coindesk’s Consensus Conference.

It was prior to this event that Fundstrat’s Tom Lee (no stranger to these price articles) made a bold prediction regarding the currency’s price. He stated that bitcoin would rally during the Conference, and spike harder than it had in previous weeks. Ultimately, the price didn’t rally; in fact, it incurred several drops following the event’s commencement, and didn’t begin exhibiting signs of positive change until the Conference was over. Bitcoin lost about 10 percent of its overall value while the event was taking place.

Lee later “owned up” to his incorrect prediction, writing:

“Given conferences like Consensus are chances for the community to gather in a centralized place and meet constituents new to the community (growth in attendance), it seems natural that the combination of ‘sanity check’ (all is OK and progress is happening) plus ‘new interest’ (incremental attendance) should strengthen the crypto-community’s conviction, and coupled with growth in incremental constituents, should have aided cryptocurrency prices.”

Lee blames that lack of price rises during the Conference on the fact that regulation in America is still unclear. He says that bitcoin and cryptocurrencies in general need more clarification from organizations like the Securities and Exchange Commission (SEC), along with an increase in institutional adoption rates before prices can really fire up.

“Crypto still faces significant internal resistance and hurdles within traditional financial institutions, “he later added. “But it is encouraging, nonetheless, that a large share of incremental attendance comes by way of financial institutions.”

The fact is that bitcoin and the world of cryptocurrencies remain relatively volatile and speculative, and it’s right when we think we’ve got it down that we’re ultimately proven wrong. As we’ve seen, it’s near impossible to predict how digital currency prices will react to certain events, news, trends and other factors. Thus, making suggestions about what direction they’ll take in the future is an almost pointless task.

Lee called bitcoin’s maneuvers during the Consensus “very disappointing.” However, the analyst is sticking to his guns and insists that the currency will reach a price of $25,000 by the end of the year, beating out last year’s mega-price record by approximately $5,000. He further states that bitcoin will hit the $91,000 mark by 2020.

In addition to bitcoin, most major cryptocurrencies are hurling themselves deeper into green territory. At press time, Ethereum is up to $714 after a long week of wading through the $670 range. Ripple’s XRP has risen by approximately three cents and is on the verge of breaking $0.70, while Litecoin is traversing through the high $130 range.

Bitcoin Cash remains the only major cryptocurrency “still in a funk,” having recently taken a nosedive towards $1,180 after a solid week of meandering through $1,200. The currency has an upcoming hard fork scheduled that’s slated to render the original BCH coin null and void.