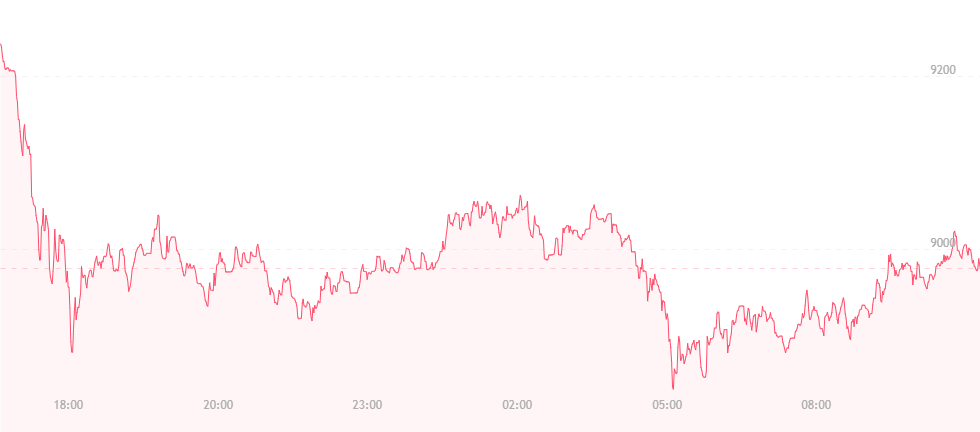

Bitcoin has fallen by roughly $400 and is now trading for $8,900. Yesterday, we discussed potential resistance between the $9,000 to 9,300 range, and now that speculation is crossing into reality, though it’s unclear if the currency is slated to stay here for much longer.

Prior to the drop came a bitcoin trading ban in Iran. The country has long allocated fears and rising concerns due to money-laundering, volatility and the loss of investor assets, and now it appears they’ve become too much to bear. Crypto trading – predominantly bitcoin trading – was halted in Iran earlier this week, and now the country is issuing a state-based virtual coin to help boost the country’s economy.

Iran’s national form of fiat – the rial – ultimately plunged following President Trump’s pressure on European nations to assist the United States in rebuilding the nuclear deal it presently holds with Iran. Trump will decide on May 12 whether the U.S. should pull out of the deal, and sanctions are expected that could cripple Iran’s financial infrastructure. The digital currency it’s now issuing is a “back-up plan” that representatives and state officials have had in motion since February.

Iran’s information and communications technology minister Mohammad Javad Azari-Jahromi explains:

“Last week, at a joint meeting to review the progress of the local cryptocurrency project, it was announced that the experimental model was ready. The Central Bank’s ban does not mean the prohibition or restriction on the use of the digital currency in domestic development. The CBI ban on bitcoin dealings was made due to concerns that the volatility in the crypto market could lead people to lose their assets. Bitcoin is not the one and only cryptocurrency.”

The good news is that bitcoin is slated to survive this setback and mark a path towards $12,000 by summer. It’s the first objective of the coin on its way towards higher record prices, though it appears these records are dependent on external factors. For now, the currency continues to react in a mostly positive manner towards trends, news and political data, but investors are warned to stay cautious.

Presently, support sits at $6,000, thus cancelling any bearish objectives. Granted this breaks down, however, downward motion is expected in bitcoin’s future, though this isn’t to be expected immediately. In fact, bitcoin could rise as high as $13,000 following its $12,000 jump, followed by $15,000 and $16,000 respectively.

Despite this, reactions to cryptocurrencies and the outcomes they present remain relatively mixed. A new report issued out of Hong Kong, for example, declares the risk factor with cryptocurrencies as “medium-low,” saying that while volatility exists, bear patterns and financial crime are not presently strong enough to increase risk levels within the region.

On the other hand, Vinay Sharma – senior trader at Ayondo Markets – feels that the “buzz around cryptocurrencies is dissipating,” and that the “question of their use and viability” remains intact.

“In my view, the chances of crypto being used as a viable medium of exchange in the future is very slim,” he stated. “In my opinion, cryptocurrencies aren’t really currencies at all, with volatility so high they become assets that traders and investors can speculate on, and I imagine this will continue to be true in the long term.”